Earned wage access programs are an alternative to predatory loans

American Banker

JULY 3, 2023

California's bid to regulate EWA programs as though they are loans would harm workers, companies and the state's economy.

American Banker

JULY 3, 2023

California's bid to regulate EWA programs as though they are loans would harm workers, companies and the state's economy.

BankInovation

JULY 3, 2023

Fraud rates continue to climb each year as fraudsters scale operations. For banks seeking to protect themselves from financial crime, it can feel like a losing battle. The Federal Trade Commission received more than 2.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Banker

JULY 3, 2023

One area of focus for the bank is using advanced artificial intelligence to detect business-email compromise. The payment messaging network Swift and online gambling host Caesars are also using AI to stop people from gaming their systems.

TheGuardian

JULY 3, 2023

Ministers respond to Farage’s claims, as Treasury to review whether banks are blacklisting those with controversial views It should be “completely unacceptable” for banks to close accounts on “political grounds”, a Home Office minister has said, as Conservatives weighed in on a so-called freedom of speech row prompted by claims from Nigel Farage. Tom Tugendhat, the security minister, was speaking in parliament after the culture secretary, Lucy Frazer, urged regulators to take action against bank

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

American Banker

JULY 3, 2023

The Supreme Court's decision to strike down billions in debt forgiveness could make it harder for millions of Americans to pay back other kinds of debt. It also threatens to further curtail lending in an already sluggish credit market.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JULY 3, 2023

It's been a tough housing market for first-time homebuyers. To ease their pain, VyStar has launched Dream2Own, which provides a credit simulator that doesn't hurt these prospective borrowers' credit scores.

BankInovation

JULY 3, 2023

Financial institutions are looking to AI to create tools for coding, marketing and customer experience. However, use of AI by banks is being monitored as risk remains top of mind for bank executives.

American Banker

JULY 3, 2023

JPMorgan Chase and Discover are among the firms developing new technology to allow more people to shop from behind the wheel.

TheGuardian

JULY 3, 2023

Merchant banker who served as lord chamberlain and brought much-needed reforms to the royal household David Ogilvy, the 13th earl of Airlie, who has died aged 97, was a reforming lord chamberlain who, as head of the royal household from 1984 until 1997, reorganised many time-honoured but not necessarily efficient royal practices. Among his achievements, he persuaded Queen Elizabeth II to cut the number of royals financed through the civil list paid by the government and to rationalise the manage

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

JULY 3, 2023

Financial institutions are looking to their digital capabilities as customer retention becomes more dependent on technology and less on loyalty.

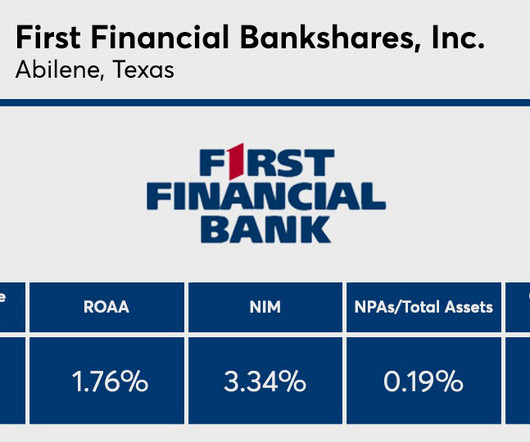

American Banker

JULY 3, 2023

In this annual list, American Banker examines key metrics of the 10 highest performing small regional banks.

The Paypers

JULY 3, 2023

Czech Republic-based embedded financing platform Lemonero has raised an extended seed round and growth capital for the acceleration of its development process in Europe.

American Banker

JULY 3, 2023

Discussions began with the Federal Reserve after the central bank's annual stress tests projected more favorable results than the lender is forecasting. BofA is seeking clarity so it can proceed with its dividend plans.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

JULY 3, 2023

Italy-based illimity Bank has partnered with the Engineering Group , with the consideration of a EUR 55.5 million funding round included in the agreement.

American Banker

JULY 3, 2023

The change comes as the Securities and Exchange Commission labeled the tokens as unregistered securities in its lawsuits against the crypto exchanges Coinbase Global and Binance Holdings in June.

The Paypers

JULY 3, 2023

Germany-based AAZZUR has partnered with Thinslices in order to streamline the procedure of launching and embedding fintech services for their customers.

American Banker

JULY 3, 2023

In Beijing, Yellen will meet with senior Chinese government officials to discuss the importance of responsibly managing the U.S.-China relationship, communicating directly about areas of concern, and working together to address global challenges.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JULY 3, 2023

Revolut has announced the launch of its services in New Zealand in order to offer Kiwis an improved digital experience and to drive market competition.

The Financial Brand

JULY 3, 2023

This article Topsy-Turvy Student Loan Battle Means Lenders Need to Re-Educate Themselves appeared first on The Financial Brand. The moratorium on student loan payments is ending (sort of) & the Biden debt forgiveness plan is dead (sort of). But really neither is kaput. This article Topsy-Turvy Student Loan Battle Means Lenders Need to Re-Educate Themselves appeared first on The Financial Brand.

The Paypers

JULY 3, 2023

Payment acceptance solution provider Ingenico has announced a partnership with Italy-based merchant service provider Axerve to improve merchant onboarding and in-store payments.

The Paypers

JULY 3, 2023

Lithuania-based regtech iDenfy offering ID verification and fraud prevention solutions has partnered with cryptocurrency and digital payment service provider Mountain Wolf.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

JULY 3, 2023

Tinaba has further expanded its partnership with the Ant Group in a joint effort to enable its Italians customers to make direct payments in Asia via its app.

The Paypers

JULY 3, 2023

Germany-based mobility provider Flix has partnered with Italy-based payments intelligence solution company Congrify to improve payment data management.

The Paypers

JULY 3, 2023

Kuwait-based fintech Spare has obtained the KSA Open Banking certification, based on the Open Banking Framework released by the Saudi Central Bank.

The Paypers

JULY 3, 2023

TerraPay, a payments infrastructure company, has joined forces with Attijariwafa bank to enable cross-border transactions in Morocco.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content