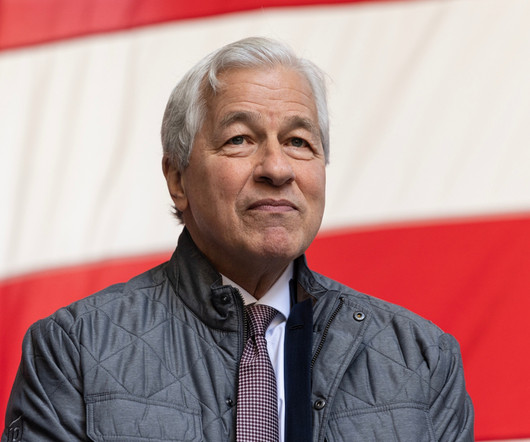

8 Lessons From The Jamie Dimon Shareholder Letter

South State Correspondent

APRIL 15, 2024

Lesson 2: Leadership Matters Jamie Dimon cites military decision making referring to the term OODA loop (observe, orient, decide, act) that we have written about HERE. Road trips, client meetings, briefings, and visits to call centers, branches, and regulators allow leaders to observe and assess the bank and the market.

Let's personalize your content