Effective model risk management and model validation in banking

Abrigo

AUGUST 1, 2022

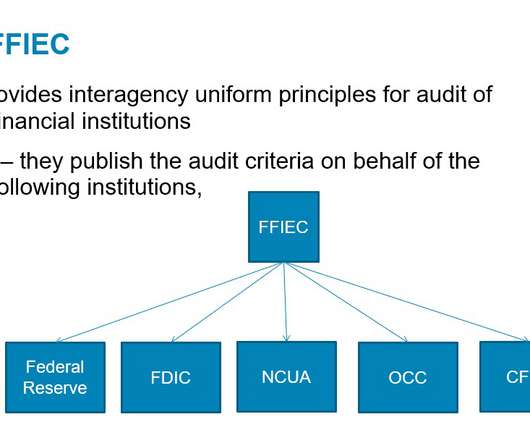

Takeaway 2 Even small banks or credit unions not regulated by the Federal Reserve are required to address control risks from models. What are model risk management and model validation? MRM and model validation regulations. Effective challenge is a requirement for banks regulated by the Federal Reserve or OCC.

Let's personalize your content