Fiserv racks up merchants for pay-by-bank services

Payments Dive

JULY 31, 2023

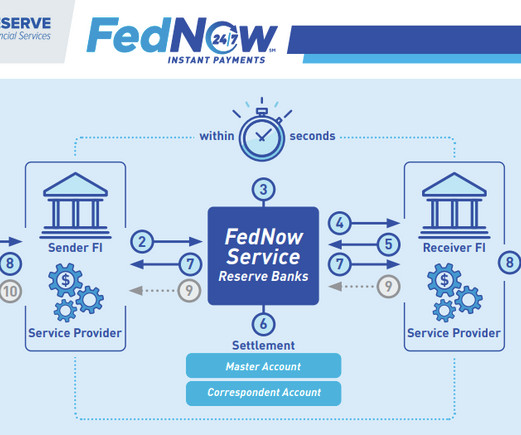

The Federal Reserve’s new instant payments system is driving more merchant interest in pay-by-bank capabilities for consumers, a Fiserv executive said.

Payments Dive

JULY 31, 2023

The Federal Reserve’s new instant payments system is driving more merchant interest in pay-by-bank capabilities for consumers, a Fiserv executive said.

BankBazaar

JULY 31, 2023

It’s time to put on y our party hats and join the celebration as BankBazaar turns 15! Over the past decade and a half, we’ve been on a thrilling journey, redefining the way Indians access credit. Let’s take a delightful trip down memory lane and relive some of the most remarkable moments that shaped BankBazaar’s incredible 15-year adventure.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 31, 2023

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

CFPB Monitor

JULY 31, 2023

The Texas federal district court hearing the lawsuit challenging the validity of the CFPB’s final rule implementing Section 1071 of the Dodd-Frank Act (Rule) has issued an order that preliminarily enjoins the CFPB from implementing and enforcing the Rule “pending the Supreme Court’s reversal of [ Community Financial Services Association of America Ltd.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JULY 31, 2023

“The M&A market has had a lull, but for us this is the right time and we were able to find the right asset,” Trintech CFO Omar Choucair told CFO Dive.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JULY 31, 2023

Artificial intelligence has revolutionized credit decisioning. What was once a slow, manual and subjective process is becoming highly automated, and the all-important act of approving or denying credit is increasingly being turned over to highly sophisticated neural networks.

CFPB Monitor

JULY 31, 2023

The CFPB has released the Summer 2023 edition of Supervisory Highlights. The report discusses the Bureau’s examinations in the areas of auto origination and servicing, consumer reporting, debt collection, deposits, mortgage origination and servicing, and payday and small dollar lending, that were completed from July 1, 2022 to March 31, 2023. .

TheGuardian

JULY 31, 2023

Former Ukip leader is still taking legal action against bank demanding compensation and apology Nigel Farage has said that the newly installed boss of Coutts has offered to keep his accounts there open, reversing a decision that triggered scandal and the resignation of the private bank’s previous chief executive. The former Ukip leader said he welcomed the offer but was still taking legal action against NatWest, which owns Coutts, demanding compensation, a full apology and a face-to-face meeting

CFPB Monitor

JULY 31, 2023

A new FTC blog post titled “Tenant background check reports: Put it in writing” reminds landlords, property managers, and other housing providers of their obligation under the Fair Credit Reporting Act to provide notice of adverse action when information in a consumer report leads them to deny housing to an applicant or require the applicant to pay a deposit that other applicants would not be required to pay. .

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

JULY 31, 2023

Last year's racially targeted mass shooting at a Buffalo, New York, grocery store has renewed conversations about whether banks have a duty to help segregated, impoverished communities that were shaped in part by discriminatory lending practices. What do banks owe the Black community, and what influence could they have?

The Paypers

JULY 31, 2023

International banking group Standard Chartered has announced its partnership with Ant Group in order to promote sustainable developments around the globe.

American Banker

JULY 31, 2023

Regulators noted the demise of Heartland Tri-State Bank involved an isolated problem. Industry observers cautioned against prediction of more failures to follow, saying second-quarter earnings show community banks generally remain in sound financial health.

The Paypers

JULY 31, 2023

HAYVN Pay , a regulated cryptocurrency payment solution, has announced a partnership with CrossBet , a regulated online betting operator in Australia.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

JULY 31, 2023

A federal judge has temporarily stopped the Consumer Financial Protection Bureau from implementing its small-business data collection rule until after the Supreme Court rules next year on whether the bureau's funding is constitutional.

TheGuardian

JULY 31, 2023

FCA lays out 14-point plan to monitor how banks are treating customers following month-long review of savings market Business live – latest updates UK retail financial services set for biggest overhaul in 20 years Banks with the lowest savings rates will face “robust action” within months if they cannot justify their pricing decisions, the City watchdog warned, as it laid out a 14-point plan amid claims banks are profiteering.

American Banker

JULY 31, 2023

In July's roundup of American Banker's favorite stories: A Zelle outage at JPMorgan Chase could cause headaches for other banks, talking points for understanding FedNow, the Elkhart, Kansas-based Heartland Tri-State Bank is shuttered by the Federal Deposit Insurance Corp. and more.

The Paypers

JULY 31, 2023

US-based payments and money transfer company MoneyGram has partnered with Venezuela-based bank Banesco to expand its digital receive network.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

JULY 31, 2023

While talks between House Financial Services Committee Chairman Patrick McHenry, R-N.C., and ranking member Rep. Maxine Waters, D-Calif., fell apart on stablecoin legislation, crypto anti-money-laundering bills quietly moved forward in the Senate.

TheGuardian

JULY 31, 2023

Nick Moss wonders when Tory ministers will get similarly worked up about former offenders like him having their banking facilities withdrawn with no explanation. Plus letters from Alison Crowther and David Simpson It would be a pleasant surprise if the Financial Conduct Authority, the financial ombudsman, the chancellor or the prime minister could “work up an indignant head of steam” ( Don’t be fooled: this row is about more than Nigel Farage and Coutts – what lies beneath is Brexit, 27 July ) a

BankInovation

JULY 31, 2023

Intelligent automation has emerged as a transformative solution to revolutionize both customer interactions and backend operations. Through technologies like chatbots, virtual assistants, automated workflows, Robotic Process Automation (RPA) and data analytics, financial institutions can provide personalized support, streamline processes, reduce errors and ensure regulatory compliance.

American Banker

JULY 31, 2023

Payment companies hope the government-backed rail could spur both domestic and international growth for instant settlement.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

JULY 31, 2023

JPMorgan on July 11 appointed John China as the co-head of Innovation Economy (IE) for Commercial Banking (CB). China joined the $3.2 trillion bank after serving as president of Silicon Valley Bank, which was acquired by First Citizens Bank this year, for more than four years until this month.

American Banker

JULY 31, 2023

The top five community banks have more than $670 million in combined home equity loan portfolios as of March 31, 2023.

The Paypers

JULY 31, 2023

Spain-based bank BBVA has partnered with Banco Santander and CaixaBank in a joint effort to fight financial fraud.

American Banker

JULY 31, 2023

A pending deal between two sizable institutions in Minnesota could mark the end of a dealmaking drought, experts say.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content