How Google’s settlement will change in-app payments

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

Perficient

DECEMBER 21, 2023

Earlier this year, the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (Fed), and the Federal Deposit Insurance Corporation (FDIC) unveiled a proposed rule that would reshape the landscape for certain financial institutions. In this article, we delve into the latest developments around the extended comment period, providing stakeholders an increased opportunity to share their insights.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 21, 2023

In an expanded partnership between the two companies, Walmart is adding Affirm’s buy now, pay later option at its checkout kiosks at most stores.

BankUnderground

DECEMBER 21, 2023

Rebecca Freeman As another year draws to an end and the blog prepares for some downtime over the festive period, we wanted to take a look back at the blog in 2023. In case you missed any of our posts the first time round, the five most viewed posts for the year were: How house prices respond to interest rates depends on where they are in the country Why lower house prices could lead to higher mortgage rates Bomadland: How the Bank of Mum and Dad helps kids buy homes ‘There is all the difference

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

DECEMBER 21, 2023

Spade is tapping its recent funding to try to lure more big U.S. banks to its services, CEO Oban MacTavish said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

DECEMBER 21, 2023

Multi-function wallet apps will support shopping, loyalty, paying at the pump or EV charging station and crypto asset management, challenging the roles of U.S. financial institutions.

CFPB Monitor

DECEMBER 21, 2023

Providers of consumer financial services that rely on federal preemption to charge customers uniform interest rates and fees on a nationwide basis are currently facing a series of legislative and litigation challenges. In this episode, which repurposes a recent webinar, we first discuss the U.S. Supreme Court’s grant of certiorari in Cantero v.

American Banker

DECEMBER 21, 2023

The Federal Deposit Insurance Corp. finalized rules governing display of the FDIC logo Wednesday, requiring a new digital FDIC sign on online banking platforms beginning in 2025, conspicuous physical signs in nontraditional bank facilities and explicit labeling of insured and non-deposit products.

CFPB Monitor

DECEMBER 21, 2023

Democratic Senator Sherrod Brown, who chairs the Senate Banking Committee, and Democratic committee members Raphael Warnock and John Fetterman, have sent a letter to Director Chopra urging the CFPB to “continue focusing on” buy-now-pay-later (BNPL) products to ensure they do not “become a method to take advantage of struggling consumers.” The Senators observed that “[w]hile BNPL might provide some consumers with helpful flexibility, it also presents new risks that the CFPB should continue to mon

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

DECEMBER 21, 2023

Tanya Otsuka's confirmation gives the Democrats control of the National Credit Union Administration's board for the first time since 2016. Here's how that will impact its agenda.

BankInovation

DECEMBER 21, 2023

Credit Acceptance Corp. went live Dec. 19 with real-time payments for its dealer base through a partnership with Citizens Financial Group. Dealers can receive payments six times per day, Monday through Saturday and on select holidays, Credit Acceptance (CAC) Chief Marketing and Product Officer Andrew Rostami told Auto Finance News, a sister publication to Bank Automation News.

American Banker

DECEMBER 21, 2023

Funding pressures moderated in recent months, but loan charge-offs climbed. With festering concerns about a vulnerable economy, the potential for elevated credits costs could loom large over the upcoming bank earnings season.

BankInovation

DECEMBER 21, 2023

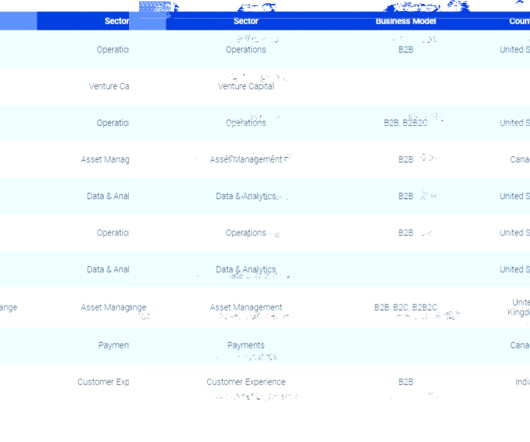

As the global economy faced macroeconomic headwinds coupled with rising rates, fintech funding in 2023 remained subdued compared to prior years. Global fintech funding stood at $30.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

DECEMBER 21, 2023

Six North American banks did well in Evident's latest assessment of banks' AI efforts, but JPMorgan and Capital One have a clear lead.

BankInovation

DECEMBER 21, 2023

Fraudsters continue to do damage in the finance industry, evidenced by recent attacks against Fidelity National Financial and Mr. Cooper, and financial institutions must strengthen their systems to avoid hacks and respond to breaches. In 2023, the average cost of a data breach in the financial industry was $5.

American Banker

DECEMBER 21, 2023

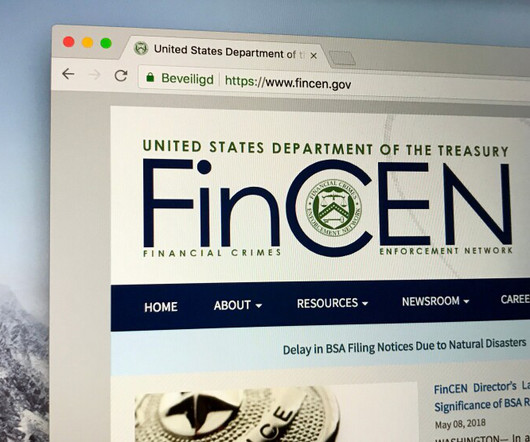

The Financial Crimes Enforcement Network issued a final rule on beneficial ownership information ahead of a deadline to start reporting this data on January 1, 2024, with revisions to address concerns from lawmakers and banking advocates.

TheGuardian

DECEMBER 21, 2023

Talks with hedge fund owners could return ethical bank to its mutual roots and create high street challenger with 5m customers Coventry Building Society is in exclusive talks to potentially buy the Co-operative Bank from its hedge fund owners, in a move that would return the ethical bank to member ownership and create a high street challenger with nearly 5 million customers.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

DECEMBER 21, 2023

CEOs, regulators, advocates, lawmakers: who will have the biggest impact on the banking industry this year?

The Paypers

DECEMBER 21, 2023

Oman-based Development Bank (DB) has selected Newgen Software to simplify its banking processes and provide enhanced experiences.

American Banker

DECEMBER 21, 2023

The banks' resistance to changes being recommended by the Federal Housing Finance Agency do not bode well for their future or that of the industry.

The Paypers

DECEMBER 21, 2023

Worldpay from FIS has partnered with music and entertainment retailer HMV to support its European expansion with an enhanced omnichannel strategy developed alongside FreedomPay.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

DECEMBER 21, 2023

Corporations and trial lawyers have long fought over whether consumers should be forced into arbitration to resolve their complaints. Now there's a new wrinkle: It's becoming harder for aggrieved customers to even get to arbitration.

The Paypers

DECEMBER 21, 2023

Fintech company empowering SMBs to transact, do business, and grow globally Payoneer has launched new features to improve the customer experience and help entrepreneurs connect with the global economy.

American Banker

DECEMBER 21, 2023

Provident Financial in Iselin initially anticipated completing its deal for Oak Ridge-based Lakeland Bancorp in the second quarter. Now as it waits for regulatory approval, Provident says the process will stretch into spring 2024.

The Paypers

DECEMBER 21, 2023

Financial technology company PayPal has announced its commitment to modify its terms and conditions in order to fully comply with the European Union ’s consumer laws.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content