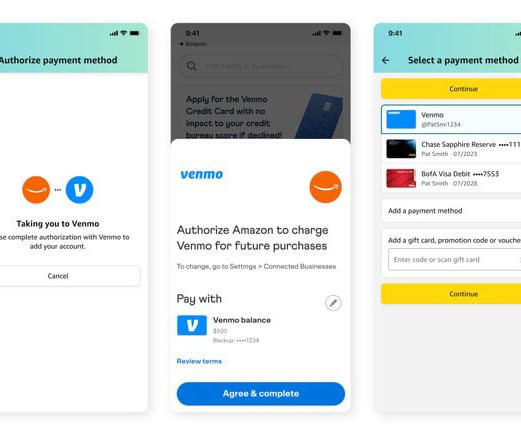

Amazon drops Venmo users

Payments Dive

DECEMBER 7, 2023

Jettisoning Venmo from the retail juggernaut’s marketplace is another strike against PayPal’s recent growth efforts.

Payments Dive

DECEMBER 7, 2023

Jettisoning Venmo from the retail juggernaut’s marketplace is another strike against PayPal’s recent growth efforts.

CFPB Monitor

DECEMBER 7, 2023

The Office of the Comptroller of the Currency (OCC) has issued a bulletin (2023-37) that provides guidance on managing risks associated with “buy now, pay later” (BNPL) lending. The BNPL loans addressed in the bulletin are loans that are payable in four or fewer installments and carry no finance charges. The bulletin cautions banks about the risks to banks and consumers associated with BNPL lending. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 7, 2023

The digital payments company replaced one director and added another, increasing the representation from Sequoia Capital entities, a trade publication reported.

Gonzobanker

DECEMBER 7, 2023

It’s time for banks and credit unions to finally execute those C&I lending priority initiatives. Senior bank and credit union executives have ranked commercial and industrial (C&I) loans as a top lending priority over the past several years in Cornerstone Advisors’ annual What’s Going On in Banking research. But further analysis shows the execution is not measuring up.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

DECEMBER 7, 2023

The payments processor has hired an enterprise growth officer who will zero in on M&A, strategy and ventures for the company.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

DECEMBER 7, 2023

The CFPB has released its Fall 2023 rulemaking agenda as part of the Fall 2023 Unified Agenda of Federal Regulatory and Deregulatory Actions. The agenda’s preamble indicates that “[t]he Bureau reasonably anticipates having the regulatory matters identified [in the agenda] under consideration during the period from November 2023 to October 2024.”.

ATM Marketplace

DECEMBER 7, 2023

WWS Fill4Me is the solution that extends the bank's operations to unstaffed channels such as self-service devices including ATMs, advanced ATMs and ASSTs.

CFPB Monitor

DECEMBER 7, 2023

This two-part podcast repurposes our most recent webinar on the latest salvo of actions in the Biden Administration’s initiative directed at combatting so-called “junk fees.” Launched in January 2022, the initiative shows no signs of abating. In Part I, we first review the background of the initiative, the range of fees the Administration has labeled “junk fees,” and discuss the Administration’s focus on competition and its related guidance and directives to federal agencies. .

Jack Henry

DECEMBER 7, 2023

Discover the impact of Jack Henry™ Connect 2023: Building relationships in banking tech, fostering trust, collaboration, and empowerment.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

DECEMBER 7, 2023

A provision to standardize and clarify banks' operational risk obligations — which opponents say is excessively costly and may not be effective — is emerging as the focal point of the public debate on the broader rule. It may also be the key to taking the rule over the finish line.

BankInovation

DECEMBER 7, 2023

Goldman Sachs is looking to generative AI for developer assistance, including coding purposes, and for lead generation among client-facing operations, Chief Financial Officer Denis Coleman said during Goldman Sachs 2023 U.S. Financial Services Conference on Tuesday.

American Banker

DECEMBER 7, 2023

Banks and fintechs are coming together to help older customers with a variety of needs, from avoiding financial exploitation to planning for the future.

BankInovation

DECEMBER 7, 2023

The UK has started consulting on its proposals to oversee the cloud computing and data analytics services that banks depend on, a push that could see parts of firms like Amazon.com Inc., Alphabet Inc. and Microsoft Corp. come under the remit of the country’s financial regulators.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

DECEMBER 7, 2023

Only 111 credit unions currently use The Clearing House's real-time payments platform, out of nearly 5,000 nationwide, but having the world's largest credit union in the system could lead more to join.

BankInovation

DECEMBER 7, 2023

NatWest’s generative AI team is looking at hundreds of applications for the technology throughout the bank, and categorizing the use cases is part of the strategy.

American Banker

DECEMBER 7, 2023

The multiple potential applications of generative artificial intelligence to the financial services industry are a huge opportunity — for the institutions prepared to adapt.

William Mills

DECEMBER 7, 2023

The fintech industry has many events, but what makes a show really stand out? The organizers of Fintech Meetup have nailed the answer to this question. The first edition of Fintech Meetup was described as “the best fintech show of the year”, “the best event for creating new opportunities” and “the industry’s newest and coolest event”, among other superlatives.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

DECEMBER 7, 2023

The Georgia-based bank says it's expanding its relationship with GreenSky, a home improvement lender that Goldman Sachs bought in 2022 but put up for sale a year later. The deal will bring a one-time revenue boost and a recurring fee income stream.

The Paypers

DECEMBER 7, 2023

BearingPoint has conducted a survey in seven European countries, concluding that cash is the most used payment method overall and contactless debit cards come second.

American Banker

DECEMBER 7, 2023

Leaders of the Dallas-based crypto services platform BankSocial hope to further decentralized finance concepts throughout the industry by using distributed ledger technology to support the proposed Defy Federal Credit Union's offerings of a deposit account and cryptocurrency services.

The Paypers

DECEMBER 7, 2023

Flutterwave has secured 13 new money transmission licences in the US in order to optimise the process of transferring funds between Africa and the US for its customers.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

DECEMBER 7, 2023

Once the pace of private equity-backed sales of middle-market companies picks up, the Rhode Island-based bank expects to benefit. CEO Bruce Van Saun says that Citizens' recent expansions in private banking and wealth management will provide opportunities to cross-sell to corporate clients.

The Paypers

DECEMBER 7, 2023

PayQuicker has announced the official launch of its Deals and Offers program for all account holders in the US.

American Banker

DECEMBER 7, 2023

Top industry executives said this week that price increases are abating, even if they haven't yet fully abated. Their remarks reflect increased confidence that the Federal Reserve will hold interest rates steady — or perhaps even cut them — in the first half of 2024.

The Paypers

DECEMBER 7, 2023

Currencycloud has announced its partnership with BriskPe in order to provide India-based micro and small businesses with multiple cross-border payment options.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content