Fees, interest charges rise to $347B: report

Payments Dive

JUNE 23, 2023

Fees and interest incurred on financial services, including credit cards, rose 14% last year, the Financial Health Network reported.

Payments Dive

JUNE 23, 2023

Fees and interest incurred on financial services, including credit cards, rose 14% last year, the Financial Health Network reported.

Abrigo

JUNE 23, 2023

A unified data platform helps banks organize without the headaches Abrigo Connect offers an alternative to data warehousing that lets financial institutions more easily put their data to use. You might also like this on-demand webinar on the new CFPB small business data collection rule Watch Takeaway 1 Banks and credit unions often face challenges implementing data warehouses and are not pleased with the result.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 23, 2023

The online broker said it agreed to acquire the credit card business for $95 million. X1 doesn’t charge card holders annual or late fees, but does charge interest.

CFPB Monitor

JUNE 23, 2023

On June 20, 2023, the Consumer Financial Protection Bureau (“CFPB”) issued its Office of Servicemember Affairs Annual Report , which analyzes consumer complaints received from servicemembers, veterans, and their families for the prior year. This year’s report highlights an increasing number of complaints received from servicemembers regarding payment apps and the heightened risks associated with identity theft and unauthorized use for military consumers.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 23, 2023

Can ATMs justify their existence in an increasingly cashless world?

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

ABA Community Banking

JUNE 23, 2023

Banks can use low-code no-code tools to drive innovation and customize and automate workflows even if they don’t have staff with highly technical coding experience. The post Low-code no-code: A visual approach to tech innovation for banks appeared first on ABA Banking Journal.

BankInovation

JUNE 23, 2023

Plaid is looking to fight fraud with its Thursday launch of a network-based tool to help financial institutions take a collective approach to a problem that cost consumers nearly $8.8 billion in 2022, according to the Federal Trade Commission.

CFPB Monitor

JUNE 23, 2023

On June 21, 2023, the American Financial Services Association (“AFSA”) asked the House Appropriations Committee to include language in the Financial Services and General Government appropriations bill that would prevent the Federal Trade Commission (“FTC”) from finalizing or implementing the Motor Vehicle Dealers Trade Regulation Rule (the “Proposed Rule”).

BankInovation

JUNE 23, 2023

Tech giant Google launched an anti-money laundering tool backed by AI on Wednesday for financial institutions to detect nefarious activities. The tool uses machine learning (ML) to help financial institutions (FIs) identify risky transactions efficiently while driving down operational costs and improving consumer experience by using first-party data by the FI, according to Google’s release.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CFPB Monitor

JUNE 23, 2023

Today, the U.S. Supreme Court held in a 5-4 decision that an appeal of the denial of a motion to compel arbitration automatically stays lower court proceedings pending the outcome of the appeal. The decision in Coinbase, Inc. v. Bielski resolves a split between the Third, Fourth, Seventh, Tenth, Eleventh, and D.C.

TheGuardian

JUNE 23, 2023

Delay is under intense scrutiny from City watchdog – but it may not just be simple profiteering Activists, campaigners and MPs are growing increasingly concerned that savings rates are failing to keep pace with the rapid rise in borrowing costs, putting the behaviour of the UK’s biggest banks in the spotlight. While worries are mounting about how mortgage holders will cope with higher interest rates, less focus has been put on savers.

The Paypers

JUNE 23, 2023

Collaborating with the Bank of Italy , the Associazione Bancaria Italiana (ABI) has brought together a group of banks in a pilot program for a central bank digital currency (CBDC).

TheGuardian

JUNE 23, 2023

Hopes of banks and building societies giving extra help to households after interest rate rise Business live – latest updates Jeremy Hunt is meeting with the leaders of Britain’s biggest lenders in Downing Street on Friday in an attempt to quell the growing crisis in the mortgage market sparked by rapidly rising interest rates. The chancellor is expected to ask banks and building societies if they can do more to support struggling households after the Bank of England intensified its battle to ta

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JUNE 23, 2023

Aite-Novarica, RBR rebrand as 'Datos Insights'; Singapore fines DBS, Citi for breaches in Wirecard scandal; the top-ranked employers for working fathers on Wall Street and more in this week's banking news roundup.

FICO

JUNE 23, 2023

Home Blog Feed test Top 10 Reasons to Migrate to FICO® Score 10 T Leveraging FICO’s heritage of scoring expertise, FICO ® Score 10 T is built with trended credit data enabling a higher level of predictive power Thu, 05/04/2023 - 04:28 JenniferPiccinino@fico.com by Moma Chakraborty Director of Product Management, Scores expand_less Back to top Fri, 06/23/2023 - 15:00 For 30+ years, the US lending marketplace and lenders have relied upon the industry standard FICO® Score to help drive their consum

TheGuardian

JUNE 23, 2023

People who renegotiate the terms of their mortgage on a temporary basis will not have to worry about having their credit scores downgraded, the chancellor, Jeremy Hunt, has said. Banks have agreed that people should be given a 12-month grace period before repossession proceedings start UK business: latest updates Continue reading.

American Banker

JUNE 23, 2023

After working for the Federal Deposit Insurance Corp. for a decade, Marc Minish was determined that he could open his own institution. Now he is the primary organizer of the proposed Nova Bank in Huntsville, Alabama, which has received conditional regulatory approval.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

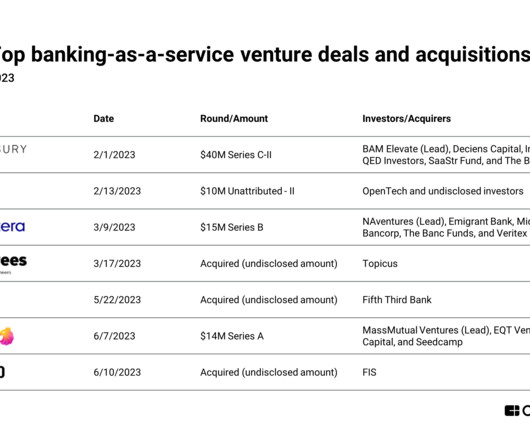

CB Insights

JUNE 23, 2023

Despite a slowdown in the overall fintech market , VCs, banks, and tech companies are opening their checkbooks to invest in or acquire banking-as-a-service (BaaS) providers. BaaS providers use application programming interfaces (APIs) to enable banks, fintechs, and companies outside of financial services to offer banking and payment products to end users.

American Banker

JUNE 23, 2023

We have the tools to address our housing challenges through a mix of regulatory reforms, policy changes, incentives and investment. What's needed is the will and leadership to put those tools to work.

The Paypers

JUNE 23, 2023

QNB Group , IBM , and Mannai InfoTech have partnered to provide in an innovative digital banking experience in Doha, Qatar.

American Banker

JUNE 23, 2023

JPMorgan Chase expanded one of the most high-profile projects to bring blockchain technology to traditional banking, introducing euro-denominated payments for corporate clients using its JPM Coin.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

JUNE 23, 2023

US-based fintech Fortis has gone live in Canada, acquired payments provider SmartPay and rolled out augmented funding and settlement capabilities for online marketplaces.

American Banker

JUNE 23, 2023

A former employee of The Change Company, which is the largest non-traditional mortgage lender in the U.S., claims in a new lawsuit that the firm mischaracterized the race, ethnicity and income of its borrowers. The company says the allegations, which relate to the representations it makes to be certified as a community development financial institution, are meritless.

The Paypers

JUNE 23, 2023

Cloud-based contactless receipting platform I Hate Receipts (IHR) has teamed up with Ingenico to augment the customer experience with Contactless HD Receipts at checkout.

American Banker

JUNE 23, 2023

The German bank's New York branch was entangled with U.S. regulators and law enforcement agencies for more than a decade in connection with money laundering and sanctions violations.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content