Shift4 shrinks workforce

Payments Dive

AUGUST 3, 2023

The payments company cut 150 employees in the second quarter, executives said Thursday during an earnings conference call.

Payments Dive

AUGUST 3, 2023

The payments company cut 150 employees in the second quarter, executives said Thursday during an earnings conference call.

South State Correspondent

AUGUST 3, 2023

Seasoned bankers call it “The Distributor Tactic,” and it is a little-discussed technique used for ages in banking to speed up the sales cycle to land commercial bank deposits and treasury management accounts faster. The key to this tactic is to know that very few commercial checking customers utilize any medium or high-value treasury management services at banks (see below).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 3, 2023

New CEO Paulette Rowe was previously at cross-border digital payments company Paysafe. Stax’s sister-brother co-founders exited quietly earlier this year.

CFPB Monitor

AUGUST 3, 2023

Nebraska Governor, Jim Pillen, signed into law Legislative Bill 92 on June 6, 2023, which amended the Nebraska Installment Loan Act (the “Act”) effective June 7, 2023 (the “Effective Date”). As amended, the licensing requirement under the Act includes “any person that is not a financial institution who, at or after the time a loan [of $25,000 or less with rates exceeding the Nebraska general usury limit] is made by a financial institution, markets, owns in whole or in part, holds, acquires, ser

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

AUGUST 3, 2023

The marketing push follows the addition of consumer-focused features by the tech giant this year, including a buy now, pay later payments tool.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

AUGUST 3, 2023

Digital payments titan PayPal is nearing a decision on who will be its next CEO, with the company circling a short list of candidates.

BankBazaar

AUGUST 3, 2023

Discover the magic of travel Credit Cards and unlock exciting benefits and rewards to enhance your vacations like never before. From accelerated rewards on travel to complimentary lounge access to air mile earning, travel Credit Cards offer a unique world of exciting benefits and rewards that make them necessary for any travel enthusiast. As the financial landscape evolves to cater to the needs of everyone, let us look at what travel Credit Cards have to offer and understand why they are an es

Payments Dive

AUGUST 3, 2023

The tool can help CFOs wade through a complicated tax compliance environment, easing the path to international growth, Stripe said.

CFPB Monitor

AUGUST 3, 2023

Yesterday, we published a blog post in which I urged the CFPB to agree to extend the relief granted by the Texas federal district court in the lawsuit challenging the CFPB’s final small business lending rule (Rule) to all entities covered by the Rule. The court issued an order that preliminarily enjoins the CFPB from implementing and enforcing the Rule “pending the Supreme Court’s reversal of [ Community Financial Services Association of America Ltd.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

AUGUST 3, 2023

The transition to a new CFO comes at a time when the digital payments company might be gearing up to go public.

CFPB Monitor

AUGUST 3, 2023

After discussing what are “dark patterns” and the most common forms they can take, we consider whether and how “dark patterns” used to influence consumers’ online behavior differ from traditional scams directed at consumers involving the use of deception. We then discuss the federal and state statutes and common law claims currently being used to challenge the use of “dark patterns” as well as current legislative action to more directly target “dark patterns” and the challenges lawmakers face i

Perficient

AUGUST 3, 2023

What is Generative AI? Generative Artificial Intelligence , or generative AI, is a categorical or descriptive term ascribed to algorithms using machine learning to create or ” generate” new content. Generative AI ingests data and understands guidelines incredibly well; therefore, businesses across industries are jumping to take advantage of all the possible ways the tool can help save them money and create elevated, uber-personalized customer experiences.

CFPB Monitor

AUGUST 3, 2023

Last year, Kentucky enacted the Student Education Loan Servicing, Licensing, and Protection Act of 2022 (the “Act”), which requires student loan services to be licensed in Kentucky. The Act took effect on July 13, 2023 (the “Effective Date”). On the Effective Date, the Kentucky Department of Financial Institutions (“DFI”) released its new application checklist and made a license application available through the Nationwide Multistate Licensing System & Registry (“NMLS”). .

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

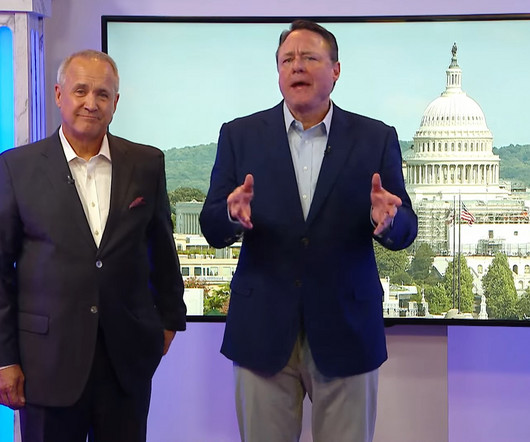

American Banker

AUGUST 3, 2023

Critics of the proposed deal between the National Association of Federally-Insured Credit Unions and the Credit Union National Association say their combination could drown out the concerns of the groups' smallest members.

TheGuardian

AUGUST 3, 2023

Chancellor wants Financial Conduct Authority to investigate whether practice is ‘widespread’ Jeremy Hunt has asked the financial regulator to urgently investigate whether banks are barring politicians from accounts on a “widespread” basis, after Nigel Farage had his account shut down by private bank Coutts. The chancellor said everyone must be able to express their opinions and people must have access to banking.

American Banker

AUGUST 3, 2023

Despite big talk months ago, experts don't see a lot of political appetite to change bank oversight rules — or the deposit insurance system — in the wake of three large regional bank failures that happened earlier this year.

BankInovation

AUGUST 3, 2023

PayPal is investing in AI to increase efficiency, improve consumer experience, reduce the time to bring products to market and develop proprietary AI models to drive business growth.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

AUGUST 3, 2023

Regulators have been issuing real-time-payment requirements that push EU banks to modernize their core processing systems. U.S. banks may feel similar pressure from the movement toward real-time payments.

BankInovation

AUGUST 3, 2023

When considering credit underwriting for small- and medium-sized businesses, satellite heat mapping and detailed traffic patterns may not be the first data points that come to mind.

American Banker

AUGUST 3, 2023

Critics complain a bill sponsored by the leaders of the Senate Small Business Committee would reinstate a moratorium on participation in the SBA's flagship 7(a) program by nondepository lenders. Supporters of the bill argue that widening the program could invite more fraud.

BankInovation

AUGUST 3, 2023

There is a general complaint encountered by developers from among open banking participants, even after partner APIs are made available: Adoption isn’t straightforward. We’ve experienced this across hundreds of integration points. Even with the developer assistance toolbox, which includes documentation, software developer kits and sandboxes, and developer self-service consoles, partner integration timelines are intractable.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

AUGUST 3, 2023

Two bank trade groups have asked the Consumer Financial Protection Bureau to relieve all banks from complying with its small-business lending rule until after the U.S. Supreme Court decides whether the bureau's funding is constitutional.

The Paypers

AUGUST 3, 2023

US-based finance automation platform Ramp has announced its expansion into procurement and entered a partnership with Canada-based Shopify.

American Banker

AUGUST 3, 2023

The Minneapolis company is issuing stock to the Japanese banking giant that previously owned MUFG Union Bank in order to repay part of a $3.5 billion obligation. The move will also boost a key capital ratio, which sagged after the deal was completed, but is expected to cut into U.S. Bancorp's earnings per share.

The Paypers

AUGUST 3, 2023

Communication solutions company Safaricom has announced a partnership with Uber that is set to enable Kenya-based riders to pay for trips through the mobile money service M-PESA.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content