PayPal may axe straggler business units

Payments Dive

MARCH 12, 2024

On the fringes of the digital payment pioneer’s two main businesses are some in a third category that could be jettisoned this year, CEO Alex Chriss said last week.

Payments Dive

MARCH 12, 2024

On the fringes of the digital payment pioneer’s two main businesses are some in a third category that could be jettisoned this year, CEO Alex Chriss said last week.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 12, 2024

Tokenization could be a "major leap" for the monetary system. FDIC Vice Chairman Travis Hill doesn't want the U.S. to be left out.

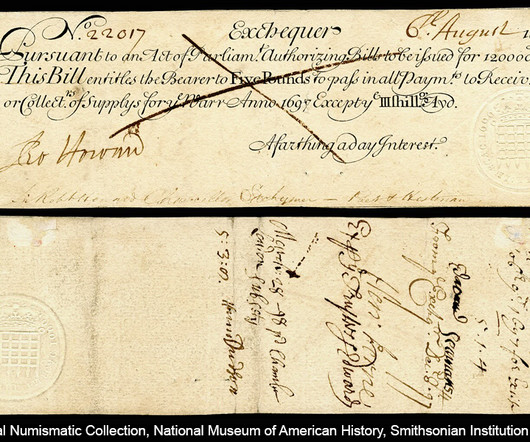

BankUnderground

MARCH 12, 2024

David Rule and Iain de Weymarn Technologies such as distributed ledgers create the possibility of new forms of digital money, whether privately-issued ‘stable coins’, tokenised commercial bank deposits, or central bank digital currencies. Authorities are considering a world where digital money circulates alongside existing forms of money. In the past, the nature of money has often changed.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

MARCH 12, 2024

The digital payments company will power website and app-based reservations for the car rental business, along with providing a point-of-sale system.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 12, 2024

The buy now, pay later company seeks to be involved in more consumer spending opportunities, but finance chief Michael Linford all but ruled out auto lending.

William Mills

MARCH 12, 2024

In a time where information reigns supreme, the strategic use of proprietary data in PR and marketing is not just an advantage — it's essential. As data-driven storytelling has become a cornerstone for success, PR and marketing professionals must learn how to properly gather, analyze and derive this information to help create stronger messages, bring more credibility, and garner greater media attention for clients.

CFPB Monitor

MARCH 12, 2024

The CFPB recently published a notice in the Federal Register indicating that it is seeking approval from the Office of Management and Budget for two new surveys intended to identify factors that influence a consumer’s decision to file a complaint with the CFPB. Comments must be received on or before May 6, 2024.

American Banker

MARCH 12, 2024

Through its integration with the auto manufacturer, Origence and its indirect lending subsidiary FI Connect aim to match buyers in need of auto loans to eligible credit unions.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Cisco

MARCH 12, 2024

Think of how much digital channels and the contact center have evolved.

American Banker

MARCH 12, 2024

Silicon Valley Bank, Heartland Tri-State and Citizens Bank in Sac City, Iowa, were among bank failures in 2023. What's changed since?

BankInovation

MARCH 12, 2024

First Financial Bank has grown its operations and attracted new customers through implementation of an AI-driven digital assistant. The $4.8 billion FFB teamed up with AI-driven tech provider Kasisto toward the end of 2022 to launch a digital assistant, according to a Feb. 22 case study by Kasisto.

American Banker

MARCH 12, 2024

The stock prices of five of these banks fell by more than 7% on the day they announced their fourth-quarter results, including two with double-digit decreases.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MARCH 12, 2024

Fintel Connect helps Live Oak Bank increase its deposit volume. The digital, FDIC-insured bank looked to affiliate marketing platform Fintel Connect nearly two years ago to expand its reach, Fintel Connect Chief Executive Nicky Senyard tells Bank Automation News on this episode of “The Buzz” podcast.

American Banker

MARCH 12, 2024

Banks must work closely with technology companies, regulatory authorities and each other to develop comprehensive strategies to combat deepfake fraud.

Realwired Appraisal Management Blog

MARCH 12, 2024

Last week a new DataComp Suite customer bought our software but then found out he couldn’t get out of his contract with a competing product. He missed the deadline to give notice. He signed our contract and we already ran his credit card. What should we do?

The Paypers

MARCH 12, 2024

Inpay has announced its plans to facilitate the European expansion of the global payment service provider (PSP) Tranglo by offering Instant SEPA across the region.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

TheGuardian

MARCH 12, 2024

Chief executive David Duffy would be biggest winner on £3.5m, with large paydays for about 12 other staff if deal goes through Banking bosses at Virgin Money are in line for a £6m windfall if Nationwide Building Society pushes ahead with a proposed takeover of the lender, with more than half of that sum to be pocketed by its longtime chief executive, David Duffy.

The Paypers

MARCH 12, 2024

Banco do Brasil has partnered with Germany-based Giesecke+Devrient in a bid to make offline payments with digital money a reality in Brazil.

American Banker

MARCH 12, 2024

The attack is one of three major incidents the lender has suffered in the past three years.

The Paypers

MARCH 12, 2024

A significant devaluation of Revolut , one of the UK's prominent fintech companies, has been indicated by a major shareholder.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

MARCH 12, 2024

Powered by its data-aggregation arm Finicity, Mastercard is piloting a service giving consumers an analytical view of all the subscriptions they routinely pay via credit, debit or ACH with options to cancel, pause or resume them.

The Paypers

MARCH 12, 2024

The UK government has announced its initiative to publish a National Payments Vision, in order to accelerate the development of the local payments ecosystem.

American Banker

MARCH 12, 2024

Regulators in the coming weeks or months will have to decide whether or how to finalize last year's Basel III endgame capital proposal, but there are risks — and rewards — to whichever path they choose.

Commercial Lending USA

MARCH 12, 2024

Looking for commercial loans in the USA? Commercial Lending USA specializes in arranging commercial mortgages for businesses and commercial purposes nationwide. Get the funding you need today!

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content