Cash App enforcement action expected this year

Payments Dive

MARCH 4, 2024

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

Payments Dive

MARCH 4, 2024

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

CFPB Monitor

MARCH 4, 2024

On February 27, 2024, the U.S. Supreme Court heard oral argument in Cantero v. Bank of America, N.A. , a case involving the effect of the Dodd-Frank Act on the scope of preemption under the National Bank Act (NBA). The question before the Court is whether, post-Dodd-Frank Act, the NBA preempts a New York statute requiring banks to pay interest on mortgage escrow accounts. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 4, 2024

A Mastercard executive painted Regulation II as potentially harmful to consumers, while Fiserv’s CEO said it was an appropriate update due to the rise of online transactions.

Jack Henry

MARCH 4, 2024

Building financial technology can be an expensive undertaking for a bank or credit union. It’s generally reserved for the largest banks in the U.S. that have entire teams dedicated to R&D and building – rather than buying – custom solutions.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

MARCH 4, 2024

The peer-to-peer payment app provided a performance update, with transactions volume and value both up about 30% from the previous year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

MARCH 4, 2024

Rhode Island, Minnesota, and Nevada have joined the list of jurisdictions considering proposals to legislatively opt out of federal interest rate preemption established under the federal Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA). Although the legal effect remains unclear, the apparent objective of these proposed laws is to prevent interest rate “exportation” by state-chartered financial institutions.

BankInovation

MARCH 4, 2024

Lloyds Bank is looking to invest in cybersecurity and technology related to insurance and regulatory monitoring in 2024 amid uncertain macroeconomic conditions. “I like regtech because it’s important to keep on innovating in that space,” Robin Scher, head of fintech investment at Lloyds Bank, said at FinovateEurope last week.

CFPB Monitor

MARCH 4, 2024

After targeting credit card late fees in its proposed rule , the CFPB has set its sights on further attacking credit card pricing through interest rates. The CFPB published a blog late last month stating that credit card interest rate margins are at an all-time high, with an average 14.3% margin in 2023 compared to 9.6% margin in 2013, and have fueled the profitability of revolving balances.

American Banker

MARCH 4, 2024

Banco San Juan Internacional is suing the Federal Reserve Bank of New York and the Board of Governors in Washington claiming they wrongfully terminated its access to the federal payments system.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

MARCH 4, 2024

Citizens Bank takes a measured approach to adopting new technology. The best new products are created with an abundance of identified use cases, Jo Wyper, executive vice president and head of operations at Citizens Commercial Bank, tells Bank Automation News on this episode of “The Buzz” podcast.

American Banker

MARCH 4, 2024

A large language model detects signs of agent burnout and sends stressed-out employees calming videos created by Ariana Huffington's company Thrive Global.

TheGuardian

MARCH 4, 2024

Scion of the famous banking dynasty who was an admired cultural philanthropist in the arts and heritage worlds Jacob Rothschild, Lord Rothschild, who has died aged 87, combined a ruthlessly successful business career, following in the family tradition as a financier in the City of London, with philanthropic projects. These mainly centred on the arts and heritage, including the restoration of the dynasty’s enormous 19th-century replica of a French chateau Waddesdon , in the middle of the Buckingh

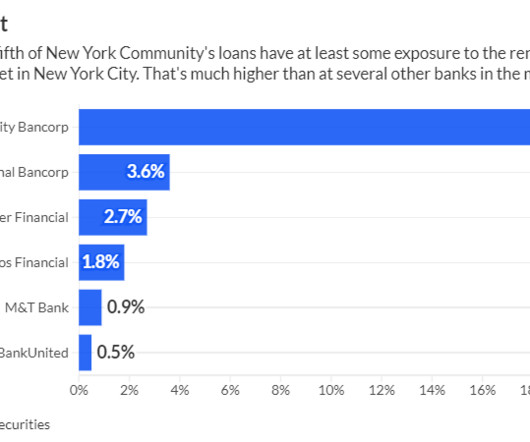

American Banker

MARCH 4, 2024

Long Island-based New York Community Bancorp has a large concentration in loans on New York City apartment buildings with rent restrictions. Property values in that sector have tanked amid higher interest rates, inflation and 2019 revisions to state law.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

MARCH 4, 2024

Nigerian authorities have called for a USD 10 billion penalty against Binance , as the platform caused financial losses within the country by manipulating exchange rates.

American Banker

MARCH 4, 2024

The peer-to-peer network moved $219 billion in the final three months of 2023, with scams and fraud accounting for about 0.1% of all volume, according to Early Warning Services, which operates Zelle and is owned by a consortium of banks.

The Paypers

MARCH 4, 2024

Global fintech services company TrueNorth has partnered with Brim Financial to provide consumer, SME, and commercial credit card solutions to banks and fintechs in the US and Canada.

American Banker

MARCH 4, 2024

Anu Aieyengar, Global head of M&A at JPMorgan discusses her career and her outlook for M&A activity in the year ahead.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MARCH 4, 2024

Flipkart has announced the launch of a new UPI service in partnership with Axis Bank , aiming to optimise fund transfers and checkout payments for Android users.

American Banker

MARCH 4, 2024

The Consumer Financial Protection Bureau says it is in favor of consumer choice, but its shifting position on earned wage access calls that commitment into question.

The Paypers

MARCH 4, 2024

Microsoft has rolled out Copilot for Finance to provide AI-powered, role-based workflow automation, recommendations, and guided actions in the flow of work.

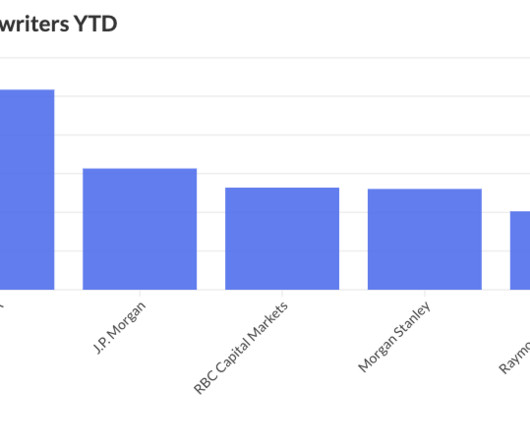

American Banker

MARCH 4, 2024

The bank has also hired some analysts to its infrastructure group over the past several weeks as it plans to beef up its muni team.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

MARCH 4, 2024

Global payment processing and orchestration platform WLPayments has collaborated with Payplug to deliver improved payment options for the former’s merchants and partners.

The Financial Brand

MARCH 4, 2024

This article Bankers Say BaaS Turmoil Primes Future Growth appeared first on The Financial Brand. Bankers now say upheaval in the industry has spurred the refinement needed to bring banking-as-a-service to the front of the table. This article Bankers Say BaaS Turmoil Primes Future Growth appeared first on The Financial Brand.

The Paypers

MARCH 4, 2024

Singapore-based B2B embedded finance startup Fairbanc has received USD 13.3 million in debt financing to expand operations in Indonesia.

The Financial Brand

MARCH 4, 2024

This article It’s Time for Banks to Shift to Trust-Centered Customer Relationships appeared first on The Financial Brand. Consumer attitudes about data privacy are changing — and the dynamics of power are shifting in their favor. This article It’s Time for Banks to Shift to Trust-Centered Customer Relationships appeared first on The Financial Brand.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content