Payments funding slips further

Payments Dive

OCTOBER 18, 2023

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

Payments Dive

OCTOBER 18, 2023

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

South State Correspondent

OCTOBER 18, 2023

Grid-based pricing is typically used to set the applicable margin of a loan based on specific performance measures, such as credit rating or cash flow coverage. However, grid-based pricing can also be used to increase deposit balances. The average borrower does not calculate their cost of borrowing and return on deposits on the economic value as determined by fund transfer pricing (FTP).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 18, 2023

The new council is tasked with providing “strategic guidance” to the San Francisco-based card giant’s Washington think tank, but none of the initial members are based in the U.S.

Jack Henry

OCTOBER 18, 2023

We’re halfway through #JHConnect week and the forward momentum continues with lots of great sessions, valuable Tech Hall demos, proud flair-wearing, and ongoing networking.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

OCTOBER 18, 2023

The company is being penalized for unauthorized withdrawals, and attempted withdrawals, from mortgage customer accounts in April 2021.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

OCTOBER 18, 2023

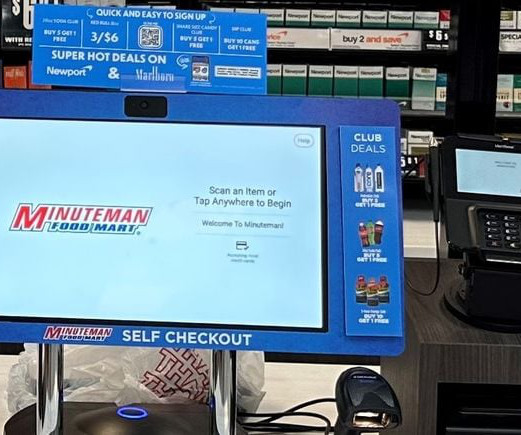

After a retrofit at a high-volume store failed, the North Carolina-based convenience store company went back to the drawing board and improved the design.

BankInovation

OCTOBER 18, 2023

U.S. Bank invested in digital capabilities within its payments business during the third quarter of 2023 as it shifted toward a more tech-led revenue approach. Tech spend at the $668 billion bank was up 20% year over year to $511 million, according to the bank’s Q3 earnings presentation.

American Banker

OCTOBER 18, 2023

The bank suffered its third breach in three years, this time by virtue of a vulnerability in Progress Software's file-transfer system. But Flagstar is only one of many such victims.

The Paypers

OCTOBER 18, 2023

UK-based X-Press Legal has added Open Banking to its online banking system, X-Press Pay, via Ordo , enabling consumers to directly pay for disbursements.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

OCTOBER 18, 2023

The Tennessee bank said a $72 million charge-off tied to a borrower in bankruptcy shaved 10 cents per share off its earnings. Management downplayed the issue, calling it "idiosyncratic," and emphasized that it was growing its loan portfolio.

BankInovation

OCTOBER 18, 2023

Citizens Bank reiterated its commitment to migrating all operations to the cloud by 2025 to create a modern banking platform during today’s third-quarter earnings presentation.

American Banker

OCTOBER 18, 2023

The Federal Reserve, which currently faces a Supreme Court case related to the fees, will vote on a proposal next week that will likely open up a rulemaking process to lower debit card interchange fees.

BankInovation

OCTOBER 18, 2023

Bank of Nova Scotia will dismiss 3% of its employees and take a writedown on its investment in a Chinese bank in a broad restructuring that underscores new Chief Executive Officer Scott Thomson’s focus on cutting costs. The reductions amount to about 2,700 jobs, based on the Canadian bank’s staff count as of July 31.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

OCTOBER 18, 2023

Poland-based financial technology solutions provider Verestro has announced the integration of the Quicko Wallet money transfer service within the Slack application.

American Banker

OCTOBER 18, 2023

Credit unions are seeing tepid growth at best, due in part to banks using online offerings to win over consumers.

BankInovation

OCTOBER 18, 2023

Ally Bank will continue to invest in technology to gain a competitive advantage over its peers.

American Banker

OCTOBER 18, 2023

Texas Attorney General Ken Paxton's office said it's reviewing whether 10 financial companies, including Bank of America and JPMorgan Chase, violate a state law that punishes firms for restricting their work with the oil-and-gas industry because of climate-change concerns.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

OCTOBER 18, 2023

Global card issuing platform Marqeta has announced its partnership with Motive in order to launch the Motive Card and deliver clients up to 10 percent savings.

American Banker

OCTOBER 18, 2023

Worried about the economy and new Fed rules on capital, the bank wants to hang onto its money just in case, CFO Daryl Bible told investors as he outlined second-quarter earnings.

The Paypers

OCTOBER 18, 2023

Philippine-based digital bank Tonik has partnered with life insurance company Sun Life Grepa Financial to roll out insurance for the former’s customers.

American Banker

OCTOBER 18, 2023

The Rhode Island-based bank is bolstering its cash position in the face of worries about office loans, stricter capital requirements for regional lenders and the possibility of economic shock from overseas conflicts.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

OCTOBER 18, 2023

US-based J.P. Morgan has announced its partnership with Trovata in order to develop a new suite of solutions for treasury management improvement.

American Banker

OCTOBER 18, 2023

NCR has completed the spinoff of its ATM business, Revolut doubles its number of fraud-fighters in two years, China builds a zone for digital yuan users, and more.

The Paypers

OCTOBER 18, 2023

Amazon Payment Services , a digital payments provider operating across the MENA region, has been granted a Retail Payment Services licence by the UAE Central Bank.

American Banker

OCTOBER 18, 2023

The "Get My Rate" tool, launched on Sept. 4 in collaboration with SavvyMoney, tells current and prospective members what loan rates they qualify for without adversely affecting their credit scores.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content