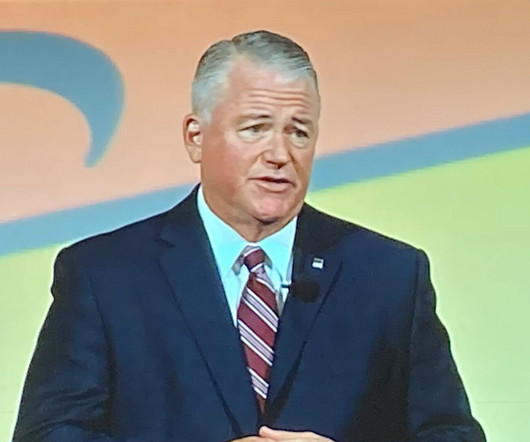

Dan Robb: Capital proposal is concerning to community bankers

ABA Community Banking

OCTOBER 9, 2023

Community banks need to get engaged on the regulators’ capital framework overhaul, outgoing ABA Chair Dan Robb told ABA’s Annual Convention in Nashville this morning. The post Dan Robb: Capital proposal is concerning to community bankers appeared first on ABA Banking Journal.

Let's personalize your content