Will other states mimic New Jersey’s credit card surcharge?

Payments Dive

JULY 17, 2023

The state’s legislature passed a bill recently to cap credit card surcharges. One experienced payments executive believes that’s the wave of the future.

Payments Dive

JULY 17, 2023

The state’s legislature passed a bill recently to cap credit card surcharges. One experienced payments executive believes that’s the wave of the future.

CFPB Monitor

JULY 17, 2023

The CFPB has filed an amicus brief jointly with Maine’s Attorney General, Bureau of Financial Institutions, and Bureau of Consumer Credit Protection in the Maine Supreme Judicial Court in a case, Franklin Savings Bank v. Bordick , involving whether the Truth in Lending Act (TILA) applied to the defendants’ loan. Although Maine was granted an exemption from certain parts of TILA, the Maine Consumer Credit Code incorporates TILA and Regulation Z.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 17, 2023

In the U.S., total BNPL app downloads for the second quarter fell 19% compared to the year-ago period, Bank of America Securities analysts said.

American Banker

JULY 17, 2023

The Wildflower Foundation is seeking to raise $10 million for its Sunlight Loan Fund, which supports teachers who want to provide broader access to Montessori education. U.S. Bank recently closed on the inaugural commitment to the fund.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

BankInovation

JULY 17, 2023

FV Bank focuses on emerging trends and nimble technology as it invests in digital. Head of Core Banking and Cards Madhu Balasubramanian told Bank Automation News that the San Juan, Puerto Rico-based bank considers customer needs first and technology needs second, with regard to product and service implementation.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JULY 17, 2023

Data-sharing runs through dozens of projects designed to generate revenue beyond the point of sale.

BankInovation

JULY 17, 2023

State Street Corp. looked to optimize savings and operational productivity through technology and automation in the second quarter.

American Banker

JULY 17, 2023

An executive with the Federal Home Loan Bank of Chicago pushes back on a BankThink article criticizing the Mortgage Partnership Finance program.

The Paypers

JULY 17, 2023

Bahrain-based fintech enabler Arab Financial Services (AFS) has announced that it is powering the newly launched prepaid card offering from digital mobile-only bank ila Bank.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JULY 17, 2023

Consumer Financial Protection Bureau Director Rohit Chopra will engage in informal talks with Didier Reynders, the European Commission's commissioner for justice and consumer protection, on artificial intelligence, buy now/pay later and digital payments.

The Paypers

JULY 17, 2023

Global spend management solution Payhawk has launched in Lithuania and opened a new local office in Vilnius, aiming to develop its solutions in the region.

American Banker

JULY 17, 2023

Such concerns have taken on new importance with recent advances in artificial intelligence tools, which are "the most transformative technology of our time," Securities and Exchange Commission Chair Gary Gensler says.

The Paypers

JULY 17, 2023

Embedded rewards platform loyalBe has partnered with UK-based Open Banking customer rewards app Cheddar to facilitate loyalBe’s user base transition.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JULY 17, 2023

In a data breach at OpenAI, some ChatGPT users were able to see other users' financial data. In other cases, users have invoked their dead grandmothers to access information that should have been sealed off.

The Paypers

JULY 17, 2023

The Financial Conduct Authority has published the feedback statements for its 2022 Discussion Paper focusing on the competition impacts of Big Tech entry.

American Banker

JULY 17, 2023

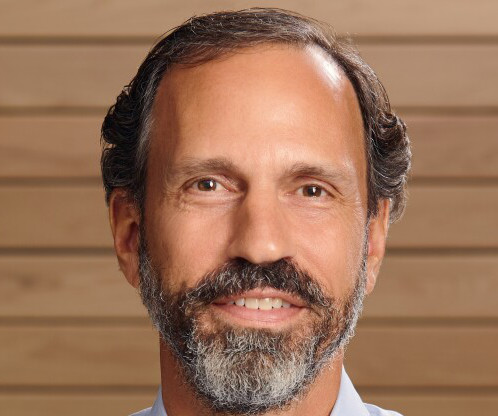

Known for his personal style and his support of affordable housing, the former MBA president also earned an ignominious distinction as the face of the Financial Crisis.

The Paypers

JULY 17, 2023

Saudi Arabia-based payment gateway HyperPay has acquired spend management fintech Sanad Cash to augment its digital payments suite across the MENA region.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JULY 17, 2023

The companies are both tapping the U.S. investment-grade primary market, kicking off a potential deluge of fresh bank bonds in the wake of second-quarter earnings.

The Paypers

JULY 17, 2023

Global acquiring, payment, fraud, and data analysis services company PXP Financial has received a Visa accreditation to become a token service provider.

American Banker

JULY 17, 2023

The group of banks would pay $68 million to settle the lawsuit, which originally estimated damages at $340 million.

The Paypers

JULY 17, 2023

Financial technology provider Bottomline has launched the Payer Name Verification service, which is an expansion of Confirmation of Payee (CoP).

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JULY 17, 2023

Scully, who founded and then eventually sold Howard Bank, will help the Rockville, Maryland-based Capital expand its footprint in the Washington, D.C., metro area.

The Paypers

JULY 17, 2023

Singapore-based B2B payments platform Thunes has raised USD 72 million in its Series C, with help from Visa , EDBI , and Endeavor Catalyst.

The Financial Brand

JULY 17, 2023

This article Student Loan Repayments Return to a Shifting Credit Landscape appeared first on The Financial Brand. Federal student loan payments won't be coming back to the same credit landscape that existed when the moratorium was put in place. This article Student Loan Repayments Return to a Shifting Credit Landscape appeared first on The Financial Brand.

The Paypers

JULY 17, 2023

Blockchain project Gnosis has launched a Visa card that allows users to spend funds from self-custodial wallets anywhere Visa is accepted.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content