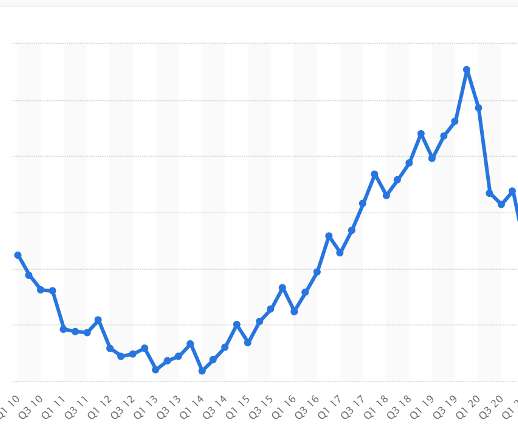

Consumer Credit Update for 2Q 2023

South State Correspondent

AUGUST 16, 2023

Short-term interest rates will remain at 5.60% for most of the year, and inflation will persist. Home equity lines of credit (HELOCs) and bank card usage are up 24% and 17%, respectively. Unsecured personal loan usage is up 21%. Consumer Credit – Mortgage & HELOC Originations are down to the lowest level since 2005.

Let's personalize your content