Self-checkout promises ultimate convenience. Is it doing its job?

Payments Dive

FEBRUARY 26, 2024

The process can make for faster, easier experiences, but it needs regular attention and helpful associates to thrive, consultants said.

Payments Dive

FEBRUARY 26, 2024

The process can make for faster, easier experiences, but it needs regular attention and helpful associates to thrive, consultants said.

BankInovation

FEBRUARY 26, 2024

BNY Mellon has appointed Julie Gerdeman as its global head of data and analytics. Gerdeman will be responsible for managing software and data for nearly $47 trillion of assets managed by BNY, according to a Feb. 20 release.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 26, 2024

Fidelity National Information Services promised bigger profit margins this year from its newly reconfigured business focused on banking and capital markets.

BankInovation

FEBRUARY 26, 2024

Terrence Thomas, executive vice president and chief information officer at First Bank, will speak at Bank Automation Summit U.S. 2024 on Monday, March 18, at 4 p.m. CT.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

FEBRUARY 26, 2024

Launching the Paze wallet will require preloading about 150 million cards, meaning the launch will occur as “more of a ramp up over a few months,” EWS Managing Director James Anderson said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 26, 2024

Today’s B2B customers demand a seamless order-to-cash experience, and brands must embrace automation to adapt.

CFPB Monitor

FEBRUARY 26, 2024

On February 7, 2024, the U.S. Court of Appeals for the Third Circuit affirmed the district court’s Order granting a motion for judgment on the pleadings and holding that a charged-off loan made by a lender licensed under the Consumer Discount Company Act (“CDCA”) that is subsequently sold to a third-party debt collector is no longer subject to the CDCA and collecting on the debt without holding a CDCA license is not in and of itself a violation of the Fair Debt Collection Practices Act (“FDCPA”)

Jack Henry

FEBRUARY 26, 2024

In the race to adapt and thrive in today's disruptive financial services landscape, the speed and direction of your technology modernization strategy and efforts can make all the difference.

CFPB Monitor

FEBRUARY 26, 2024

A proposed class action lawsuit filed in the U.S. District Court for the Northern District of Georgia on February 21, 2024 against TitleMax of Georgia, Inc. and TMX Finance LLC (together, “TitleMax”) accuses the Georgia-based title and pawn lender of various violations of the Military Lending Act (“MLA”), including charging servicemembers and their dependents interest in excess of the MLA’s 36% rate cap.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

FEBRUARY 26, 2024

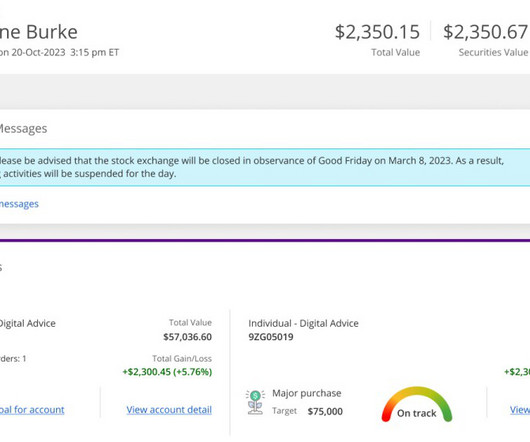

The $6.8 billion-asset institution partnered with FusionIQ to launch digitally advised and self-directed investment platforms as part of a push to attract and retain younger generations of consumers.

CFPB Monitor

FEBRUARY 26, 2024

On February 20, 2024, Director Samuel Levine of the Federal Trade Commission’s Bureau of Consumer Protection (Bureau) issued a statement promoting the use and acceptance of tolling agreements. Tolling agreements pause the running of statutes of limitations, permitting enforcement agencies such as the Federal Trade Commission (FTC) to file an enforcement action against a party after the deadline otherwise established by the applicable statute.

The Paypers

FEBRUARY 26, 2024

The Financial Action Task Force (FATF) has announced that it has dropped the UAE from its grey list regarding concerns about financial crime and money laundering.

CFPB Monitor

FEBRUARY 26, 2024

The oral argument in Cantero v. Bank of America, N.A. will be heard on Tuesday, February 27 before the US Supreme Court. The Court recently granted the unopposed motion of the Solicitor General to participate in the oral argument. The Solicitor General will be taking 10 minutes of the oral argument time allocated to the Petitioners.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

FEBRUARY 26, 2024

The lawmakers, led by Sen. Elizabeth Warren, D-Mass., said the deal would further anti-consumer bank consolidation, but also criticized the OCC's proposed changes to the merger process, asking that they be strengthened.

CFPB Monitor

FEBRUARY 26, 2024

Federal News Wire – a non-partisan news group focusing on the activities of federal agencies – has issued a Freedom of Information Act (“FOIA”) request to the Consumer Financial Protection Bureau, seeking a list of all organizations who have received payments from the Bureau’s “Civil Penalty Fund” (“CPF”) since the Bureau’s formation in 2011.

American Banker

FEBRUARY 26, 2024

The hiring of Viswas Raghavan as Citi's head of banking is the latest move by the global bank to attract talent from rivals. His departure set off more leadership tweaks at JPMorgan Chase.

BankInovation

FEBRUARY 26, 2024

Technology provider FIS is now certified to send and receive payments on the FedNow payments rail as demand for the rail grows. FIS has 215 clients in contract or in the pipeline for the Federal Reserve’s payments rail, Chief Executive Stephanie Ferris said during the company’s fourth-quarter earnings call today.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

FEBRUARY 26, 2024

Intuit , the fintech platform behind Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, has unveiled QuickBooks Solopreneur, a tailored product designed for solo entrepreneurs.

BankInovation

FEBRUARY 26, 2024

Jack Henry Chief Operating Officer Greg Adelson will take over as chief executive for the tech provider in July. On this episode of “The Buzz” podcast, he discusses how his four-tenet leadership strategy will be reflected in his new role as he takes on Jack Henry’s ongoing cloud modernization. The tenets: 1. Transparency.

American Banker

FEBRUARY 26, 2024

Tipalti, Stax and Stripe are among those using new artificial intelligence tools as digital helpers for staff. The specifics vary based on each company's mission and level of comfort with the technology.

The Paypers

FEBRUARY 26, 2024

Trading platform OANDA has opened an FCA-registered crypto trading platform ‘OANDA Crypto’ in the UK, following the acquisition of a majority stake in Coinpass.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

FEBRUARY 26, 2024

The Narrow Bank — a passthrough bank that first applied for a Federal Reserve master account in 2017 — is appealing an "ill-founded" December decision by the Federal Reserve to deny its application for a master account.

The Paypers

FEBRUARY 26, 2024

Axway has announced that it entered an exclusive discussion to acquire most of Sopra Banking Software activities, to develop a new enterprise software house.

American Banker

FEBRUARY 26, 2024

Version 2.0 of the Cybersecurity Framework, often cited by financial regulators, provides a structured approach to enhancing an institution's cybersecurity.

The Paypers

FEBRUARY 26, 2024

Google Pay has announced it undergoes significant changes, merging US app with Google Wallet and augmenting features for payments.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content