These Are Your Most Profitable Cash Management Clients

South State Correspondent

SEPTEMBER 20, 2023

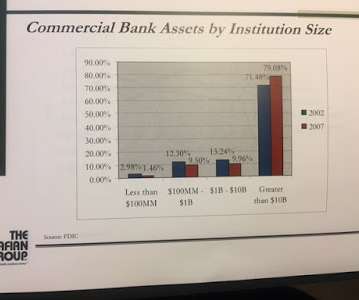

The treasury or cash management customer is usually a bank’s most profitable customer on a risk-adjusted basis ( HERE ). In this article, we discuss cash management profitability and rank the most profitable industries for banks to go after. As such, operating accounts have low-interest rate sensitivity.

Let's personalize your content