CFPB announces launch of new system for providing guidance and issues first Circular; FDIC issues final rule on misuse of FDIC name or logo or making misrepresentations about deposit insurance

CFPB Monitor

MAY 19, 2022

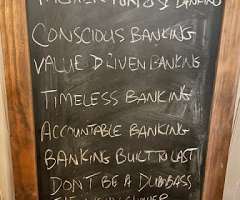

They provide background information about applicable law, articulate considerations relevant to the Bureau’s exercise of its authorities, and, in the interest of maintaining consistency, advise other parties with authority to enforce federal consumer financial law. FDIC Final Rule.

Let's personalize your content