Achieving Real-Time Fraud Prevention Across Your Teams

Jack Henry

NOVEMBER 29, 2023

Discover how innovative technologies are reshaping processes and safeguarding against fraudulent activities in our latest FinTalk blog.

Jack Henry

NOVEMBER 29, 2023

Discover how innovative technologies are reshaping processes and safeguarding against fraudulent activities in our latest FinTalk blog.

Payments Dive

NOVEMBER 29, 2023

PayPal is attacking illegitimate customer returns with new policies after a rise in e-commerce activity has fueled that type of fraud across the industry.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

NOVEMBER 29, 2023

One of the lessons that was driven home at the recent American Banker Small Business Banking Conference in Nashville was the difference in marketing between large national banks and community banks, particularly deposit marketing. Most national and regional banks allocate marketing resources to recently acquired customers to get them to build deposit balances and purchase other products, while most community banks do not.

Payments Dive

NOVEMBER 29, 2023

The proposed winddown would entail the entire consumer partnership, including the savings account that was rolled out this year, sources told The Wall Street Journal.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

South State Correspondent

NOVEMBER 29, 2023

Community banks are striving to increase loan yield and maintain their cost of funding (COF). Unfortunately, pressure on COF is expected to remain, and loans will reprice slower than expected as borrowers with below-market rates will wait until the last maturity day to refinance their credits. We have created and used a novel structure to take advantage of the inverted yield curve to allow community banks to increase net interest margin (NIM) and fee income on these existing fixed-rate loans.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

NOVEMBER 29, 2023

Throughout the past few years, the CFPB has sought input from a range of stakeholders, including community-based organizations and financial institutions, for feedback about how it can improve consumer financial products and services for consumers with limited English proficiency (LEP). As a part of these efforts, the CFPB has taken the following actions: in 2020, it published a Request for Information regarding challenges faced by LEP consumers and hosted a roundtable to discuss these challenge

Payments Dive

NOVEMBER 29, 2023

As consumers feel the pinch of inflation, some are turning to installment payment services to stretch their budgets.

CFPB Monitor

NOVEMBER 29, 2023

The U.S. Department of Housing and Urban Development (HUD) recently announced the 2024 loan limits for FHA insured forward mortgage loans and FHA insured Home Equity Conversion Mortgages (HECMs). The announcements were made in Mortgagee Letter 2023-21 and Mortgagee Letter 2023-22 , respectively. For forward mortgage loans in non-high cost areas, the amount for a single unit home increased from $472,030 in 2023 to $498,257 in 2024.

BankUnderground

NOVEMBER 29, 2023

Rebecca Freeman, Richard Baldwin and Angelos Theodorakopoulos Supply chain disruptions are routinely blamed for things ranging from elevated inflation to shortages of medical equipment in the pandemic. But how should exposure to foreign supply chains be measured? Using a global input-output database, this post shows that the full exposure of US manufacturing to foreign suppliers (especially China) is much larger than face value measures indicate.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

NOVEMBER 29, 2023

Are banks communicating effectively? How are they reaching underserved populations? Mack Turner, president and owner of Mack Turner Consulting and Insights, discussed this in detail in today's podcast.

Jack Henry

NOVEMBER 29, 2023

Jack Henry™ Connect 2023 Takeaways Determining how to improve back-office and branch operations is similar to making racing decisions for the Indy 500.

CFPB Monitor

NOVEMBER 29, 2023

Last week, the CFPB issued its Semi-Annual Report to Congress covering the period beginning October 1, 2022 and ending March 31, 2023. Today, CFPB Director Chopra appeared before the House Financial Services Committee for a hearing, “The Semi-Annual Report of the Consumer Financial Protection Bureau.” Tomorrow, he is scheduled to appear before the Senate Banking Committee for a hearing, “The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress.”.

American Banker

NOVEMBER 29, 2023

The Port Angeles, Washington-based bank said it has already invested "significant resources" into enhancing its compliance management for fintech partnerships, after self-reporting a problem last year.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

NOVEMBER 29, 2023

Technology providers Alkami, Finastra and Temenos all brought on new financial institution customers in the third quarter as demand for cloud-based solutions and digital banking rose. “Digital banking is an essential product now for a financial institution.

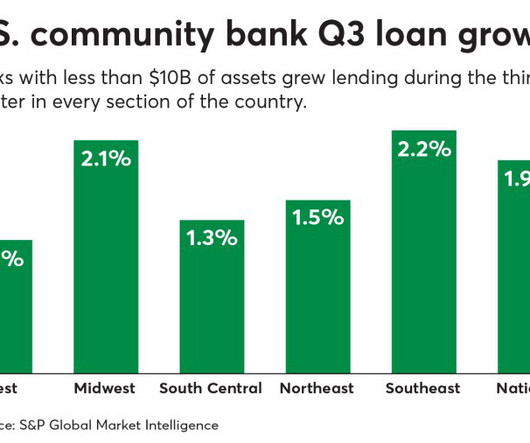

American Banker

NOVEMBER 29, 2023

Total loans at U.S. banks with less than $10 billion of assets grew by 1.9% in the third quarter, according to S&P Global Market Intelligence data. That was a slowdown from the previous quarter, and concerns about the viability of commercial real estate lending could dampen activity further.

BankInovation

NOVEMBER 29, 2023

Apple and Goldman Sachs are parting ways on the Apple Card and the tech giant will be in the market for a new issuer — and whether that’s a traditional financial institution or card-issuing fintech is the question now.

American Banker

NOVEMBER 29, 2023

Morais, who leads the auto lender's consumer and commercial banking divisions, is preparing to leave as Ally Financial conducts a search for its next chief executive officer. She had been seen as a potential candidate to replace outgoing CEO Jeffrey Brown.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

NOVEMBER 29, 2023

Australia-based regtech and onboarding provider LAB Group has entered the SMSF administration vertical by partnering with SuperGuardian for automated digital onboarding.

American Banker

NOVEMBER 29, 2023

Net income at banks fell 4.6% year over year in the third quarter, though it remained above pre-pandemic levels, according to the latest Quarterly Banking Profile. FDIC Chairman Gruenberg cautioned about deteriorating commercial real estate loans and unrealized losses on securities in a high interest rate enviroment.

The Paypers

NOVEMBER 29, 2023

UK-based Paysend has announced the raise of a USD 65 million in funding round, aimed at its development process and improvement of cross-border payments tools.

American Banker

NOVEMBER 29, 2023

Small towns, in which community banks are disappearing, have increasingly little to offer nascent businesses in the way of reliable credit.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

NOVEMBER 29, 2023

Switzerland-based Brighty App has launched Brighty Business, its European B2B payment platform, to simplify financial operations management for businesses.

American Banker

NOVEMBER 29, 2023

The U.S. Supreme Court heard oral arguments in a case that has large stakes for bankers who get into hot water with their regulators. Conservative justices asked tough questions of a Biden administration lawyer who defended agencies' reliance on administrative law judges.

The Paypers

NOVEMBER 29, 2023

Corporate mobility payments platform XXImo has announced that it is going all-in on Amazon Web Services as an EU Visa card issuer to process payments entirely through the AWS Cloud in Q1 2024.

American Banker

NOVEMBER 29, 2023

Two years after acquiring the installment lender Afterpay, Block, which also owns Square, is seeing the payoff of a strategy that focuses on the sale of specialty items.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content