What does Gen Z want from banks?

ATM Marketplace

JANUARY 23, 2024

How should your bank appeal to Gen Z? Should the branch play a role? What about digital signage?

ATM Marketplace

JANUARY 23, 2024

How should your bank appeal to Gen Z? Should the branch play a role? What about digital signage?

Perficient

JANUARY 23, 2024

This post has been updated to reflect FINRA Regulatory Notice 24-02, issued January 23, 2024. The COVID-19 pandemic prompted several unprecedented shifts in society, notably impacting the workplace and necessitating the adoption of innovative technologies that facilitate collaboration and efficiency in a work-from-home (WFH) environment. For brokers, in the financial services sector, remote work became especially difficult due to the requirement for firms to register and supervise all home offic

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 23, 2024

“This wasn’t a scaled business for Ally, but on our side, this is absolutely a scaled business,” Synchrony CEO Brian Doubles said Tuesday. “This is exactly the type of acquisition that we look for.

CFPB Monitor

JANUARY 23, 2024

On September 18, 2023, the Federal Reserve, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency jointly published and sought comments on a proposal to implement new, standardized capital requirements that would, among other things, increase capital requirements for banks with $100 billion or more in total assets.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JANUARY 23, 2024

The Federal Reserve extended the time period during which it will accept public comments on its proposal to reduce the cap on debit card fees.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JANUARY 23, 2024

Greg Adelson, the company’s current president and chief operating officer, will take the reins from outgoing CEO David Foss in July.

American Banker

JANUARY 23, 2024

Several regional banks have projected minimal growth or even a decline in lending this year. But Connecticut-based Webster is bullish based on its pipeline of nonoffice commercial real estate, public finance and other credits, CEO John Ciulla says.

Payments Dive

JANUARY 23, 2024

Many venture-dependent startups that put off fundraising will be forced to do so this year or find an exit plan.

American Banker

JANUARY 23, 2024

The credit card issuer said it's "cautiously optimistic" about its borrowers' financial health, with charge-offs expected to rise not much further than pre-pandemic levels. The upbeat outlook contrasts with a key competitor's guidance of significantly higher losses.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

JANUARY 23, 2024

Expense management company and neobank Brex announced today it will lay off 282 employees, roughly 20% of its workforce. The move will help Brex become “a high-velocity company” that is “leaner, faster and closer to customers,” Brex founder and co-chief executive Pedro Franceschi said in a release.

American Banker

JANUARY 23, 2024

The Indiana bank is "on offense by continuing to invest in new client-facing and key support talent and being ready and opportunistic for acquisitions," CEO Jim Ryan says.

BankInovation

JANUARY 23, 2024

Synchrony Financial is expanding its distribution network through acquisition and additional product offerings in 2024. The Stamford, Conn.-based company “continued to diversify our programs in 2023, broadening the utility of our offerings and extending our reach,” President and Chief Executive Brian Doubles said today during Synchrony’s fourth-quarter 2023 earnings call.

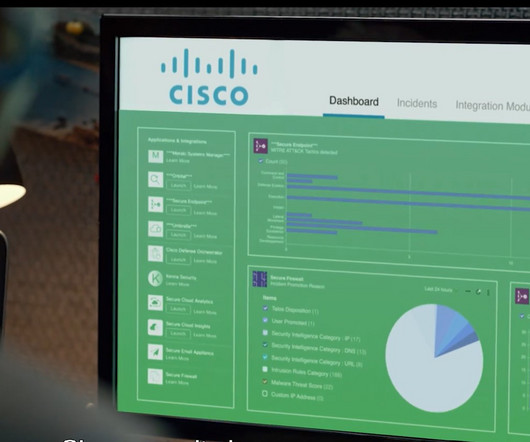

Cisco

JANUARY 23, 2024

Cyber security attacks in 2023 reached a new level of sophistication as significant supply chain attacks and evolved malware tools have accelerated the risk facing financial institutions.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JANUARY 23, 2024

The digital financial services firm announced layoffs Tuesday, with the goal of keeping the company steady until conditions improve for its business users.

BankInovation

JANUARY 23, 2024

Klarna Bank AB, the Swedish fintech that was once Europe’s most valuable startup, may soon launch a stock market listing in the US, according to Chief Executive Officer Sebastian Siemiatkowski.

American Banker

JANUARY 23, 2024

ModernFi, which helps banks source or offload deposits in reciprocal or one-way arrangements, recently raised a Series A with participation from Huntington Bancshares, First Horizon Corp. and Regions Financial.

The Paypers

JANUARY 23, 2024

UK-based fintech company Revolut has launched the Mobile Wallets feature to simplify the process of sending money abroad.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JANUARY 23, 2024

The Salt Lake City bank said that it doesn't expect to see major losses, even though the amount of problem loans in its portfolio rose at the end of 2023.

The Paypers

JANUARY 23, 2024

Singapore-based Terraform Labs , the company behind the TerraUSD stablecoin, has filed for bankruptcy protection in the United States.

American Banker

JANUARY 23, 2024

The Tennessee-based bank was forced to keep operating on its own after a proposed acquisition was called off. Months later, First Horizon has picked up new customers and improved its profitability, but investors remain cautious amid plans for catch-up spending on technology.

The Paypers

JANUARY 23, 2024

Singapore-based payment solution provider AXS has partnered with Triple-A , a global digital currency payments institution, to allow for bill payments with digital currencies.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

JANUARY 23, 2024

The former treasurer of FMC Corp. worries that the proposed new capital rules will translate into higher costs for corporate borrowers and reduced access to key types of financing options.

The Paypers

JANUARY 23, 2024

Lithuania-based Electronic Money Institution (EMI) company Satchel has partnered with UK-based financial crime compliance regtech Napier to integrate the latter’s AML platform.

American Banker

JANUARY 23, 2024

The CFPB is well within its authority to make these changes, which will increase the availability of credit to many Americans.

The Paypers

JANUARY 23, 2024

The European Parliament and the Council negotiators have reached a provisional agreement to reduce money laundering and limit cash payments to a maximum of EUR 10,000.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content