Connecticut moves to regulate EWA

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

Perficient

SEPTEMBER 19, 2023

The world’s largest gathering of insurance innovation, InsureTech Connect (ITC) , is right around the corner. And our team of industry experts is excited to connect, collaborate, and address the most pressing business needs of national and regional carriers. Following last year’s conference, Perficient Insurance Principal Brian Bell shared three key takeaways from the 2022 event: First, data and analytics investments still topped many insurers’ list of operational priorities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 19, 2023

Brex, which got its start by offering corporate credit cards to startups, is one of many software vendors racing to bet on artificial intelligence.

CFPB Monitor

SEPTEMBER 19, 2023

California continues to be at vanguard of data privacy rights. The latest effort by California legislators to protect consumer privacy rights focuses on data brokers, who under the proposed California Senate Bill 362 , aka the “Delete Act,” would be required to recognize and honor opt-out signals from Californians. The law seeks to expand on the deletion and opt-out rights provided under the CCPA, which currently requires a Californians to submit their deletion and opt-out requests on a compa

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

SEPTEMBER 19, 2023

The service uses blockchain technology to convert clients’ deposits into digital tokens that can be used for instant, cross-border payments 24/7, the bank said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Realwired Appraisal Management Blog

SEPTEMBER 19, 2023

What would you do differently if you were starting over with your bank? Would you build your team, vendors and technology differently? Do you still have passion for the valuation industry? This is a tale rooted in Zen philosophy, offering insights into the pursuit of personal excellence.

TheGuardian

SEPTEMBER 19, 2023

FCA review gained attention after closure of former Ukip leader’s account by Coutts Business live – latest updates The UK’s financial regulator is expected to say it found no evidence that customers are being denied bank accounts or other financial services because of their political views, after launching a review after the Nigel Farage debanking row.

CFPB Monitor

SEPTEMBER 19, 2023

American Bankers Association (ABA), Association of Credit and Collection Professionals (ACA International), U.S. Chamber of Commerce (Chamber), Synchrony Bank (Synchrony), and National Consumer Law Center (NCLC) submitted comment letters in response to the Consumer Financial Protection Bureau’s request for information, about medical credit cards and other lending products used to pay for health care expenses.

American Banker

SEPTEMBER 19, 2023

The Consumer Financial Protection Bureau issued guidance on the use of artificial intelligence in credit underwriting, saying that creditors are relying too heavily on a CFPB checklist and sample forms when they should provide specificity to explain why a consumer is denied credit.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

The Paypers

SEPTEMBER 19, 2023

A group of banks such as JP Morgan and Bank of America have revealed their plans to launch a mobile wallet named Paze in a bid to compete with Big Tech companies.

American Banker

SEPTEMBER 19, 2023

A proposal by Sen. Josh Hawley to cap credit card interest rates deserves to be taken seriously, but requires far more detail than the legislative language provides.

TheGuardian

SEPTEMBER 19, 2023

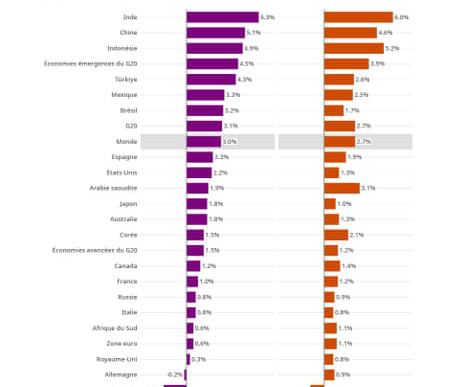

Rolling coverage of the latest economic and financial news, as Brent crude hits 10-month high and eurozone price pressures ease Farage row: no evidence of politicians being debanked, watchdog set to find Newsflash: inflation across the eurozone fell last month. Consumer prices across the single currency area rose by 5.2% in the year to August, down from 5.3% in July, and lower than the 5.3% initially estimated for August.

American Banker

SEPTEMBER 19, 2023

As Apple and Android enable smartphones to accept payments with little setup, an exec at the bank's Elavon unit contends countertop devices have a lot of life left.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

SEPTEMBER 19, 2023

TORONTO — Bank of America announced the addition of AI capabilities to its CashPro Chat function at Sibos 2023 Monday, bringing an enhanced user experience to its corporate and commercial clients. The $3.

American Banker

SEPTEMBER 19, 2023

Dawson Her Many Horses, a commercial banker at Wells Fargo, is a pivotal player in an effort among tribal leaders, the federal government and the private sector to improve the availability of economic data about Native American communities to encourage outside investment there.

PopularBank

SEPTEMBER 19, 2023

Beware of the latest bank phone call scam, which involves scammers impersonating bank call centers and fraud departments. These scammers will try to trick you into telling them your personal data so that they can hack into your accounts. How to spot the red flags of a bank phone call scam. The scammer claims to be calling from your bank. The caller ID may even look like it’s coming from your bank.

American Banker

SEPTEMBER 19, 2023

Denver-based InBank will expand into Georgia and Arizona, part of a wider plan to seize market share and build what one executive called a top-tier SBA lender.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

ABA Community Banking

SEPTEMBER 19, 2023

Whether sponsoring large-scale events or supporting local-level initiatives, banks can strengthen their brand presence and attract new customers while demonstrating a genuine commitment to the well-being of their communities. The post Taking your brand on the road appeared first on ABA Banking Journal.

American Banker

SEPTEMBER 19, 2023

The service was created to meet institutional clients' needs for real-time payments.

The Paypers

SEPTEMBER 19, 2023

Revolut has launched RevTags, a global payments solution addressed to businesses with the goal of disrupting SWIFT.

American Banker

SEPTEMBER 19, 2023

The $223 billion-asset bank said it will train its commercial bankers to work with clients to develop decarbonization transition plans. It also committed to reaching carbon neutrality within 12 years.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

SEPTEMBER 19, 2023

Silicon Valley Bank’s integration with First Citizens Bank is going “better than expected.

The Paypers

SEPTEMBER 19, 2023

Intesa Sanpaolo and Nexi have launched SoftPOS in Italy, allowing merchants to use their smartphones to accept payments from customers using contactless cards and digital wallets.

American Banker

SEPTEMBER 19, 2023

The Swedish furniture giant debuts a modest U.S. buy now/pay later loan program via Afterpay, with interest-free terms that are unlikely to anger regulators.

The Paypers

SEPTEMBER 19, 2023

iGaming fintech platform Xprizo has partnered with payments provider M-Pesa to enable its customers to withdraw funds using M-pesa directly into their Xprizo wallet.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content