How Process Mining Accelerates Efficiency for Highly Regulated, Customer-obsessed Industries

Perficient

NOVEMBER 27, 2023

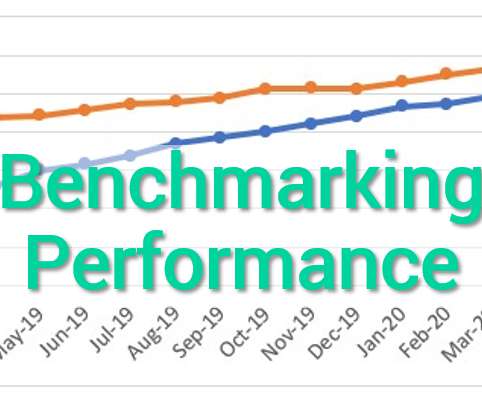

In the dynamic environment of highly regulated industries like healthcare and financial services, leaders often balance competing goals to delight customers while cutting costs. This comparison enables your teams to assess process effectiveness and identify deviations that require attention due to inefficiencies and/or non-compliance.

Let's personalize your content