Charities and churches left in financial disarray after Barclays shuts accounts

TheGuardian

DECEMBER 4, 2023

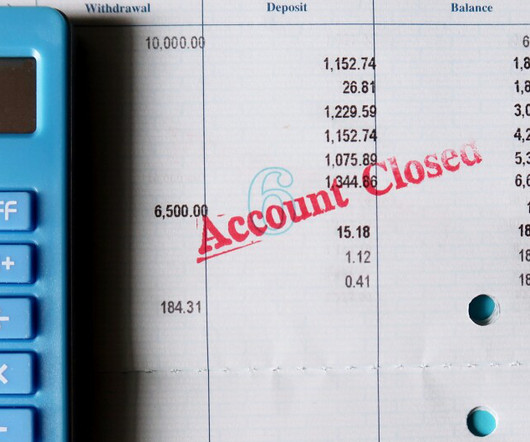

A number of community organisations say they were left struggling after bank closed or froze accounts ‘without warning’ Some charities, churches and other community groups have described being thrown into financial disarray after Barclays shut or froze their bank accounts without warning. Several of the organisations affected, which include charities helping young people, and a Methodist church in the midst of significant building works, have banked with Barclays for over 20 years.

Let's personalize your content