Global Payments mulls price increases

Payments Dive

JUNE 14, 2023

Global Payments CEO Cameron Bready called the payment services pricing environment “favorable” in light of increases rivals have made.

Payments Dive

JUNE 14, 2023

Global Payments CEO Cameron Bready called the payment services pricing environment “favorable” in light of increases rivals have made.

Gonzobanker

JUNE 14, 2023

To realize the rewards of the BaaS industry, banks and fintechs are going to have to learn to play by some non-negotiable rules – together. Cross River Bank recently found itself in hot water with the FDIC when the agency declared that the bank engaged in unsafe or unsound banking practices in relation to its compliance with fair lending laws and regulations, specifically the Equal Credit Opportunity Act and the Truth-in-Lending Act.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 14, 2023

The agency is eager to encourage open banking in the U.S., with plans for a rule proposal and oversight of standard-setting in the evolving arena.

CFPB Monitor

JUNE 14, 2023

The CFPB has released its Spring 2023 rulemaking agenda as part of the Spring 2023 Unified Agenda of Federal Regulatory and Deregulatory Actions. The agenda’s preamble indicates that “[t]he Bureau reasonably anticipates having the regulatory matters identified [in the agenda] under consideration during the period from June 1, 2023 to May 31, 2024.”.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 14, 2023

The program is part of Visa’s effort to invest $1 billion in the continent’s digital transformation over five years.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JUNE 14, 2023

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

BankBazaar

JUNE 14, 2023

Be it Credit Cards or coffee, too much of anything is bad! If you’re addicted to applying for Credit Cards, then this article might just be the antidote that you’re looking for. Swiping a Credit Card is as cool as sporting the best shades or shoes in the market (at least for me). Paying with a Credit Card has an air of sophistication to it. With all due respect, debit cards and payment apps are fine, but Credit Cards give a sense of exclusivity to proceedings.

American Banker

JUNE 14, 2023

In a new survey, 38% of treasurers said they want to bump up their allocation to money market funds. Only 27% were looking to increase their bank deposits, highlighting the pressures the industry faces as it strives to hold onto customers' cash.

William Mills

JUNE 14, 2023

Last month was the annual FinovateSpring conference, and as always, it did not disappoint. This conference is said to be “the future of Fintech events” and has been described as “the best Fintech show of the year.” This year, FinovateSpring took place at Marriott Marquis in San Francisco on May 23-25 where 1,300+ attendees were able to engage with impressive demos, insightful keynote speakers and expert panels.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JUNE 14, 2023

Total loans from credit unions increased by nearly 18%, driven in part by car dealerships rebuilding their inventory. Headwinds in the mortgage market also fueled interest in home equity loans.

The Paypers

JUNE 14, 2023

The Bank of Thailand has revealed its plans to launch a retail CBDC pilot in a regulatory sandbox in collaboration with three payment providers.

American Banker

JUNE 14, 2023

Both regional banks announced weaker guidance for net interest income than they had foreseen two months ago. The disclosures highlighted pressures that figure to take up a lot of the oxygen during second-quarter earnings season.

FICO

JUNE 14, 2023

Home Blog Feed test Critical Steps to Improving Hyper-Personalization at Scale Alyson Clarke of Forrester Consulting takes a deep dive into the implications and expectations around hyper-personalization to banks and their customers Thu, 06/15/2023 - 16:50 JenniferPiccinino@fico.com by Darryl Knopp expand_less Back to top Thu, 06/15/2023 - 11:05 Research shows more than half of all decision-makers understand the importance of hyper-personalization.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JUNE 14, 2023

Acting Comptroller of the Currency Michael Hsu said the banking industry has been largely insulated from crypto winter, but added that bank interest in servicing the crypto industry has waned over the same period.

BankInovation

JUNE 14, 2023

Amazon Pay has selected Affirm as its first buy now, pay later provider in the United States, with the goal to give customers a more flexible payment option and give merchants on the platform a way to reach new customers, according to Omar Soudodi, director of Amazon Pay.

American Banker

JUNE 14, 2023

If a lender can address language barriers, the loans can be simple to originate and are likely to deliver higher yields as well as ultra-low delinquency rates, experts said.

BankInovation

JUNE 14, 2023

Wells Fargo Chief Financial Officer Mike Santomassimo fielded criticism over stagnating consumer deposits Tuesday during Morgan Stanley’s US Financials, Payments and CRE Conference, and highlighted Wells’ digital infrastructure investment in response.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JUNE 14, 2023

For small credit unions, enlisting outside helps accelerate the development of new products — as long as all risks and regulations are properly addressed.

The Paypers

JUNE 14, 2023

Real-time payments gateway Volt has announced that it was approved by global commerce company Shopify as a global Open Banking partner.

TheGuardian

JUNE 14, 2023

Bank says UK consumers could lose £250m from scams originating on Meta platforms in 2023 Fraud on Facebook, Instagram and WhatsApp is projected to cost victims £250m this year, a leading UK bank has said, adding to pressure on the tech firms’ parent company, Meta, to tackle scams on its platforms. The chief executive of TSB , which produced the forecast, has written to the US tech company calling on it to take urgent action to address the soaring levels of fraud on social media.

American Banker

JUNE 14, 2023

This week in global news: Stripe joins the MACH Alliance, GoCardless downsizes, CBA battles crypto crooks and more.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

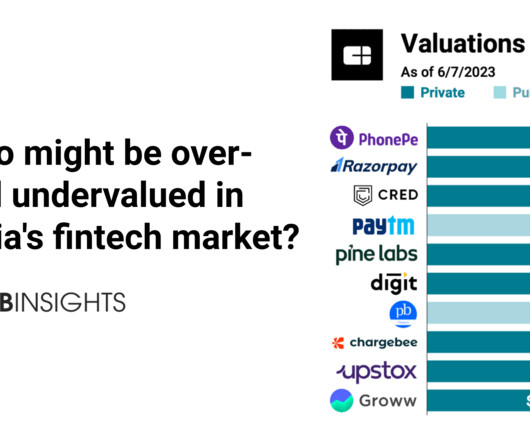

CB Insights

JUNE 14, 2023

With a population of over 1.4B people and strong economic tailwinds despite the global slowdown, India’s fintech ecosystem could be poised for growth. That’s at least the thinking of General Atlantic and the other investors who’ve pumped $850M in funding into PhonePe , one of India’s leading fintechs, since the start of this year.

The Paypers

JUNE 14, 2023

SaaS solution Mirakl has integrated generative AI-powered tools into its platform with the launch of a Large Language Model (LLM) feature built on OpenAI’s GPT-3.5.

American Banker

JUNE 14, 2023

The Federal Reserve chair said that as the Treasury replenishes its general account at the Fed, it will lead to fewer reserves in the banking system.

The Paypers

JUNE 14, 2023

US-based Astra has partnered with identity risk manager Alloy to streamline onboarding when existing Alloy customers leverage Astra’s transfer technology in their applications.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content