3 pieces of modern infrastructure needed to manage tech-disrupted finance flows

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

CFPB Monitor

MARCH 18, 2024

Following a year of new DOJ policies and guidance designed to incentivize companies to self-report misconduct and to cooperate with government investigations, the DOJ has added a new pilot whistleblower rewards program. In their remarks at the American Bar Association’s 39 th Annual National Institute on White Collar Crime, Deputy Attorney General Lisa Monaco and Acting Assistant Attorney General Nicole Argentieri both explained that the new whistleblower policy is designed to incent

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 18, 2024

The company, which provides point-of-sale payments and other technology services to merchants, isn’t interested in handling acquiring, said President Chris Kronenthal.

American Banker

MARCH 18, 2024

False information, job losses, diminishing skills and human interaction, among other concerns, have bankers worried about deploying both generative artificial intelligence, like ChatGPT, and more long-accepted forms of AI like machine learning, according to a new survey of American Banker readers.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

MARCH 18, 2024

The Canadian payments company confirmed it’s in talks about a potential transaction with a third party, noting the committee will explore possibilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 18, 2024

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

BankInovation

MARCH 18, 2024

Nashville, Tenn. — Arc Technologies charted a 12X increase in loan originations year over year in 2023, as it gained customers and deposits when businesses looked to pivot to new banking partners after the collapse of Silicon Valley Bank.

Payments Dive

MARCH 18, 2024

The Block-owned buy now, pay later provider said its expansion is a response to younger consumers looking for new tools to manage inflation.

BankInovation

MARCH 18, 2024

AI has landed for the consumer. It’s no longer a topic for data scientists and IT alone. But what is Generative AI? Equally as mystifying is Process Intelligence – a complex subject, frequently hidden behind the process expert wisdom.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

BankInovation

MARCH 18, 2024

NASHVILLE, Tenn. — Wells Fargo has created a generative AI council within the organization to study implementation, development and deployment of gen AI.

American Banker

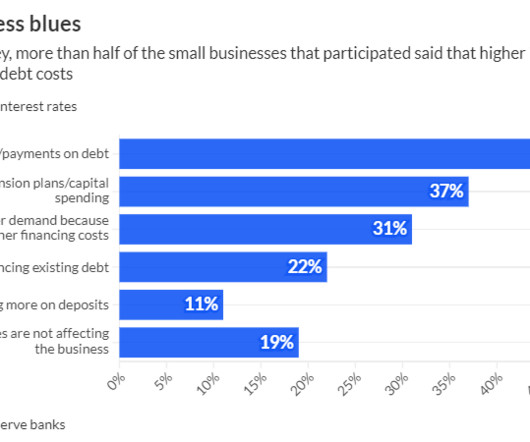

MARCH 18, 2024

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

BankInovation

MARCH 18, 2024

NASHVILLE — Bank Automation Summit U.S. 2024 kicks off today with panelists from BankUnited, Fifth Third Bank and Wells Fargo taking the stage to discuss today’s AI revolution in banking at the Omni Nashville in Nashville, Tenn.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

MARCH 18, 2024

Despite fresh waves of online fraud and scams, czars of social media platforms, peer-to-peer networks and blockchain products have renewed ambitions to marry financial services with social apps.

BankInovation

MARCH 18, 2024

Fintech valuations and funding rounds had a tough year in 2023 as high interest rates pushed investors into capital conservation mode. In 2023, “VCs were just trying to protect their own portfolios and be cautious with their investments,” Robin Scher, head of fintech investment at Lloyds Bank, said at FinovateEurope last month.

The Paypers

MARCH 18, 2024

Australia-based HeirWealth has announced its integration with US-based financial technology firm Envestnet | Yodlee , aiming to incorporate Open Banking data sharing technology.

American Banker

MARCH 18, 2024

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MARCH 18, 2024

UK-based mobile business account ANNA has announced that it acquired Australia-based GetCape , a fintech company that functions as a business spend management platform.

American Banker

MARCH 18, 2024

The head of the Consumer Financial Protection Bureau summarized his findings from a year-long probe into the Appraisal Foundation. He says the "lawmaking body" is not accountable to the public or market forces.

The Paypers

MARCH 18, 2024

India-based cybersecurity company Ensurity has integrated biometric technologies from Fingerprint Cards (Fingerprints) for its new FIDO2 biometric security key.

American Banker

MARCH 18, 2024

Orders on the NASDAQ exchange were unable to execute early Monday morning because of an error with the exchange's price discovery tool. The error has since been resolved.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

MARCH 18, 2024

The Open Finance Association (OFA) has released its statement regarding the Centre for Finance, Innovation, and Technology ’s (CFIT) Open Finance Blueprint Report.

American Banker

MARCH 18, 2024

Increased federalization of the U.S. banking industry would be a disservice to consumers and the economy. The court must act to protect the vibrancy of the dual-banking system.

The Paypers

MARCH 18, 2024

UK-based AML specialist SmartSearch has analysed global AML events and published a new report which showcases drug trafficking as one of the most prevalent issues.

American Banker

MARCH 18, 2024

Stephanie Cohen's exit adds to the dwindling ranks of senior women at the firm as Chief Executive Officer David Solomon has failed to make good on his pledge of correcting the lack of women in the firm's top ranks.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content