Banks should step up scam response: fraud expert

Payments Dive

FEBRUARY 9, 2024

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

Payments Dive

FEBRUARY 9, 2024

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

Abrigo

FEBRUARY 9, 2024

ANPR to Address Residential Real Estate Money Laundering FinCEN is focusing on residential real estate money laundering. Here is what you need to know. You might also like this on-demand webinar, "AML/CFT hot topics for 2024: What to expect for financial crime." WATCH NOW Takeaway 1 Real estate money laundering is a serious issue , with a n estimated $2.3 billion laundered between 2015 and 2020 through the U.S. real estate market alone.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ATM Marketplace

FEBRUARY 9, 2024

As financial services providers continue their digital transformation efforts, ATMs are becoming smarter, faster and more interconnected. In this context, the importance of comprehensive ATM testing cannot be overstated.

BankBazaar

FEBRUARY 9, 2024

Happy with paying your Credit Card bill by the due date? Hold on. There’s a case for paying earlier if you want to reduce your interest costs or fortify your Credit Score. Read on! Ever wondered about the optimal time to settle your Credit Card bill? Let’s explore the details. Firstly, it’s crucial to pay at least the minimum amount due by the monthly due date.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

American Banker

FEBRUARY 9, 2024

In a surprise move this week, banking veteran Sandro DiNello was appointed executive chairman of the embattled Long Island-based company, whose stock plummeted in the face of questions about its financial health.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

FEBRUARY 9, 2024

The city's pilot program enables asylum seekers to pay for food and baby products — reducing government overhead while introducing newcomers to the local economy.

TheGuardian

FEBRUARY 9, 2024

About 2,800 of supermarket group’s staff will transfer to bank, which will sell Tesco-branded services Tesco has struck a deal to sell the bulk of its banking business to Barclays for £700m in a deal that will include the transfer of about 2,800 staff to the bank. Britain’s biggest supermarket group has agreed to sell its credit card, loans and savings operations to Barclays but will retain profitable elements of Tesco Bank, including its insurance, ATM, travel money and gift card operations.

The Paypers

FEBRUARY 9, 2024

Global payment orchestration platform FinMont has added B2B payment platform ConnexPay ’s all-In-one payment solution to their travel orchestration platform.

BankInovation

FEBRUARY 9, 2024

Banks are identifying uses for generative AI and finding ways to make it effective and responsible. According to a Dec. 11 report by consulting giant EY, 100% of respondents said they are either already using or plan to use generative AI within their institutions.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

FEBRUARY 9, 2024

Only a few dozen mortgage firms could likely afford the $7 million ad for this year's big game, a marketing veteran said.

BankInovation

FEBRUARY 9, 2024

Nvidia Corp.’s stock has rallied so much this year that it’s now threatening to overtake Amazon.com Inc. to become the fourth most valuable US company. Having added nearly Tesla Inc.’s entire market capitalization in the past two months alone, Nvidia is worth $1.74 trillion, just shy of Amazon at $1.77 trillion.

The Paypers

FEBRUARY 9, 2024

In a recent announcement, HSBC and Google Cloud have joined forces to support climate mitigation and resilience efforts.

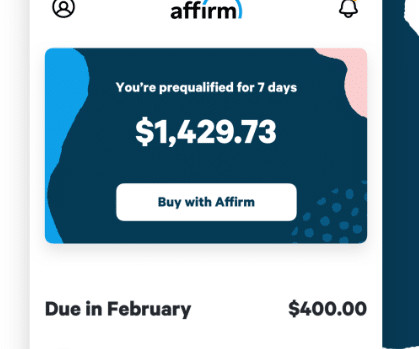

BankInovation

FEBRUARY 9, 2024

Buy now, pay later provider Affirm reduced overall operating expenses for the fourth consecutive quarter as operational efficiency and consumer growth remained a priority. Tech and data analytics spend, which totaled $59 million during the quarter, was down 32% year over year, according to Affirm’s earnings supplement for the fiscal second quarter, which ended Dec.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

ATM Marketplace

FEBRUARY 9, 2024

The Hero offers an advanced design and user-friendly interface displayed on a 15” screen. This full Windows model can support WinCE and Windows 10 to handle whatever transaction set you can dream up. Its sophisticated look combined with its high cash capacity make the Hero series an ideal fit for both Retail and Financial installs.

Commercial Lending USA

FEBRUARY 9, 2024

SBA Loan Prepayment Penalty: A Simple Guide for Business Owners. Uncover potential costs and make informed financial choices for your success.

ATM Marketplace

FEBRUARY 9, 2024

The Hero T is a through-the-wall ATM that delivers high availability and offers a wide variety of optional modules along with traditional service offerings. The Hero T offers best in class reliability, security, and high capacity. It can easily scale up after installation to suit growing demand.

The Paypers

FEBRUARY 9, 2024

Barclays has announced its decision to acquire the retail banking business of Tesco, as well as to provide customers with branded credit cards, personal loans, and deposits.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

FEBRUARY 9, 2024

Policymakers should ignore the legislative calendar and draft a proposal that will stand up to bipartisan scrutiny, even if it takes time.

The Paypers

FEBRUARY 9, 2024

Global financial technology company FIS has announced the launch of its Open Access platform, in order to secure Open Banking solutions for FIs and customers.

American Banker

FEBRUARY 9, 2024

Barclays is planning to hand dozens of investment bankers no bonus as the slowdown in dealmaking forces it to cut payouts for a larger-than-usual group of its lowest performers.

The Paypers

FEBRUARY 9, 2024

India-based payments infrastructure company Juspay has bought LotusPay to strengthen its offerings to the BSFI segment and merchants, with a focus on recurring payments.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

FEBRUARY 9, 2024

French payments company Worldline may cut 8% of its workforce, Moneygram advances its digital strategy by hiring four new leaders, Fed issues enforcement action against Peoples-Marion Bancorp and more in our weekly banking news roundup.

The Paypers

FEBRUARY 9, 2024

The inaugural edition of The Global Payments and Fintech Trends Report offers a comprehensive overview of the key trends in fintech and payments for 2024 and beyond.

The Financial Brand

FEBRUARY 9, 2024

This article One Portal to Rule Them All: How One Bank Streamlined Onboarding appeared first on The Financial Brand. Peapack-Gladstone Bank's goal was to create a truly end-to-end digital onboarding and KYC process that would work across all three lines of its business. This article One Portal to Rule Them All: How One Bank Streamlined Onboarding appeared first on The Financial Brand.

The Paypers

FEBRUARY 9, 2024

India-based fintech infrastructure platform Decentro has received its final payment aggregator licence from the Reserve Bank of India (RBI).

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content