CFPB may take legal action against Block

Payments Dive

FEBRUARY 23, 2024

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

Payments Dive

FEBRUARY 23, 2024

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

BankInovation

FEBRUARY 23, 2024

Envestnet data and analytics revenue fell during its fiscal fourth quarter amid rumblings in December of a Yodlee sale. The wealthtech giant’s data and analytics revenue fell 7% year over year to $38.6 million during the quarter, according to its earnings presentation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 23, 2024

The fee would apply if Discover chooses another buyer or if either board has a change of heart, but not if regulators block the deal.

ATM Marketplace

FEBRUARY 23, 2024

Gold has long remained a stable asset and today that asset is coming to ATMs.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

FEBRUARY 23, 2024

“To simplify the app experience, the U.S. version of the standalone Google Pay app will no longer be available,” the tech giant said in a Thursday blog post.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 23, 2024

Consumers facing financial hardships turned to buy now, pay later services more last year than stable consumers, according to survey results from the Philadelphia Federal Reserve Bank.

Commercial Lending USA

FEBRUARY 23, 2024

The cost of assisted living can vary greatly depending on various factors, including location, type of care required, facilities supplied, and the individual facility.

Payments Dive

FEBRUARY 23, 2024

Cosmin Pitigoi’s appointment comes six months after Flywire announced its long-time finance chief would be exiting.

TheGuardian

FEBRUARY 23, 2024

Bill Winters’ pay rises to £7.8m as bank says annual pre-tax profits rose by 19% in 2023 to £4bn • Business live – latest updates Standard Chartered has handed its chief executive his largest pay package in nearly a decade as the lender reported a jump in profits, despite bracing for up to £1bn in potential losses due to China’s property downturn. The profit bump helped push the longstanding chief executive Bill Winters’ pay up 22% to £7.8m – from £6.4m in 2022.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CFPB Monitor

FEBRUARY 23, 2024

On February 16, the Financial Crimes Enforcement Center (“FinCEN”) published a Notice of Proposed Rulemaking (“NPRM”) regarding residential real estate. The final version of the NPRM published in the Federal Register is 47 pages long. We have created a separate document which more clearly sets forth the proposed regulations themselves, at 31 C.F.R.

American Banker

FEBRUARY 23, 2024

After his aggressive cost-cutting raised profits above analysts' expectations, Block's CEO aims to retool several features of Square and Cash App to enable them to operate like a "social bank.

The Paypers

FEBRUARY 23, 2024

Telecommunications operators Cell C , MTN , and Telkom have welcomed the launch of two universal APIs available in South Arica that combat fraud and digital identity theft.

BankInovation

FEBRUARY 23, 2024

Capital One could be excluded from the proposed Credit Card Competition Act of 2023 if its acquisition of Discover Financial Services goes through and the bank creates an in-house processor. Read more on the Capital One, Discover deal The proposed act, introduced in June 2023 by U.S. Sen.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

FEBRUARY 23, 2024

The Financial Conduct Authority (FCA) of the UK has initiated an investigation into Lloyds Banking Group ’s Anti-Money Laundering (AML) controls.

American Banker

FEBRUARY 23, 2024

The quarterly filings ought to include far more detailed breakdowns of banks' commercial real estate loan portfolios, including the crucial distinction between owner-occupied properties and rentals.

The Paypers

FEBRUARY 23, 2024

Egypt-based Commercial International Bank has partnered with Ripple to implement blockchain technology aiming to enhance the efficiency of cross-border payments.

American Banker

FEBRUARY 23, 2024

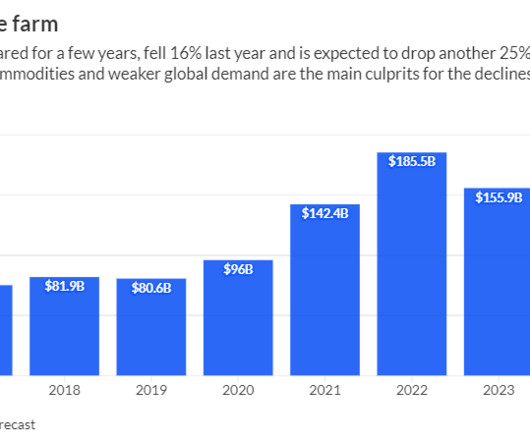

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

FEBRUARY 23, 2024

Google has announced its plans to launch the SoundPod, its portable speaker developed to validate and announce successful payments instantly, to SMEs across India.

American Banker

FEBRUARY 23, 2024

An FDIC enforcement action against Lineage Bank is part of a wave of cases involving banks that have partnered with fintechs in recent years.

The Paypers

FEBRUARY 23, 2024

Canada-based payments gateway Zum Rails has raised USD 7.78 million to expand its all-in-one payments gateway, including new Banking-as-a-Service offerings.

American Banker

FEBRUARY 23, 2024

The Department of Justice appoints Jonathan Mayer as its first chief AI officer, HTLF's CEO Bruce Lee plans to retire, Wilmington Trust's Doris Meister will step down in May, and more in the weekly banking news roundup.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

FEBRUARY 23, 2024

Prove Identity has announced its partnership with TargetData in order to continue its expansion in Brazil and provide customers with its suite of solutions.

The Paypers

FEBRUARY 23, 2024

US-based digital bank and fintech Green Dot Corporation has announced its collaboration with Dayforce , serving as the banking provider for the Dayforce Wallet.

The Paypers

FEBRUARY 23, 2024

UK-based API-first bank Griffin has launched Foundations, a programme for UK companies to integrate financial products with BaaS solutions.

The Paypers

FEBRUARY 23, 2024

iDenfy has announced collaborating with Rawcaster , a social media platform designed for influencers and their fans, aiming to increase influencer security.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content