4 ways to “Break the Cycle” and leave manual reimbursements in the past

Payments Dive

DECEMBER 11, 2023

Manual travel reimbursements cost companies time and money yet remain common in corporate policies.

Payments Dive

DECEMBER 11, 2023

Manual travel reimbursements cost companies time and money yet remain common in corporate policies.

CFPB Monitor

DECEMBER 11, 2023

Recently, Professor Sovern replied to our blog post that commented on the letter that he and 160 other law academicians submitted to the CFPB in support of the pending Petition for Rulemaking that would prohibit pre-dispute consumer arbitration clauses and permit only post-dispute clauses. In response, we would like to acknowledge that two of Professor Sovern’s statements are accurate. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 11, 2023

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

CFPB Monitor

DECEMBER 11, 2023

As we reported , the CFPB just released its Fall 2023 rulemaking agenda as part of the Fall 2023 Unified Agenda of Federal Regulatory and Deregulatory Actions. I have been contacted by many clients who have asked me whether we should read any significance into the fact that the anti-arbitration Petition for Rulemaking submitted to the CFPB by a consortium of consumer advocacy groups on September 13 is not mentioned in the new rulemaking agenda. .

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

DECEMBER 11, 2023

Michael G. Rhodes, previously the group head for Canadian personal banking at TD Bank Group, will take the helm at Discover in March.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

DECEMBER 11, 2023

“We’re going to continue to invest whatever we have to invest in order to get the compliance issues behind us,” CFO John Greene said last week.

American Banker

DECEMBER 11, 2023

Proposed capital rules aimed at bigger institutions will force regional and larger community banks to consider ways to grow or seek an exit strategy, bankers and analysts predict.

Commercial Lending USA

DECEMBER 11, 2023

Looking for commercial loans in the USA? Commercial Lending USA specializes in arranging commercial mortgages for businesses and commercial purposes nationwide. Get the funding you need today!

American Banker

DECEMBER 11, 2023

Bank CEOs are eyeing a near-term peak in deposit costs as the Fed perhaps moves closer to cutting interest rates. But the pressures they've faced this year as depositors ask for more compensation may not die down right away.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

DECEMBER 11, 2023

The European Parliament and European Council reached a deal Friday on AI regulation to protect consumers from high-risk uses of the technology while promoting innovation in a controlled environment. The deal could become the international benchmark on AI.

American Banker

DECEMBER 11, 2023

Michael Rhodes, who has spent the last dozen years in various executive roles at TD Bank Group, will become CEO and president of Discover Financial Services. The move comes four months after the unexpected departure of Discover's longtime CEO Roger Hochschild.

The Paypers

DECEMBER 11, 2023

The Hong Kong government has assigned USD 25.6 billion and has made significant investments to establish Hong Kong as a fintech hub through innovation and technology.

American Banker

DECEMBER 11, 2023

Mobile banking features that encourage customers to set savings goals can supercharge customer loyalty and attract new primary banking customers. A renewed focus on consumer savings may also help banks offset the decline in deposits reported at many banks in 2023.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

DECEMBER 11, 2023

Challenger bank Dave launched its generative AI-driven chatbot last week and is exploring multiple uses of the technology.

American Banker

DECEMBER 11, 2023

Leaders at the helms of organizations like Georgia United Credit Union, BayPort Credit Union, Blend Labs and more are adapting products such as "soft check" credit scoring, artificial intelligence-powered bots to streamline application reviewal and more.

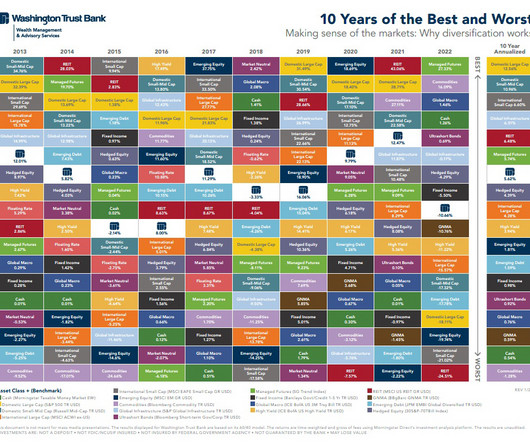

TrustBank

DECEMBER 11, 2023

Investing in the financial market can sometimes feel like sailing through unpredictable seas, especially during times of market stress and volatility. The waves of market uncertainty can make even the most seasoned investors uneasy, or at times even seasick. 2023 has been a time of turbulent markets. The graph below displays the year-to-date investment growth of a 60% equity and 40% fixed income portfolio (as illustrated by the MSCI All Countries World Index for equity and the Bloomberg Intermed

American Banker

DECEMBER 11, 2023

Internet-based banks are siphoning deposits away from urban centers in the U.S. and, unlike brick-and-mortar banks, face no requirement that they loan money back into those communities.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

DECEMBER 11, 2023

TikTok has entered into a joint venture with Indonesian tech company GoTo to resume its online shopping operations in the country.

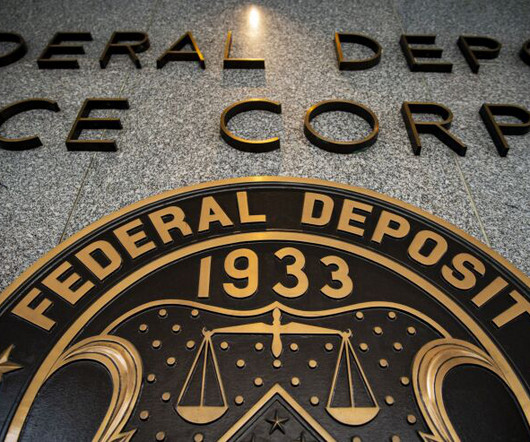

American Banker

DECEMBER 11, 2023

The Federal Deposit Insurance Corp. said Monday it has hired Cleary Gottlieb Steen & Hamilton to conduct an independent review of its workplace culture amid allegations of rampant sexual harassment in the workplace.

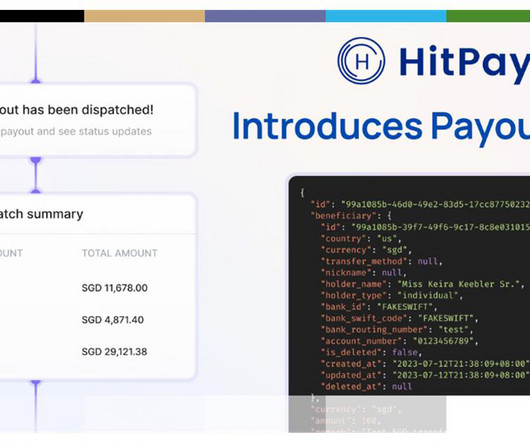

The Paypers

DECEMBER 11, 2023

Payment platform for SMEs HitPay has introduced Payout APIs in the regions of Singapore, Malaysia, and the Philippines, for multiple types of disbursements.

American Banker

DECEMBER 11, 2023

Citi is among an increasing number of global banks that's now building out desks to finance carbon offset projects, trade credits and advise corporate buyers in the hope of latching on to growth in a market that may reach $1 trillion.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

DECEMBER 11, 2023

Swift has tested an interoperability solution with BNY Mellon , Deutsche Bank , and four eBL platforms to promote the adoption of electronic documents for digitising trade.

American Banker

DECEMBER 11, 2023

More than half of those elevated to the senior role were women or people of color, marking the fourth consecutive year that historically underrepresented groups made up the majority of the class.

The Paypers

DECEMBER 11, 2023

AI-powered fraud and risk platform DataVisor has expanded its end-to-end platform capabilities by integrating SMS customer authentication for fraudulent transactions.

American Banker

DECEMBER 11, 2023

Activist investor Bluebell Capital Partners called on French payments company Worldline to shake up its board and replace its chairman to "restore the trust of the market" after the shares plunged almost 60% in a day.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content