How digital wallets are reshaping the payments landscape

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

TheGuardian

MAY 13, 2024

Younger homebuyers are turning to ultra-long loans, prompting fears over the risk to their finances and the wider economy For a long time the traditional length of a UK mortgage has been 25 years, but runaway house prices and, more recently, dramatically higher borrowing costs are prompting more and more people to “go long” on their home loans. On Monday, the former pensions minister Steve Webb revealed that younger homebuyers were increasingly being forced to gamble with their retirement prospe

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 13, 2024

The 5th Circuit Court of Appeals blocked the Consumer Financial Protection Bureau’s $8 late fee cap on Friday, but the federal agency said it will continue to “defend” the rule.

Commercial Lending USA

MAY 13, 2024

Explore Alternative Commercial Lenders with Commercial Lending USA. Fast approvals, flexible options, expert guidance. Contact us now!

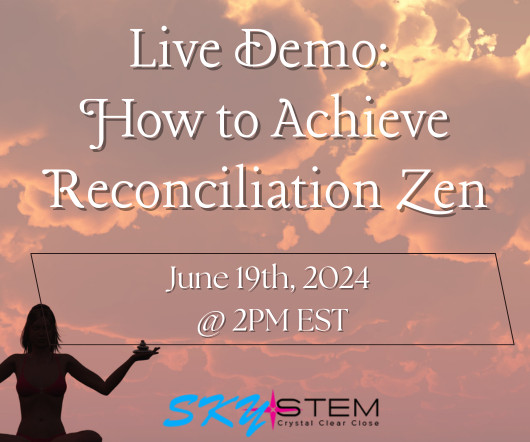

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Payments Dive

MAY 13, 2024

The restaurant-focused payments company expects to see an impact from lowered interchange fees by the second half of 2025.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MAY 13, 2024

With CaaS, you can reimagine the payment process, offer new payment services and improve the customer or employee experience.

BankInovation

MAY 13, 2024

Major banks in the United States are increasing tech investment for added efficiencies and frictionless digital experiences — which has become the consumer’s expectation since the pandemic.

American Banker

MAY 13, 2024

What lies ahead for the banking industry this year? Here's what analysts and investors are tracking after the latest bank earnings reports.

BankInovation

MAY 13, 2024

Adoption is ticking up for The Clearing House’ Real Time Payments network and the Federal Reserve’s FedNow payments rail as financial institutions add payment services to their platforms. The RTP network has more than 500 institutions on its network, according to The Clearing House’s website.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

American Banker

MAY 13, 2024

A federal judge has granted a preliminary injunction against the Consumer Financial Protection Bureau's credit card late fee rule, pausing it from being implemented days before it was meant to go live.

The Paypers

MAY 13, 2024

Money Carer , in collaboration with Tag Systems and Fingerprints , have introduced biometric-enabled 'carer cards' to improve financial access for vulnerable people in the UK.

American Banker

MAY 13, 2024

Branch office deposit data is among the most confidential information at a bank, especially those with many branches. Why have regulators made this sensitive competitive data public for banks and thrifts annually for over 50 years but not for credit unions?

The Paypers

MAY 13, 2024

Kima has partnered with FinSec Innovation Lab receiving a grant from the IIA to fund an initiative to connect decentralised finance (DeFi) applications with fiat systems.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

American Banker

MAY 13, 2024

Rep. Andy Barr, R-Ky., is asking the Federal Deposit Insurance Corp. to withdraw a corporate governance guidance proposal as FDIC chair Martin Gruenberg is set to testify in Congress later this week.

The Paypers

MAY 13, 2024

Banque Internationale à Luxembourg (BIL) has gone live with Temenos core banking and payments to increase agility and efficiency of its retail, corporate, and private banking.

American Banker

MAY 13, 2024

Quaint Oak Bancorp sold its majority stake in an equipment lender less than two years after the partnership helped drive record profits at the Southampton-based company.

The Paypers

MAY 13, 2024

UK-based Open Banking payment provider Noda has launched a selection of end-user KYC solutions for online merchants.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

American Banker

MAY 13, 2024

The fintech topped American Banker's annual list this year. CEO Dave Buerger attributed the company's hands-off management style as one reason that draws in and keeps workers around.

The Paypers

MAY 13, 2024

UK-based Fintech Farm , a startup that provides technology to medium-sized banks in developing markets to build digital tools, has raised USD 32 million in Series B funding.

American Banker

MAY 13, 2024

The core provider's new CEO, Stephanie Ferris, vowed to refocus on banks as FIS reboots after selling off WorldPay.

The Paypers

MAY 13, 2024

The Federal Reserve Board has released a summary of an exploratory pilot Climate Scenario Analysis (CSA) exercise conducted with six major US banks.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Financial Brand

MAY 13, 2024

This article Marketers Must Shift Focus and Tactics to Fight Waning Consumer Loyalty appeared first on The Financial Brand. The primacy of product and offers, particularly among younger customers, prioritizes channel and messaging over brand. This article Marketers Must Shift Focus and Tactics to Fight Waning Consumer Loyalty appeared first on The Financial Brand.

The Paypers

MAY 13, 2024

Global Market Insights ’ report has uncovered that the Banking-as-a-Service (BaaS) market is expected to reach a revenue collection of USD 64.7 billion by 2032.

The Financial Brand

MAY 13, 2024

This article AI is Set to Shake Up Banks’ Employee Ranks – But Maybe Not How You Think appeared first on The Financial Brand. AI is changing banking. But even amid the hype, what the technology means for employees remains to be seen. This article AI is Set to Shake Up Banks’ Employee Ranks – But Maybe Not How You Think appeared first on The Financial Brand.

The Paypers

MAY 13, 2024

US-based integrated payments company American Express has announced the expansion of its collaboration with Worldpay to provide additional payment capabilities for small businesses.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content