NCR outlines ATM spin-off strategy

Payments Dive

JUNE 30, 2023

The separation of NCR’s ATM business and its digital commerce operations is expected to occur in the fourth quarter.

Payments Dive

JUNE 30, 2023

The separation of NCR’s ATM business and its digital commerce operations is expected to occur in the fourth quarter.

South State Correspondent

JUNE 30, 2023

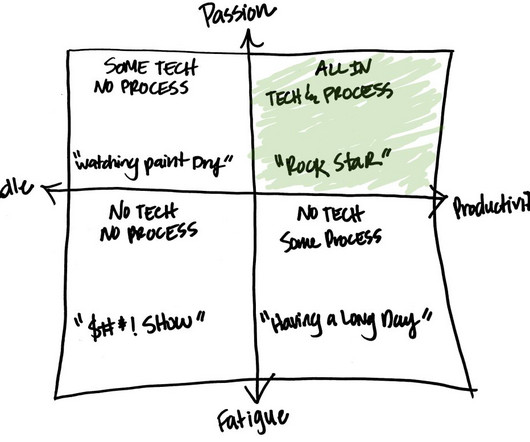

Many banks pride themselves on superior customer service, and approximately 90% of all community banks believe that they provide an above-average level of customer service (the math cannot work that way). The reason bankers should want to provide an above-average level of service is to increase profitability, which translates to charging customers more in the form of higher loan rates, lower deposit rates, and more charged fees.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 30, 2023

GetGo’s mobile payments promotion adds to the handful of initiatives the company has undertaken in recent months, including installing bitcoin ATMs at some locations.

Realwired Appraisal Management Blog

JUNE 30, 2023

With the current bank slowdown, many in the valuation field are considering retiring. In the past, retiring meant taking less jobs but not a full stop. Does green golf courses or fishing on the bay in your center console boat sound alluring? Maybe it’s thoughts of getting to all those house projects.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 30, 2023

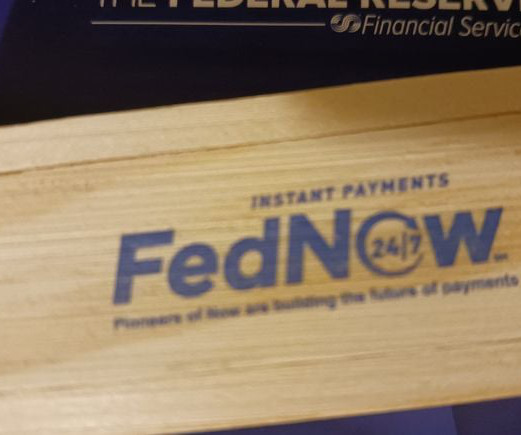

The soon-to-launch real-time payments system from the Federal Reserve may reduce interchange fee revenue for some payments players and increase IT costs for others.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JUNE 30, 2023

Sen. Elizabeth Warren, D-Mass., in a letter to the Consumer Financial Protection Bureau, challenged the idea that credit card late fees serve as a deterrent to delinquency, instead saying issuers told her office that some of them earn tens of millions of dollars collecting late fees.

The Paypers

JUNE 30, 2023

The EU has reached a provisional agreement between the European Parliament and the Council of the European Union for the legal framework regulating the European Digital Identity.

American Banker

JUNE 30, 2023

In June's roundup of American Banker's favorite stories: Attempts to steal consumer data target a growing number of banks, credit unions secure deposits outflowing from other financial institutions, Citizens recruits 50 former private banking employees of First Republic and more.

The Paypers

JUNE 30, 2023

The EU has reached an agreement on changes to the Capital Requirements Regulation and Directive, including new regulations for crypto assets.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JUNE 30, 2023

The card brand's Multi Token Network supports transaction authentication for blockchains and other new electronic payment options.

BankInovation

JUNE 30, 2023

Financial institutions can see the terms of a loan being offered by a competitor with a new platform launched Thursday by Salesforce. The San Francisco-based Salesforce’s Data Cloud combines data across systems to give banks a more complete picture of consumer activities, according to Salesforce.

American Banker

JUNE 30, 2023

Banks are simultaneously looking to shed their obligations under laws like the Community Reinvestment Act and begging the government for more support in the form of higher deposit insurance limits.

BankInovation

JUNE 30, 2023

London-based open banking startup Volt is looking to expand global operations with a $60 million series B round. The additional funds were announced by the company this month. Founded in 2019, Volt is seeking to create a global real-time payments system by uniting various open payments networks onto one platform, according to its website.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JUNE 30, 2023

Wells Fargo leads $70 million funding effort targeting credit-challenged entrepreneurs; PayPal adds Tap to Pay for Venmo, Zettle; Amex names new CFO to succeed retiring veteran finance chief and more in this week's banking news roundup.

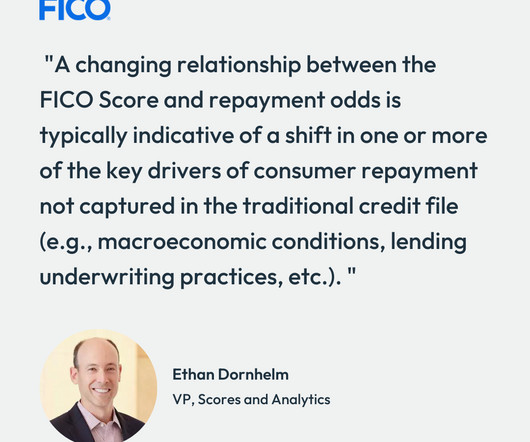

FICO

JUNE 30, 2023

Home Blog Feed test ‘FICO Drift’: What Is It, and What Causes It? FICO ® Scores rank-order the likelihood of borrowers’ credit repayment risk - the relationship between the FICO Score and repayment odds can and does shift Thu, 05/04/2023 - 01:08 JenniferPiccinino@fico.com by Ethan Dornhelm Vice President, Scores and Analytics expand_less Back to top Fri, 06/30/2023 - 17:00 Last month I attended the SFVegas conference , and I was struck by the number of attendees who approached me and asked about

American Banker

JUNE 30, 2023

With LIBOR's long-awaited sunset, the future of interest rate benchmarking must be defined by choice.

The Paypers

JUNE 30, 2023

Australia-based API platform Basiq has recently launched a partnerships programme aimed at bolstering customer capabilities and improving overall value, according to Australian Fintech.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JUNE 30, 2023

Following regulatory stress tests, three midsize institutions expect to be required to maintain larger stress capital buffers. The reverse is true for four of the nation's largest banks.

The Paypers

JUNE 30, 2023

US-based spend management platform Airbase has partnered with TravelPerk to enable businesses to manage their travel expenditure with less effort through one integration.

American Banker

JUNE 30, 2023

The changes, which are being discussed as part of a sweeping review by the Federal Housing Finance Agency, would amount to the most dramatic reshaping of the $1.6 trillion system in decades.

The Paypers

JUNE 30, 2023

Portugal-based transit system Lisbon Metro has partnered with UK-based transit payments processing company Littlepay to facilitate contactless bank card payments.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JUNE 30, 2023

The San Antonio bank says it will open 17 new financial centers in the Austin region by 2026. It's the latest step in a physical expansion strategy that has led to dozens of new branches in Houston and Dallas.

The Paypers

JUNE 30, 2023

Cybersecurity company Nokod has raised USD 8 million to establish a presence in the US market and further research vulnerabilities of low-code/no-code domains.

American Banker

JUNE 30, 2023

Yellen said that she sees diminishing risk for the U.S. to fall into recession, and suggested that a slowdown in consumer spending may be the price to pay for finishing the campaign to contain inflation.

The Paypers

JUNE 30, 2023

German-based mobility provider FREENOW has partnered with Revolut to offer access to Revolut Pro and its benefits to its drivers.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content