The effect of nonbanks in the mortgage space

Independent Banker

MAY 31, 2022

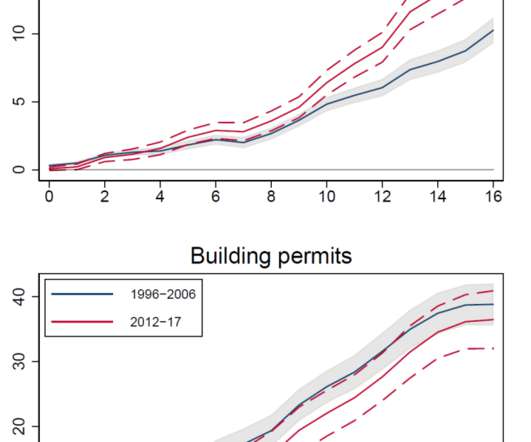

Nonbank institutions continue to be serious contenders in the home lending space. trillion in mortgages in 2020—nearly two-thirds of total origination activity—and made double the number of residential mortgages in 2019, according to Home Mortgage Disclosure Act data collected by S&P Global Market Intelligence. million in 2023.

Let's personalize your content