Fiserv rises on international, government sales

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

BankBazaar

APRIL 23, 2024

Let’s face it, talking about money isn’t always sunshine and rainbows. We all dream of financial freedom, but the road there can be paved with some pretty epic stumbles. From the infamous “bottomless cocktail brunch” every Sunday that mysteriously drained your savings account to the “surely-I’ll-win-the-lottery” mentality, personal finance fails are a universal experience.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 23, 2024

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

TheGuardian

APRIL 23, 2024

Bank of England executive says creeping sense of complacency and lack of data is putting lenders at risk UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned. In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector –

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

APRIL 23, 2024

The Swedish BNPL pioneer said it has formed new partnerships with the ride-share company, as well as the travel firm Expedia Group.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

APRIL 23, 2024

Institutions and their investors are facing pressure from climate activists, cautiously awaiting interest rate cuts and adjusting to new Federal Reserve and FDIC policies.

BankInovation

APRIL 23, 2024

Goldman Sachs Group Inc. is closing down its automated-investing business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

American Banker

APRIL 23, 2024

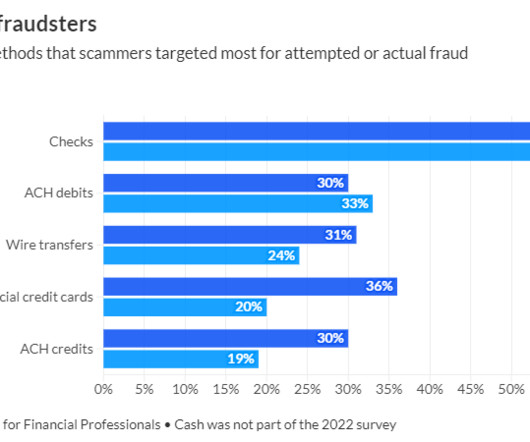

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

BankInovation

APRIL 23, 2024

Financial services technology provider Fiserv is deploying AI to drive productivity and sees growth opportunities in the point-of-sale and real-time payments segments.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

APRIL 23, 2024

In a letter to Treasury Secretary Janet Yellen last week, the Massachusetts senator highlighted the growing use of cryptocurrencies by malicious organizations abroad and underscored the need for anti-money-laundering and counterterrorism provisions in future proposals.

BankInovation

APRIL 23, 2024

Uplinq, a credit decisioning support platform for small business lenders, named former Wells Fargo leader Derek Ellington as its strategic adviser.

American Banker

APRIL 23, 2024

Many legal experts think the Supreme Court will rule in favor of the Consumer Financial Protection Bureau in a case challenging its funding. Such a ruling would unleash a flurry of litigation that has been on hold pending the outcome of the constitutional challenge.

The Paypers

APRIL 23, 2024

UAE-based du has announced the launch of du Pay to boost UAE’s transition toward a cashless economy and support the national digitalisation agenda.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

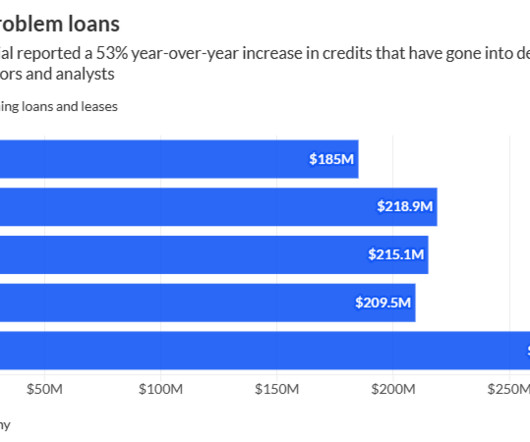

American Banker

APRIL 23, 2024

The Connecticut bank —a regional traditionally regarded as a cautious lender — said nonperforming loans and leases rose 53% year-over-year. The uptick was in mostly the commercial-and-industrial loan space, although there was one nonperforming commercial real estate loan, executives said.

The Paypers

APRIL 23, 2024

US-based payments provider Nium has partnered with Indonesia-based payment infrastructure company Artajasa to augment cross-border transfers for Indonesians.

American Banker

APRIL 23, 2024

Brendon Falconer, finance chief of the Indiana company since 2019, faces felony child molestation charges. But CEO James Ryan says management is focused on the CapStar integration and organic growth.

The Paypers

APRIL 23, 2024

South Africa’s central bank (SARB) has revealed a roadmap that would improve the country’s adoption of digital payment technologies.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

APRIL 23, 2024

The two regional banks are anticipating that borrower demand will increase in the back half of the year. High interest rates and economic uncertainty have been muting the appetite for borrowing.

The Paypers

APRIL 23, 2024

France-based SaaS platform for finance teams, Payflows has announced the rise of EUR 25 million in a Series A funding round, aimed at its expansion strategy.

American Banker

APRIL 23, 2024

The banking-as-a-service middleware provider will be acquired by TabaPay. Other middleware providers may be forced to evolve or face the same fate.

The Paypers

APRIL 23, 2024

Yuno , a payments orchestration platform, has expanded its presence in Asia by launching its payment orchestration solution in Singapore, the Philippines, Thailand, and Hong Kong, among other key markets.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

APRIL 23, 2024

Congress passes laws all the time requiring agencies to issue rules on tough problems. But in many cases — and for many reasons — agencies sometimes just don't do it. Taking those responsibilities away and giving them to another agency might keep agencies on track.

The Paypers

APRIL 23, 2024

Finland-based e-invoicing company Basware has announced the launch of AP Protect, an AI-enabled solution that aims to safeguard businesses from fraud and invoice errors.

American Banker

APRIL 23, 2024

The JPMorgan Chase CEO took aim Tuesday at the proposed Basel III endgame rules, hindrances to mergers and bureaucratic burdens. "I would love to have a more productive relationship with regulators, but I think it takes conversation," Dimon said.

The Paypers

APRIL 23, 2024

Singapore-based cross-border payments company Thunes has announced its plans to acquire Tilia , an all-in-one payments platform, to accelerate its expansion in the US.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content