More Consumers Are Concerned About Card Fraud, But Less Are Experiencing It

Bank Innovation

JULY 25, 2017

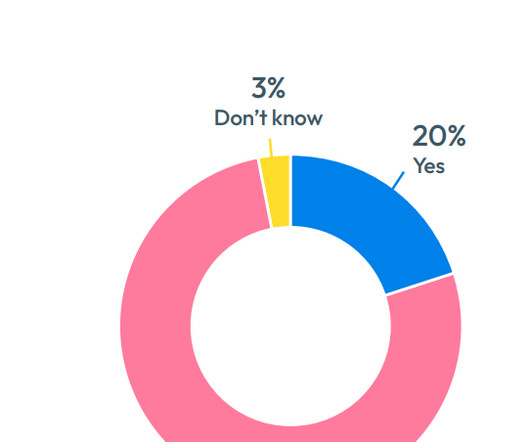

Customer fears about card security and fraud is increasing, but as it turns out, fewer consumers are actually experiencing that fraud. This is according to the Consumer Payment Card Data Security Perceptions survey by data solutions provider Transaction Network Services, released today.

Let's personalize your content