COVID-19, Digital Payments and the Future of Cash

Payments Dive

JULY 28, 2020

The COVID-19 pandemic has accelerated the use of digital payments and moved the debate over a cashless society to a near-term consideration

Payments Dive

JULY 28, 2020

The COVID-19 pandemic has accelerated the use of digital payments and moved the debate over a cashless society to a near-term consideration

Chris Skinner

JULY 29, 2020

A great headline posted in The Financial Times the other day: When the banks closed in Wuhan, nobody cared The Financial Times article makes clear how advanced the Chinese economy is today. For several months this year, banks across Hubei province, an area home to 60 million people, shut their … The post When the banks closed, no-one cared appeared first on Chris Skinner's blog.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

JULY 29, 2020

With the economic and political battles between the U.S. and China heating to a boil, one of China’s top banks is urging financial institutions (FIs) to cut their use of the SWIFT financial messaging network for cross-border transactions. The bank’s messaging applies to Hong Kong and Macau as well. With U.S. sanctions against China looming, state lenders there have reportedly been developing contingency plans.

Payments Dive

JULY 7, 2020

The rapid integration of the global payments market means that local payment methods will no longer be seen as an alternative payment method for multi-national payment processors and merchants, but the norm.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

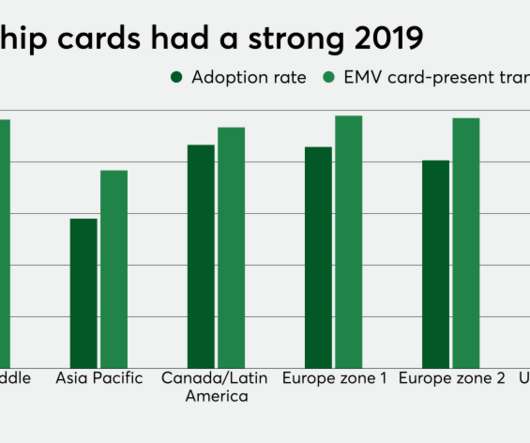

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Bobsguide

JULY 14, 2020

When auditors KPMG discovered a €1.9bn black hole in the accounts of German payments giant Wirecard last month, shockwaves were sent across the financial world. The ongoing scandal has raised questions for many, not least accounting firm Ernst & Young, whose previous audit had failed to.

Chris Skinner

JULY 6, 2020

I got an amazing reply to my post yesterday. I cannot say from whom – that’s part of the thing – but it’s such a good reply, I’m sharing it here. For me, it shows how the internet has changed the world – I can write a blog from Poland, … The post Am I wrong about Hong Kong? appeared first on Chris Skinner's blog.

PYMNTS

JULY 5, 2020

The nation’s marijuana regulator has told financial institutions to treat the $500 million hemp businesses the same way they would any other businesses. In updated rules from the Financial Crimes Enforcement Network ( FinCEN ), the U.S. Treasury Department’s financial crime division, the agency said the new guidance is in response to questions related to Bank Secrecy Act/Anti-Money Laundering regulatory requirements for hemp-related business customers.

Payments Dive

JULY 10, 2020

The rapid demand for safe, contactless merchant payments has led to renewed interest in QR codes, a payment technology that historically dominated Asian markets, but lagged NFC use in the U.S.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Source

JULY 27, 2020

Bill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

Perficient

JULY 30, 2020

Perficient is a Top Place to Work in St. Louis. We’ve done it again! Perficient is proud to continue our tradition as a 2020 Top Workplace in St. Louis ! The St. Louis Post-Dispatch released the annual list with Perficient being named as one of St. Louis’ best midsize companies to work for. “I am thrilled that our employees in Missouri have once again recognized Perficient as a 2020 Top Workplace in the annual St.

Bobsguide

JULY 2, 2020

As the US startup community celebrates the recent Volcker Rule reform, some worry the change could impair the banking system as it recovers from recent market volatility. Sankar Krishnan, executive vice president and industry head, banking and capital markets at Capgemini, is.

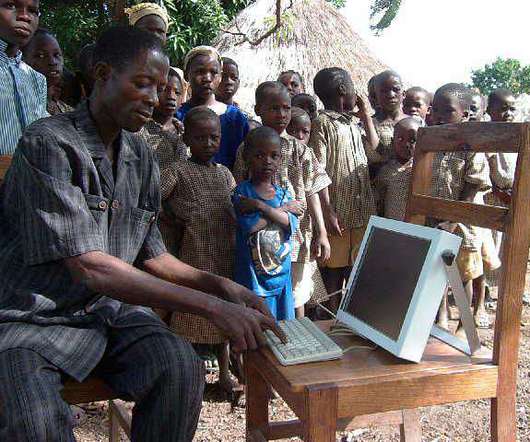

Chris Skinner

JULY 13, 2020

I have a few friends around the world that I pick up on, and The World Bank and CGAP are amongst that crew. Therefore, when I saw that Peter Zetterli, senior financial sector specialist with CGAP, was blogging about financial inclusion I couldn’t but help reach out to him and … The post Digital Banking for the Poor appeared first on Chris Skinner's blog.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

PYMNTS

JULY 3, 2020

The global pandemic has left no industry unscathed, but the travel business has the unfortunate distinction of being the sector that was slammed first and hardest, Colin Smyth , head of travel at payments platform Flywire , told Karen Webster in a recent conversation. “They took [that] punch in the stomach first, and they’ve had to rebuild, thinking about the ways they can survive until the industry opens back up again,” Smyth said.

Payments Dive

JULY 14, 2020

As the COVID-19 pandemic has rapidly changed the e-commerce landscape, online sellers need to make sure they are offering a wide range of payment options that cater to the needs of their customers.

Payments Source

JULY 2, 2020

More than a dozen large European banks plan to launch a payment system that would rival U.S. payment companies and technology firms, an idea that hasn’t worked in the past but may have a better chance given the current global health, economic and political crises.

Perficient

JULY 2, 2020

This series was written with joy by Grayson Harden , Rebekah Williamson , and Mary Claire Freese. Don’t miss out on the first article, New Hires Gain Real-World Experience in the Corporate Onboarding Boot Camp. Creating Career Connections at Perficient. When accepting internship and full-time offers with Perficient, Atlanta’s newest members were anxious to get into the office and kickoff the 10-week Boot Camp training program.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Bobsguide

JULY 3, 2020

The spread of the coronavirus and governments’ subsequent reaction has led to a surge in the adoption in contactless payment methods such as card and mobile payments. A report released by consumer research firm Dynata, surveyed 1000 people is 11 different countries found a universal uptick.

Chris Skinner

JULY 1, 2020

McKinsey I only just stumbled across this 124 page report from McKinsey. I know we can critique consulting frims, but sometimes they do produce something interesting, apart from auditing. In the case of McKinsey, building on yesterday’s free research from Deloitte, this report is all about digital transformation and replacing … The post McKinsey on digital transformation in banking (free research) appeared first on Chris Skinner's blog.

PYMNTS

JULY 14, 2020

The acceleration of [digital sales] growth can be explained almost entirely by an influx of first-time buyers.”. When consumers fled to online shopping options in Q2, many businesses weren’t set up for digital-first commerce, but quickly figured it out. There’s a cautious optimism now as SMBs, in particular, discover that going digital itself has gotten easier.

Payments Dive

JULY 10, 2020

The rapid demand for safe, contactless merchant payments has led to renewed interest in QR codes, a payment technology that historically dominated Asian markets, but lagged NFC use in the U.S.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Payments Source

JULY 1, 2020

An obscure-sounding statistic gives a fresh look at how dramatic the move to digital finance has been the past few months — and how permanent the move will be.

Perficient

JULY 20, 2020

Perficient is proud to be sponsoring this year’s Automotive CX Summit Series ! After providing an exclusive, in-person event for 15 years, this year’s Summit will take place virtually. The event will consist of two half days providing attendees with meaningful content focused on the automotive industry and peer-to-peer networking. Join Our Session.

Bobsguide

JULY 21, 2020

Automation was once embraced wholeheartedly by reconciliation departments as companies leaped at the opportunity to integrate the latest efficiency driving technology – everyone was a reconciliations superstar, focused on bringing about change and improvement. However, in more recent times.

Chris Skinner

JULY 9, 2020

In surfing this week, I found a great article on my friend Amit Goel‘s website GoMedici.com. The company has just completed a deep dive into the world of challenger banks or, as they term them, neobanks. The time for neobanks is now. Here’s their summary of thinking: Neobanking 2.0: Global … The post Neobanks: are they really challenging?

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Let's personalize your content