Payments companies pursue AI

Payments Dive

AUGUST 8, 2023

Card network giant Visa and digital payments company Block are among those tapping artificial intelligence to save money and serve customers in new ways.

Payments Dive

AUGUST 8, 2023

Card network giant Visa and digital payments company Block are among those tapping artificial intelligence to save money and serve customers in new ways.

South State Correspondent

AUGUST 8, 2023

We estimate that approximately 50% of the community banks in the industry have a credit department that exerts influence or sets standards on loan pricing. While this process appears appropriate and benign, it increases credit risk, decreases bank profitability, and undermines the proper function of bank credit/yield tradeoff. Many bankers feel that since credit officers review all loans underwritten by the bank, a credit officer’s role should also be to opine and compare loan pricing to

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 8, 2023

PayPal is planting a flag in the stablecoin space despite the slow uptake of digital assets in consumer payments and the lingering crypto chill.

Realwired Appraisal Management Blog

AUGUST 8, 2023

A Chief Appraiser friend of mine sometimes laments that the C-suite and lenders perceived him as a regulatory hurdle to overcome rather than a valuable resource. But, he and his team were determined to change that perception. Seth Godin’s book, Purple Cow: Transform Your Business by Being Remarkable reminds us not be invisible.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

AUGUST 8, 2023

Whether or not the payment type behind an active shooter’s purchase of a gun means anything may be revealed in patterns.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

AUGUST 8, 2023

Congratulations to Professor Jeff Sovern who was recently named the inaugural Michael Millemann Professor of Consumer Protection Law at the University of Maryland Francis King Carey School of Law. Professor Sovern joins Maryland Carey Law after 40 years on the faculty of St. John’s University School of Law where he wrote about and taught consumer protection law. .

William Mills

AUGUST 8, 2023

Class is back in session! Once again, school buses are lining the streets, and store shelves are packed with notebooks and pencils, but this season is much more than just back-to-school time. It's also conference season, when dozens of tradeshows and industry events pop up around the world, attracting vendors and media from all over. Although conference life may just be part of the gig for some, for many, it's a chance to get out of the office, network, and gain fresh insight.

CFPB Monitor

AUGUST 8, 2023

Less than six weeks after the U.S. Supreme Court held that President Biden lacked authority to advance his signature effort to forgive upwards of $430 billion in federal student loans, a new challenge has been filed to other major elements of his higher-education agenda. On August 4, 2023, the Cato Institute and Mackinac Center for Public Policy filed suit in the Eastern District of Michigan, alleging that the U.S.

TheGuardian

AUGUST 8, 2023

Proceeds from levy on interest rate income will be used to help mortgage holders and cut taxes Business live – latest updates Italy has approved a 40% windfall tax on banks and will use proceeds to help mortgage holders and cut taxes, the deputy prime minister said, in a move that sent banking shares plunging. “One has only to look at banks’ first-half profits … to realise that we are not talking about a few millions, but … of billions,” Matteo Salvini, who is also the country’s infrastructure m

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankUnderground

AUGUST 8, 2023

Nicholas Vause and Carolin Pflueger Recently, Pflueger, Siriwardane and Sunderam (2020) proposed a new measure of investor risk perceptions based on the cross-section of stock prices. Using that measure, they found that when risk perceptions are high, the cost of capital of risky firms is high and subsequently real investment and employment decline in the United States.

The Paypers

AUGUST 8, 2023

Mastercard has partnered with Empresa Interbancaria de Serviços (EMIS) to launch a co-branded contactless card with EMV technology to boost the digital economy in Angola.

American Banker

AUGUST 8, 2023

Seven of the 11 largest credit unions in the country by assets experienced a year-over-year drop in earnings in the second quarter, with increased deposit costs being a primary culprit.

Realwired Appraisal Management Blog

AUGUST 8, 2023

A Chief Appraiser friend of mine sometimes laments that the C-suite and lenders perceived him as a regulatory hurdle to overcome rather than a valuable resource. But, he and his team were determined to change that perception. Seth Godin’s book, Purple Cow: Transform Your Business by Being Remarkable reminds us not be invisible.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

AUGUST 8, 2023

Bankers say regulatory burden, rising costs and intensifying competition will reignite a drive for scale and spur dealmaking provided interest rates level off and the economic outlook improves.

BankInovation

AUGUST 8, 2023

Banking software provider Temenos added three banks to its platform in the second quarter as financial institutions migrated to the cloud and digitized their platforms. Temenos’ cloud offering will be central to the company’s “growth plans over the coming years, Andreas Andreades, chief executive of the Geneva-based company, said during its Q2 earnings report today.

American Banker

AUGUST 8, 2023

U.S. consumers set a new record during the second quarter, as card debt reached $1.03 trillion. Bankers say a healthy job market has allowed consumers to keep making their monthly payments, but they're also on guard about the impact of the upcoming resumption of federal student loan payments.

TheGuardian

AUGUST 8, 2023

Regulator to write to more than 20 of largest lenders after Nigel Farage’s accounts were threatened with closure The City regulator will give the UK’s largest banks two weeks to explain why they have been shutting customer accounts, after a scandal linked to the threatened closure of Nigel Farage’s bank accounts. The Financial Conduct Authority (FCA) will write to more than 20 of the UK’s largest lenders on Wednesday asking them to confirm how many customer accounts have recently been closed, su

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

AUGUST 8, 2023

Moody's decision to downgrade some banks' bond ratings isn't great news, but life will go on. The bigger and more difficult problem is shoring up U.S. sovereign debt ratings in the long-term.

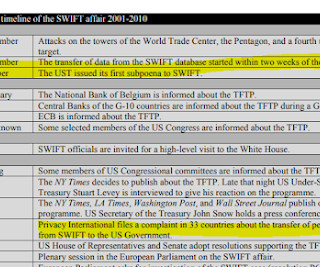

Money and Payments

AUGUST 8, 2023

Ok, so you may have been reading a complex thread on social media about the European travel rule for crypto companies and the impact it has on fundamental rights to privacy and freedom to provide services. And you may be wondering. What is it? What's happening. How can I contribute? Well, it's a long story with quite some history (see this blog here , here and here ) but I will try to summarize the situation as of mid August 2023.

American Banker

AUGUST 8, 2023

The release of two malicious language models — WormGPT and FraudGPT — demonstrate attackers' evolving capability to harness language models for criminal activities.

The Paypers

AUGUST 8, 2023

PaymentComponents , a Greece-based B2B AI, payments, and Open Banking solutions company has partnered with Brillio , a global digital technology service provider, aiming to change global payments solutions.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

AUGUST 8, 2023

Many small-business lenders have less than 18 months to figure out how to gather and report on an extensive array of data.

The Paypers

AUGUST 8, 2023

Anti-financial crime and AML company Tookitaki has announced the launch of its Compliance-as-a–Service (CaaS) solution for small and mid-size financial institutions (FIs) globally.

American Banker

AUGUST 8, 2023

The Federal Reserve has outlined the process state member banks must follow before issuing, redeeming or holding stablecoins. The agency also says it will create an examination process to monitor novel activities.

The Paypers

AUGUST 8, 2023

Ireland-based postal services provider An Post has expanded access to its Money Manager budgeting tool to everyone in Ireland, in partnership with Open Banking platform Tink.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content