The next big payments disruptors may surprise you

Accenture

JANUARY 10, 2022

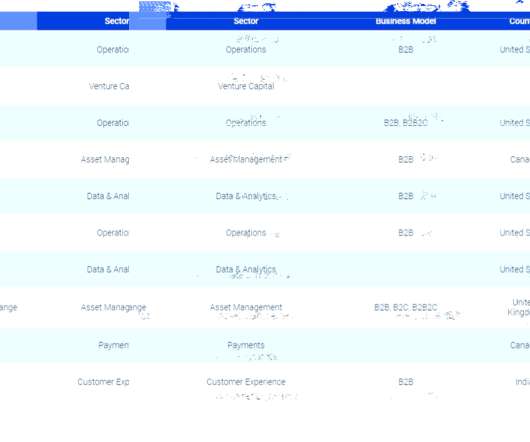

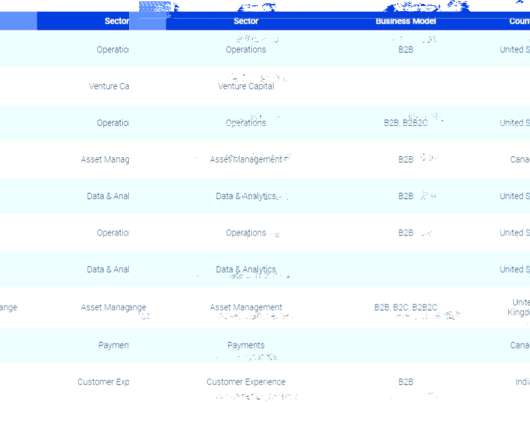

At the recent Money 2020 conference, I spoke with The Fintech Times about which potential disruptors banks and payments players are most concerned about. Accenture surveyed over 200 payments executives to find out what they thought were the biggest potential disruptors and growth opportunities in payments. That research will be available early this year, but….

Let's personalize your content