FTC revs up money transfer case against Walmart

Payments Dive

JULY 6, 2023

The Federal Trade Commission revved up its case against Walmart last week, alleging the retailer facilitated fraudulent transactions, despite a court ruling setback in March.

Payments Dive

JULY 6, 2023

The Federal Trade Commission revved up its case against Walmart last week, alleging the retailer facilitated fraudulent transactions, despite a court ruling setback in March.

Gonzobanker

JULY 6, 2023

Banking executives faced with rapid-fire industry changes may feel at times like they’re playing “Whack-a-Mole,” “Red Rover, Red Rover,” “Duck, Duck, Goose!” or any of those childhood games that if you were on the wrong team, on the wrong side of the line, or wearing the wrong clothes, chances were good you’d experience shame, blame or bruises. I feel your pain!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 6, 2023

Fidelity National Information Services will sell a 55% stake in Worldpay to the private equity firm GTCR for $11.7 billion, valuing the company at $17.5 billion.

Gonzobanker

JULY 6, 2023

Banking executives faced with rapid-fire industry changes may feel at times like they’re playing “Whack-a-Mole,” “Red Rover, Red Rover,” “Duck, Duck, Goose!” or any of those childhood games that if you were on the wrong team, on the wrong side of the line, or wearing the wrong clothes, chances were good you’d experience shame, blame or bruises. I feel your pain!

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JULY 6, 2023

“Hackers are using all sorts of sophisticated methods to trick and bypass biometric technology – like capturing audio clips of individuals’ voices, making fake fingerprints using putty and gelatin, and downloading photos and videos,” an executive writes.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JULY 6, 2023

In responses to a group of U.S. senators, the top 10 credit card issuers outlined their late fee practices and warned of potential consequences if fees are capped as the CFPB has proposed.

American Banker

JULY 6, 2023

The Consumer Financial Protection Bureau wants to wipe out $9 billion a year in consumer costs by cutting credit card late fees to just $8. But consumer complaints about late fees remain low, and experts say that's because many first-time late fees are forgiven.

Payments Dive

JULY 6, 2023

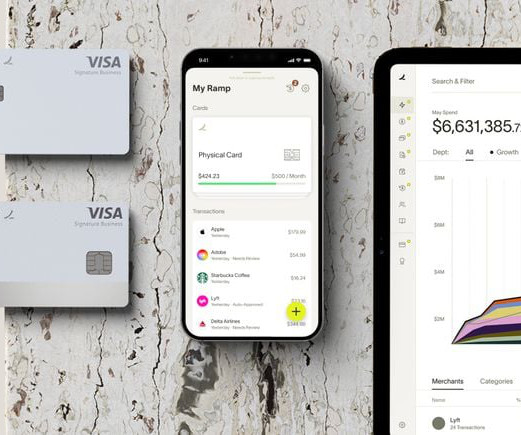

The finance automation platform said it acquired the startup to help drive AI-powered projects and solve problems for its customers.

TheGuardian

JULY 6, 2023

NatWest, Lloyds, HSBC and Barclays bosses expected to attend FCA meeting and justify disparity between loan and savings rates The chief executives of the UK’s largest high street banks will face the City watchdog on Thursday amid accusations they are “profiteering” as savings rates offered to customers lag well behind soaring borrowing costs. Bosses including NatWest’s Alison Rose, HSBC UK’s Ian Stuart, Barclays UK’s Matt Hammerstein, and Lloyds Banking Group’s Charlie Nunn, will meet the Financ

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JULY 6, 2023

Dan Kimerling, whose former company Standard Treasury was acquired by Silicon Valley Bank in 2015, shares his thoughts on what led to the bank's collapse, whether there will be a chilling effect on tech lending and if there is a future for niche banks.

The Paypers

JULY 6, 2023

Alipay, the China-based digital payment platform, has expanded its collaboration with countries in Southeast Asia in response to the increased spending by Chinese tourists on its platform.

American Banker

JULY 6, 2023

Eligible borrowers would receive a credit for up to $5,000 to pay for expenses like insurance, taxes and closing costs. The program comes months after fair-lending advocacy groups criticized KeyBank for its low rate of lending to Black borrowers.

The Paypers

JULY 6, 2023

PayNuts, a new Australia-headquartered payments provider, has unveiled its solution designed to provide merchants with a fresh approach for accepting payments.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

JULY 6, 2023

Private equity firm GTCR LLC agreed to buy a majority stake in Worldpay, the Fidelity National Information Services Inc. unit that handles card payments for businesses all over the world, in a deal valuing the target at $18.5 billion. FIS will receive upfront, net proceeds of about $11.

FICO

JULY 6, 2023

Home Blog Feed test FICO World 2023: Four Enterprise Fraud Management Takeaways Enterprise fraud management was a big topic at FICO World 2023, and this post explores four key themes that presenters and attendees discussed at the event Thu, 02/09/2023 - 10:23 Pawel Pasik by Debbie Cobb Senior Director, Product Management expand_less Back to top Thu, 07/06/2023 - 09:05 In May, I was fortunate to be at FICO World 2023 in Hollywood, Florida.

BankInovation

JULY 6, 2023

Financial institutions including JPMorgan Chase, Truist Bank and Wells Fargo are using AI models to expedite administrative processes and organize unstructured data through UiPath. Unstructured data from emails, texts and voice notes can provide value to a bank but might take time to collect and store, Gartner analyst Moutusi Sau told Bank Automation News.

American Banker

JULY 6, 2023

A resilient U.S. economy, lingering inflation and comments from the Federal Reserve contributed to a 10-basis-point hike in the 30-year fixed rate, Freddie Mac said.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

CB Insights

JULY 6, 2023

UBS — one of the world’s largest wealth managers — has greatly expanded its market footprint over the past few years. Notably, the bank recently completed a $3.2B rescue acquisition of its Switzerland-based competitor, Credit Suisse, which collapsed amid US banking turmoil in March. Beyond this deal, UBS has also turned to technology to strengthen its leadership position.

American Banker

JULY 6, 2023

Long, founder and CEO of Custodia Bank, has pushed for digital-asset regulation in her home state of Wyoming. Now she's working on a national scale.

BankInovation

JULY 6, 2023

PNC Treasury Management is automating its payments process for corporate clients through API integrations.

The Paypers

JULY 6, 2023

Payment processor Total Processing has announced a partnership with A2A payment infrastructure provider Token.io to offer Open Banking-enabled payments to European customers.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JULY 6, 2023

The company directed its bilingual team to steer customers away from products with no closing costs toward "predatory lending options" without disclosing the costs, in part by refusing to provide Spanish-language written materials, according to a lawsuit filed by current and former members of the company's bilingual mortgage sales team.

The Paypers

JULY 6, 2023

Mastercard has announced that it is leveraging AI capabilities to fight real-time payment scams with its ‘Consumer Fraud Risk’ solution, now live in the UK.

American Banker

JULY 6, 2023

The Securities and Exchange Commission plans to hold a meeting next week to finalize the changes, which are meant to prevent the kind of outflows that occurred in March 2020 when the onset of the pandemic roiled markets.

The Paypers

JULY 6, 2023

FinMont, a global Payment Orchestration platform, has joined forces with Justt, a chargeback mitigation provider, to implement automated solutions for chargeback disputes.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content