How APIs can improve banking security

ATM Marketplace

JULY 18, 2023

Screen scraping is a major security issue for banks. By replacing this practice with APIs, banks can eliminate this issue and improve customer experience.

ATM Marketplace

JULY 18, 2023

Screen scraping is a major security issue for banks. By replacing this practice with APIs, banks can eliminate this issue and improve customer experience.

Payments Dive

JULY 18, 2023

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankInovation

JULY 18, 2023

PNC upped its 2023 improvement plan savings outlook by $50 million in the second quarter, increasing its cost-reduction efforts to $450 million, up from the previously announced $400 million.

Payments Dive

JULY 18, 2023

While there was a drought of venture capital for payments startups and other fintechs in the first half of the year, industry reports spot potential for new flows in the second half.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

BankInovation

JULY 18, 2023

BNY Mellon is looking toward digitization and automation to increase efficiency, drive down operational costs and improve consumer experience. WHY IT MATTERS: The $425 billion bank focused on digitally cleaning inefficient operations and planning medium- and long-term digitization efforts, Chief Executive Robin Vince said during BNY Mellon’s second-quarter earnings call today.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

JULY 18, 2023

The U.S. Court of Appeals for the Second Circuit has ruled that because “there is no bright-line rule that only purely factual or transcription errors are actionable under the [Fair Credit Reporting Act (FCRA)],” the FCRA does not contemplate a threshold inquiry by the court as to whether an alleged inaccuracy is “legal” for purposes of determining whether the plaintiff has stated a cognizable claim under the FCRA. .

Payments Dive

JULY 18, 2023

Rob Beard, who will also serve as head of global policy, brings M&A and capital markets experience to his new role at the card network company.

CFPB Monitor

JULY 18, 2023

The Consumer Financial Protection Bureau, the California Department of Financial Protection and Innovation (CA DFPI), and ten state Attorneys General have filed a lawsuit against Prehired, LLC (Prehired) and two related companies, Prehired Recruiting, LLC and Prehired Accelerator, LLC, alleging that the companies violated the Consumer Financial Protection Act (CFPA), the Truth in Lending Act (TILA), and the Fair Debt Collection Practices Act (FDCPA) in connection with offering and collecting on

Payments Dive

JULY 18, 2023

Ten banking and payments trade associations sent a letter to Congress on Friday objecting to the Credit Card Competition Act.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

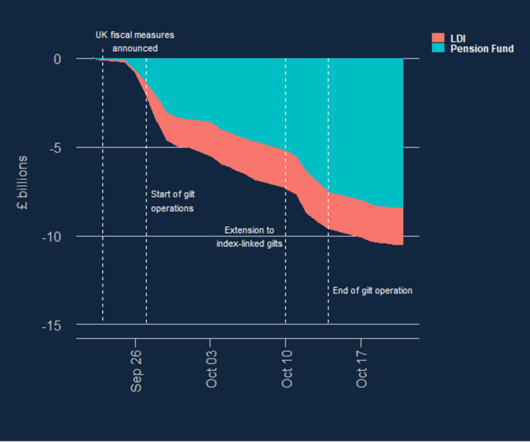

BankUnderground

JULY 18, 2023

Lydia Henning, Simon Jurkatis, Manesh Powar and Gian Valentini Autumn 2022 saw some of the largest intraday moves in gilt yields in history. It was then that jargon normally confined to financial stability papers entered into mainstream commentary – ‘LDI’, ‘doom loop’, ‘deleveraging’. And it was then that the Bank of England engaged in an unprecedented financial stability motivated government bond market intervention.

Payments Dive

JULY 18, 2023

Allegiant Stadium in Las Vegas just added its 10th frictionless store as the trend at sporting ventures expands.

TheGuardian

JULY 18, 2023

Former Ukip leader says he has a copy of a Coutts committee report showing decision was not based on his finances Nigel Farage has claimed to have obtained documents showing a prestigious private bank closed his account because his views “do not align with our values”, rather than due to not meeting a financial threshold. The former leader of the UK Independence party said he got hold of a report from Coutts’s reputational risk committee used to justify the closure via a subject access request.

ATM Marketplace

JULY 18, 2023

Banks are facing two main challenges: provide customer an even more engaging and omnichannel digital experience and reduce infrastucture and operational costs.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JULY 18, 2023

The nation's second-largest bank has weathered the Federal Reserve's rate hikes better than many others, but it's still at the central bank's mercy as deposit pressures continue.

BankInovation

JULY 18, 2023

BNY Mellon is looking toward digitization and automation to increase efficiency, drive down operational costs and improve consumer experience. WHY IT MATTERS: The $425 billion bank focused on digitally cleaning inefficient operations and planning medium- and long-term digitization efforts, Chief Executive Robin Vince said during BNY Mellon’s second-quarter earnings call today.

American Banker

JULY 18, 2023

Outgoing CEO James Gorman, who is set to become the investment bank's executive chairman, said he has no plans to ditch virtual annual meetings. He also argued that earnings should be reported twice each year, rather than quarterly.

BankInovation

JULY 18, 2023

Stablecoins are driving financial services innovations in Latin America, a growing fintech market. Argentine fintech Num Finance is using the technology to help businesses scale operations and weather economic instability, co-founder and Chief Executive Agustin Liserra told Bank Automation News during the first Global Startup Cities podcast from “The Buzz.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JULY 18, 2023

In the wake of the decisions to roll back affirmative action provisions within college admissions, many executives are looking for ways to continue championing diversity, equity and inclusion.

BankInovation

JULY 18, 2023

Bank of America’s AI-driven chatbot Erica has surpassed 1.5 billion client interactions since its 2018 launch, the bank said today in its second quarter earnings presentation. The chatbot totaled 166 million client interactions in the quarter, up 35% year over year, according to the presentation.

American Banker

JULY 18, 2023

U.S. regulators are examining how consumers finance health care spending, looking at practices used by Synchrony Financial's CareCredit unit and its competitors. But Synchrony CEO Brian Doubles said he's "very proud" of CareCredit, while downplaying the unit's involvement in the medical sector.

TheGuardian

JULY 18, 2023

Nikhil Rathi tells Treasury committee there are ways to assess whether customers are being treated fairly Business live – latest updates The City regulator has warned it will consider cracking down on banks that appear to be profiteering from, or failing to quickly pass on, savings rates once new regulations come into force at the end of the month. The Financial Conduct Authority (FCA) chief executive, Nikhil Rathi, told MPs on the Treasury committee that it was likely to take a range of “factor

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JULY 18, 2023

Banks are bracing for tougher requirements on operating subsidiaries in the U.K. as regulators debate how to best protect against financial contagion from failures abroad.

The Paypers

JULY 18, 2023

Nuvei and Plaid have announced an extension of their existing global partnership to support a wider range of businesses accepting bank-based payments for multiple use cases.

American Banker

JULY 18, 2023

The Federal Reserve vice chair for supervision said regulators will adapt supervisory practices to account for advancements in machine learning.

The Paypers

JULY 18, 2023

Identity verification company iDenfy has partnered with Germany-based 42 Heilbronn to maintain a secure e-learning environment for the latter’s customers.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content