Avoiding AML compliance penalties – Tips from a former regulator

Abrigo

SEPTEMBER 20, 2023

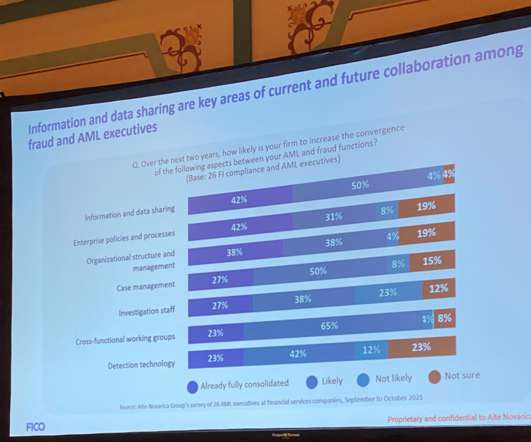

Understanding AML compliance and regulatory expectations. AML compliance is not for the faint of heart. Takeaway 1 Understand the risks associated with your customers beyond the surface level. Takeaway 2 Identify concentrations of risk and try to level out potential clusters. Here are a few tips to help along the way.

Let's personalize your content