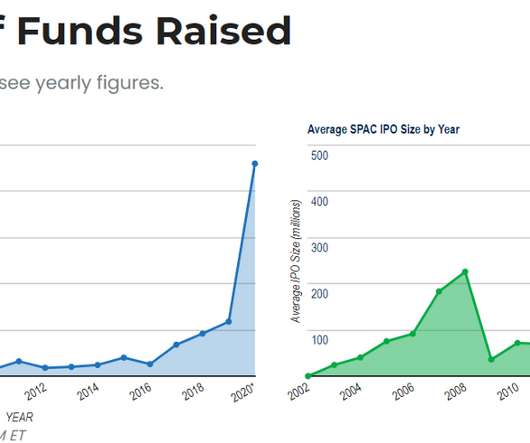

Procyclicality mechanisms in the financial system: what we know and some open questions

BankUnderground

JUNE 25, 2021

And those falls were amplified as some investors reacted by liquidating assets. This post reviews findings from research about these particular mechanisms, covering (i) how they work, (ii) how strong they are and (iii) how they might be mitigated. Or is improving liquidity preparedness among market participants a better option?

Let's personalize your content