Commercial Real Estate or Business Lending: Which Is Better?

Jeff For Banks

APRIL 30, 2022

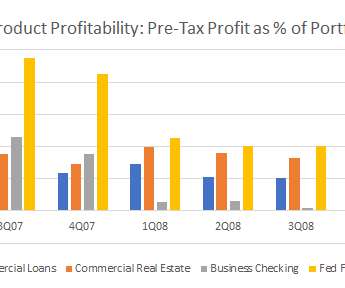

The charts below show the pre-tax profits as a percent of the total product portfolio during different rate scenarios compared to the Fed Funds Rate. So the answer, from a straight pre-tax profit perspective, is commercial real estate in more recent times and a rising rate environment. The pre-tax ROA might not look great.

Let's personalize your content