Wise CFO nets larger pay than CEO

Payments Dive

JULY 7, 2023

CFO Matt Briers took home higher compensation as he prepares to step down from the company. The money transfer service’s CEO also is leaving for a planned sabbatical in September.

Payments Dive

JULY 7, 2023

CFO Matt Briers took home higher compensation as he prepares to step down from the company. The money transfer service’s CEO also is leaving for a planned sabbatical in September.

BankInovation

JULY 7, 2023

HSBC is increasing its investment in quantum computing innovation after teaming up with Quantinuum in May. The $3 billion bank joined a quantum-secured network by BT and Toshiba that will use quantum key distribution (QKD) technology to protect against advanced cyber threats, according to a Wednesday HSBC release.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

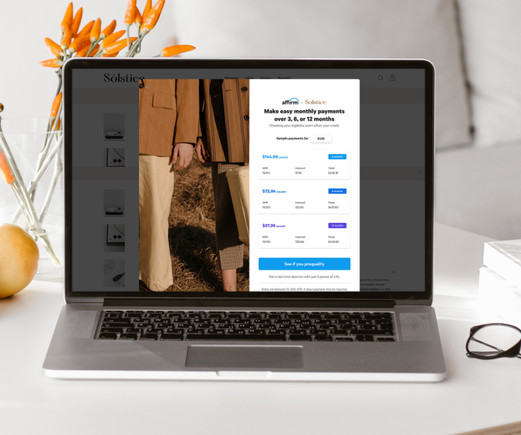

Payments Dive

JULY 7, 2023

Two years after purchasing Returnly for $300 million, Affirm said it’s divesting the returns management platform business.

Ublocal

JULY 7, 2023

As home values have increased in VT and NH in the last few years, you may have more equity in your home than you think. That equity can be borrowed against with a Home Equity Line of Credit (HELOC), or a Home Equity Loan to fund home improvements and renovations. Keep reading to learn about the differences between these two types of home financing, what they are best used for, and what to consider before applying.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JULY 7, 2023

The digital payments services provider pared its workforce last week, following on more extensive cuts last year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JULY 7, 2023

Lloyds Bank is continuing its migration to the ISO 20022 and identifying use cases for the network’s data as its capabilities roll out in phases.

ATM Marketplace

JULY 7, 2023

Avoiding financial traps is critical to increasing financial resilience and helping consumers to achieve their financial goals.

American Banker

JULY 7, 2023

The FDIC's New York regional office faced staffing shortages throughout its supervision of now-failed Signature Bank. Experts say more competitive wages, culture shifts and whistleblower protections could help regulators attract and retain talent and improve oversight.

The Paypers

JULY 7, 2023

Open Banking and Open Finance fintech Floid has announced the launch of an Open Finance product designed for the factoring industry in Colombia.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JULY 7, 2023

Some of the biggest names in banking have started using large language models to organize their institutional knowledge, but use cases like chatbots remain experimental.

BankInovation

JULY 7, 2023

AMOCO Federal Credit Union is identifying internal processes that will benefit from workflow automation built by software company IMM. The $1.5 billion credit union has used IMM for e-signature and electronic documentation for more than 19 years, Nathan Ashworth, senior vice president of technology at AMOCO, told Bank Automation News.

American Banker

JULY 7, 2023

The acquisition of Malvern Bancorp, expected to close this month, would hasten First Bank's efforts to further fortify its footprint stretching from Philadelphia to New York City.

Bussman Advisory

JULY 7, 2023

elink.io | See Original The post AI | Payments | Social Media appeared first on Bussmann Advisory AG.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JULY 7, 2023

The bank is offering earned wage access, a product that can reduce overdrafts and employee retention, but which may someday run afoul of regulators.

The Paypers

JULY 7, 2023

Open SaaS ecommerce platform for B2C and B2B brands BigCommerce has updated its multi-storefront (MSF) offering to help merchants grow internationally with localised shopping experiences.

American Banker

JULY 7, 2023

The sanctions were in response to violations of laws and regulations in areas including financial consumer protection, payment and settlement business and anti-money laundering obligation in the past years, according to China's central bank.

The Paypers

JULY 7, 2023

Non-profit organisation MACH Alliance has selected US-based payment platform PayPal as the first company to join its new Supporter membership category.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JULY 7, 2023

Banks say more transparency is needed in the annual scenario testing regime to make capital planning more predictable. But amid a flurry of regulatory reforms, the expectation is that capital requirements are only going up from here.

The Paypers

JULY 7, 2023

India-based fintech PhonePe has rolled out its Point-of-Sale (POS) device aimed at simplifying the checkout process for merchants and provide a seamless experience.

American Banker

JULY 7, 2023

California Bankers Association taps insider as next CEO, Spotify cuts off subscribers who use Apple's high-cost payments, Relay Payments backs auto-racing team and more in this week's banking news roundup.

The Paypers

JULY 7, 2023

The Chinese branch of Singapore-based DBS Bank has launched an e-CNY merchant collection solution to support the growing consumer usage of China’s CBDC.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JULY 7, 2023

A digital version of the British pound may feature a way to verify the holder's age and citizenship status, potentially smoothing the purchase of alcohol and tobacco and transactions with government agencies.

The Paypers

JULY 7, 2023

Financial Market Infrastructure (FMI) for cross-border settlements RTGS.global has partnered with MDO Humo and Credo Bank to simplify cross-border payments.

American Banker

JULY 7, 2023

Deposits of Listerhill and Avadian credit union customers were compromised by fraud conspirators, one instance in a rise of card skimming cases across the country.

The Paypers

JULY 7, 2023

France-based luxury department store Printemps has integrated Alipay+ to offer Asian customers a seamless checkout experience with their home e-wallets.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content