US check use for payments exceeds other countries: Fed

Payments Dive

AUGUST 22, 2023

Although there has been a drop in U.S. check use for transactions, other nations have seen sharper declines, a Federal Reserve study showed.

Payments Dive

AUGUST 22, 2023

Although there has been a drop in U.S. check use for transactions, other nations have seen sharper declines, a Federal Reserve study showed.

ATM Marketplace

AUGUST 22, 2023

New ATM standards for Payment Card Industry (PCI) compliance will also take effect beginning Dec. 31, 2024. Here's how to ensure you're prepared.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 22, 2023

The processing giants are battling for market share in the U.S., cutting prices in their fight to win over merchants.

Realwired Appraisal Management Blog

AUGUST 22, 2023

The appraisal department is a pivotal player that can bridge the gap between sound collateral protection and lenders making more loans safely. What if there was a way to harmonize these two seemingly divergent objectives? Let’s find a way. Now, imagine if our appraisal department could wear both hats effectively.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

AUGUST 22, 2023

How one supermarket chain aims to thwart consumer shoplifting at self-checkout kiosks, with help from smart cameras.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

AUGUST 22, 2023

The Alabama-based regional bank didn't effectively track whether some loans complied with flood insurance regulations, according to the Fed. Regions said that it had fixed the issue by 2017.

CFPB Monitor

AUGUST 22, 2023

Townstone Mortgage (Townstone) has filed its brief in the CFPB’s appeal to the U.S. Court of Appeals for the Seventh Circuit from the district court’s decision in the CFPB’s enforcement action against Townstone. In the decision, the district court ruled that a redlining claim may not be brought under the Equal Credit Opportunity Act (ECOA) because the statute only applies to applicants.

American Banker

AUGUST 22, 2023

Credit unions held more than 66% of all assets in the community development financial institution ecosystem, according to research from the Federal Reserve Bank of New York.

BankInovation

AUGUST 22, 2023

Barclays UK has announced the appointment of Lee Counselman as a managing director for technology investment banking. Counselman will focus on strategic M&A and equity work within the software banking team and report to Kristin Roth DeClark, head of technology investment banking, according to an Aug. 14 news release.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

AUGUST 22, 2023

A series of deals over the summer suggests growing interest by private equity investors in acquiring community banks. Five such deals have been announced this summer alone.

BankInovation

AUGUST 22, 2023

Barclays UK has announced the appointment of Lee Counselman as a managing director for technology investment banking. Counselman will focus on strategic M&A and equity work within the software banking team and report to Kristin Roth DeClark, head of technology investment banking, according to an Aug. 14 news release.

American Banker

AUGUST 22, 2023

The plan calls for the formation of Orca Bank in Bellingham, Washington. It would become a subsidiary of Savi, whose CEO would assume the same role at the bank.

BankInovation

AUGUST 22, 2023

Small businesses are embedding payments options beyond credit card transactions into their platforms as consumers desire pay-over-time capabilities.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

AUGUST 22, 2023

Brazil-based fintech Nomad has raised USD 61 million in an investment round held by Tiger Global Management.

American Banker

AUGUST 22, 2023

Banks are holding their fintech partners to a higher compliance standard as regulatory scrutiny of banking-as-a-service increases.

The Paypers

AUGUST 22, 2023

B2B payments and invoicing network TreviPay has launched a capability to support cross-currency sales between businesses, enabling merchants to process B2B transactions in foreign currency.

American Banker

AUGUST 22, 2023

It's hard to see FedNow as a revolutionary solution because it's not actually much newer, faster or cheaper in many cases than existing payment services.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

AUGUST 22, 2023

EchoPay , an A2A payments provider, has partnered with Token.io , an Open Banking payment infrastructure, aiming to bring A2A payments to wholesale merchants across the UK.

American Banker

AUGUST 22, 2023

Consumer loan balances fell in July for the first time since 2020 as banks have tightened lending standards in response to rising rates and jettisoned assets to bolster liquidity and capital levels.

The Paypers

AUGUST 22, 2023

India-based payments and API banking solution company Cashfree Payments has announced the launch of Vendor Payments to help businesses simplify the purchase-to-pay cycle.

American Banker

AUGUST 22, 2023

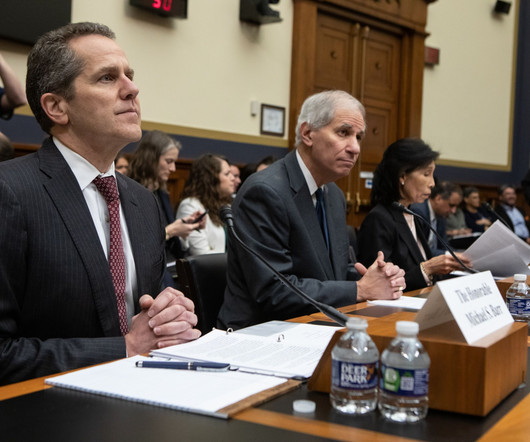

The American Bankers Association and Bank Policy Institute Tuesday urged bank regulators to delay the finalization of its Community Reinvestment Act rule, saying regulators have not calibrated the rule to account for upcoming capital changes or considered whether courts will find the Consumer Financial Protection Bureau's funding structure constitutional.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

AUGUST 22, 2023

Brazil-based B2B fintech Dock has announced its partnership with fraud and money laundering prevention company Feedzai to offer its clients new security solutions.

American Banker

AUGUST 22, 2023

The lack of affordable housing is becoming an increasingly acute political and economic problem. But a few small tweaks to a Federal Housing Administration loan program could unlock prospective homeowners' potential to solve that problem for themselves.

The Paypers

AUGUST 22, 2023

France-based Thales has announced the launch of its new payShield Cloud HSM service, aimed to improve the acceleration of cloud payments infrastructure adoption.

American Banker

AUGUST 22, 2023

News of the delisting, prompted by ongoing delays related to filing its 2022 annual report, triggered a selloff of the Philadelphia-based company's battered stock.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content