After Brief Rally, Treasury Yields Head Higher Again

South State Correspondent

OCTOBER 25, 2023

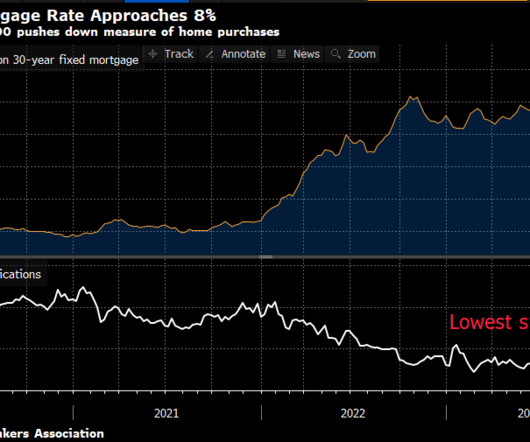

After Brief Rally, Treasury Yields Head Higher Again Treasury yields are moving higher once again this morning as the Treasury’s expected announcement next week of increased auction sizes is starting to weigh on markets, and the lates PMI and new home sales offer little indication of a slowing fourth quarter economy. Presently, the 10yr is yielding 4.91%, down 20/32nds in price while the 2yr is yielding 5.09%, down 1/32nd in price.

Let's personalize your content