At Davos, Eyeing Sovereign Debt, Digital Taxes And Regulating AI

PYMNTS

JANUARY 22, 2020

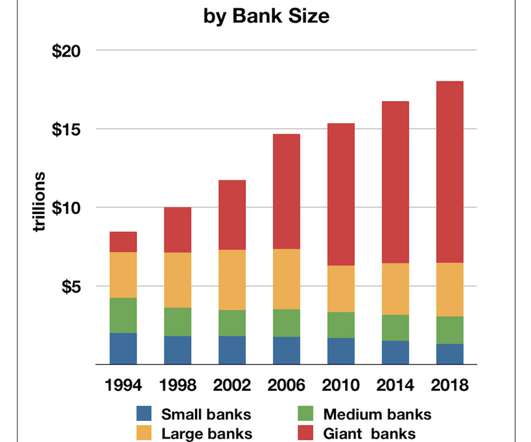

Big Tech, too, of course, and digital taxes. By way of example, the total of U.S. Separately, IBM CEO Ginni Rometty told CNBC from Davos that artificial intelligence should be subject to “precision regulation … you want to have innovation flourish and you’ve got to balance that with security.” And Digital Taxes.

Let's personalize your content