How financial institutions of all sizes can seize the instant payment opportunity

Payments Dive

SEPTEMBER 18, 2023

FedNow is driving adoption of instant payments— here’s what financial institutions need to know.

Payments Dive

SEPTEMBER 18, 2023

FedNow is driving adoption of instant payments— here’s what financial institutions need to know.

ABA Community Banking

SEPTEMBER 19, 2023

Whether sponsoring large-scale events or supporting local-level initiatives, banks can strengthen their brand presence and attract new customers while demonstrating a genuine commitment to the well-being of their communities. The post Taking your brand on the road appeared first on ABA Banking Journal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

SEPTEMBER 20, 2023

Understanding tax ID fraud FinCrime professionals looking to prevent tax ID fraud, first need to understand the fundamentals of what is happening and their best recourse for prevention. Would you like other articles like this in your inbox? Takeaway 1 Fraudsters file illegitimate tax returns early, hoping people wait to submit their legitimate ones.

South State Correspondent

SEPTEMBER 18, 2023

The banking industry’s average efficiency ratio worsened for the first time since 2021. The industry’s efficiency ratio increased to 54.30% in Q2/23 from 52.98% in Q1/23. This development is very important to community banks, as their efficiency ratio also increased, but to 61.63%. The national banks have already indicated how they plan to reverse the efficiency ratio increase – through headcount reduction.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

American Banker

SEPTEMBER 18, 2023

PayPal's new stablecoin offering should be setting off alarms at traditional banks, because it could seriously challenge their dominance in the payments space.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Accenture

SEPTEMBER 20, 2023

In their first post, “It’s now or never: Time for central banks to embrace change,” my colleagues Rohit Mathew and Oliver Reppel explored why central banks need to transform digitally to ensure they can fulfil their mandate. In this post, they explain how central banks can go about changing the way they use data and… The post Reviving the central bank: Getting (everyone) on the data train appeared first on Accenture Banking Blog.

CFPB Monitor

SEPTEMBER 18, 2023

As readers may recall, California previously attempted to enact a “Digital Financial Assets Law” with the introduction of AB 2269 in February 2022. In relevant part, AB 2269 proposed (1) a stringent licensing requirement for entities engaging in or holding themselves out as being able to engage in “digital financial business activity” with or on behalf of California residents and (2) substantial ongoing reporting and operational obligations, both of which California modeled after New York’s “Bit

The Financial Brand

SEPTEMBER 20, 2023

This article Unleashing the Power of Generative AI: 3 Use Cases for Payments appeared first on The Financial Brand. Financial services companies have long used AI to enhance products and combat fraud, but large-language models are a game-changer. This generative AI primer is for payments execs. This article Unleashing the Power of Generative AI: 3 Use Cases for Payments appeared first on The Financial Brand.

South State Correspondent

SEPTEMBER 20, 2023

Not all customers are created equal. Some customers are more profitable than others, and if you are out to build a more profitable bank, it pays to have a tactical plan to go after more profitable customers. The treasury or cash management customer is usually a bank’s most profitable customer on a risk-adjusted basis ( HERE ). In this article, we discuss cash management profitability and rank the most profitable industries for banks to go after.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Perficient

SEPTEMBER 21, 2023

With all the hype around artificial intelligence (AI), AI can feel complicated, distant, or foreign. But guess what? It’s not new news and it doesn’t need to be complicated; it’s just a revolution of how we leverage data! Let’s take a quick dive into the data-driven universe of AI (i.e., intelligence automation). This article breaks down how data powers intelligence automation.

Payments Dive

SEPTEMBER 18, 2023

Alyssa Henry, CEO of Block’s merchant business Square, will leave the company just days after a service outage left merchant clients unable to process payments.

Abrigo

SEPTEMBER 21, 2023

Internet bank fraud is here to stay; learn how to detect and stop it. Every type of fraud has something unique it leverages to dupe unsuspecting citizens. Learn what is different about internet bank fraud. Would you like other articles like this in your inbox? Takeaway 1 It is important to monitor fraud effectively and consistently. Takeaway 2 Stay informed of trends in mobile fraud as well as internet bank fraud.

CFPB Monitor

SEPTEMBER 19, 2023

California continues to be at vanguard of data privacy rights. The latest effort by California legislators to protect consumer privacy rights focuses on data brokers, who under the proposed California Senate Bill 362 , aka the “Delete Act,” would be required to recognize and honor opt-out signals from Californians. The law seeks to expand on the deletion and opt-out rights provided under the CCPA, which currently requires a Californians to submit their deletion and opt-out requests on a compa

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Perficient

SEPTEMBER 19, 2023

The world’s largest gathering of insurance innovation, InsureTech Connect (ITC) , is right around the corner. And our team of industry experts is excited to connect, collaborate, and address the most pressing business needs of national and regional carriers. Following last year’s conference, Perficient Insurance Principal Brian Bell shared three key takeaways from the 2022 event: First, data and analytics investments still topped many insurers’ list of operational priorities.

Payments Dive

SEPTEMBER 17, 2023

Small business owners envision a cashless future, according to card giant Visa, even as some legislators move to protect unbanked and underbanked consumers.

Abrigo

SEPTEMBER 20, 2023

Insights into budgeting for BSA/AML and fraud software. Take a moment to consider your best-case scenario budget, and what steps bring you closer to what you need. Would you like other articles like this in your inbox? Takeaway 1 It is never too early to plan. Make time to budget for the department you want, not the department you have. Takeaway 2 Take the time to analyze your needs thoroughly.

CFPB Monitor

SEPTEMBER 20, 2023

The Connecticut Department of Banking (the “Department”) issued a guidance letter on September 11, 2023 (the “Guidance”) providing its position regarding the amendments to Connecticut’s Small Loan Lending and Related Activities Act (the “Act”) that become effective on October 1, 2023. We previously blogged about these amendments here. The Department issued this guidance “to assist industry participants in evaluating the need for licensure and the effect of the various requirements under [the ame

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

SWBC's LenderHub

SEPTEMBER 22, 2023

In a vast—and largely digital—lending landscape, big banks and FinTechs often hog most of the financial glory. They’re more visible and have slick advertising that suggests they’re the best and safest bet for a person’s financial future.

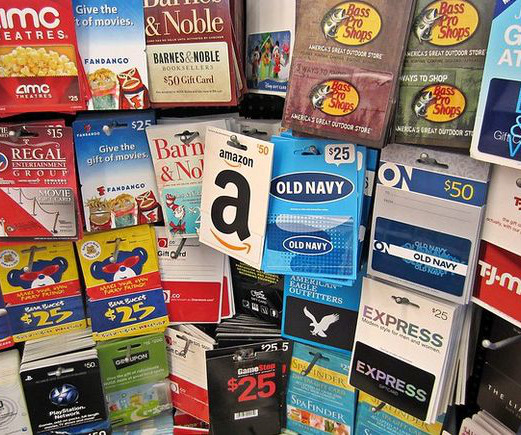

Payments Dive

SEPTEMBER 21, 2023

The state’s lawmakers approved a bill that would ban the use of plastic for gift cards by 2027, but it’s still waiting on the governor’s signature.

Abrigo

SEPTEMBER 20, 2023

How financial institutions can prevent losses from 1st-party fraud Learn strong approaches to identifying, preventing, and detecting 1st-party fraud that will keep your AML program on top of fraud trends. Join Abrigo for a webinar discussing risk assessments' role in compliance. register now Takeaway 1 1st-party fraud is especially disheartening because it is an inside job and indicates that KYC has been ineffective Takeaway 2 KYC procedures during onboarding and throughout the client relation

CFPB Monitor

SEPTEMBER 18, 2023

On September 14 th , the Federal District Court for the Eastern District of Kentucky granted the plaintiff’s motion to preliminarily enjoin the CFPB from implementing the Small Business Lending Rule (“Rule”) promulgated under section 1071 of the Consumer Financial Protection Act. As a reminder, the plaintiffs in the Kentucky lawsuit are the Kentucky Bankers Association and several Kentucky banks.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

ATM Marketplace

SEPTEMBER 19, 2023

The opening keynote at the Bank Customer Experience Summit in Charlotte from Sept. 12 to 13 covered AI, banking data and how it can all come together to deliver actionable insights.

Payments Dive

SEPTEMBER 18, 2023

The proposed digital dollar would create an electronic version of the U.S. currency, but it wouldn’t be the same as a central bank digital currency.

Gonzobanker

SEPTEMBER 21, 2023

The dog days of summer are over, but no sweater weather for deals yet. No record heat in deal activity, but warmth remains. Most players “wait and see,” but here are a few deals that caught our attention. Digital: Pigskin Pick-Ups Bankjoy , a digital banking provider, had a funding round led by the Curql Collective Credit Union Service Organization.

CFPB Monitor

SEPTEMBER 18, 2023

Last week, a group of consumer advocate organizations filed a Petition for Rulemaking with the CFPB that would prohibit the use of pre-dispute arbitration clauses in consumer contracts in favor of arbitration clauses that would permit consumers to choose between arbitration and litigation only after a dispute has arisen. We published a blog last Friday in which we enumerated the many flaws in the Petition and urged the CFPB to reject it.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content