Weekly Wrap: Varo gets FDIC approval, as Curve prepares for US launch

Bank Innovation

FEBRUARY 14, 2020

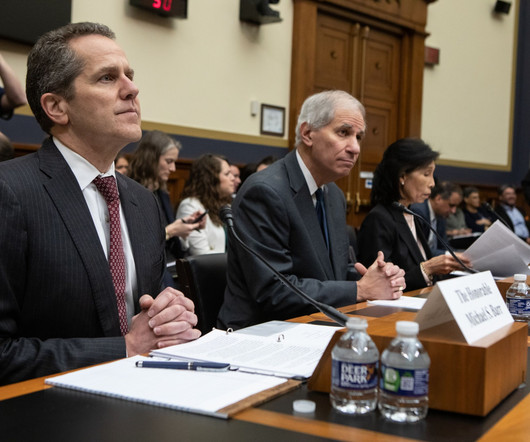

In this episode, editors discuss the following news developments: The implications of banking startup Varo’s FDIC approval; How U.K. card startup Curve opened a New York City office in advance of its U.S. Welcome to the latest episode of our Weekly Wrap series, for the week ending Friday, Feb.

Let's personalize your content