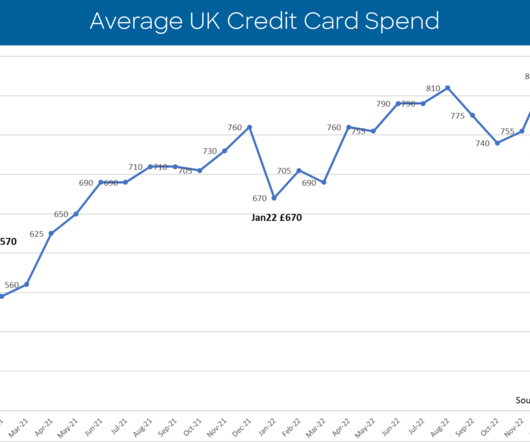

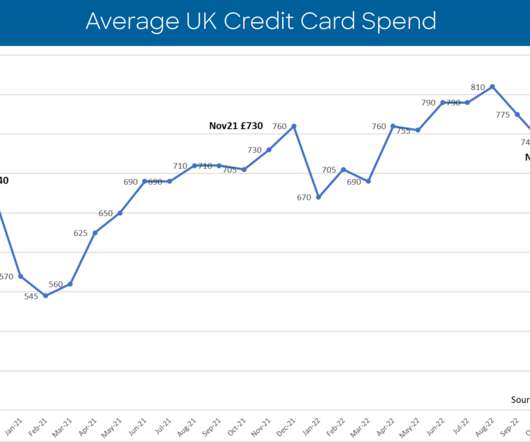

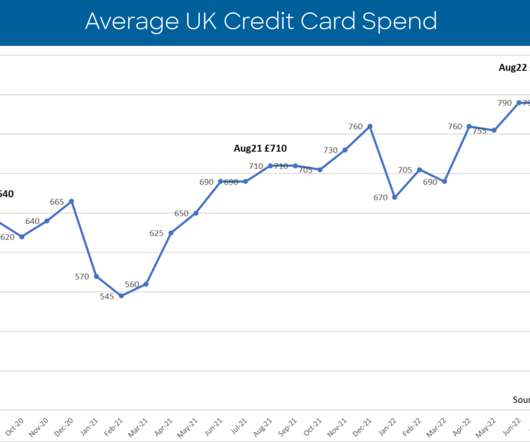

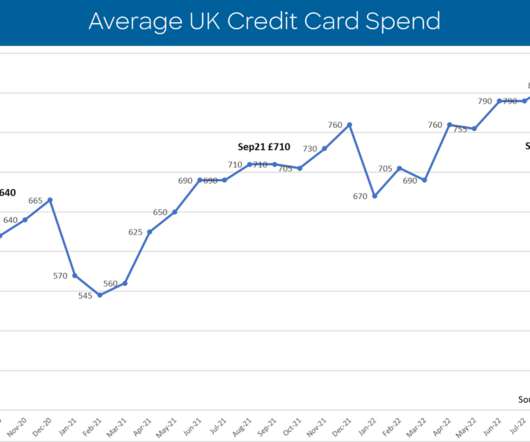

UK Card Spend Reaches Highest Level Since at Least 2006

FICO

FEBRUARY 22, 2023

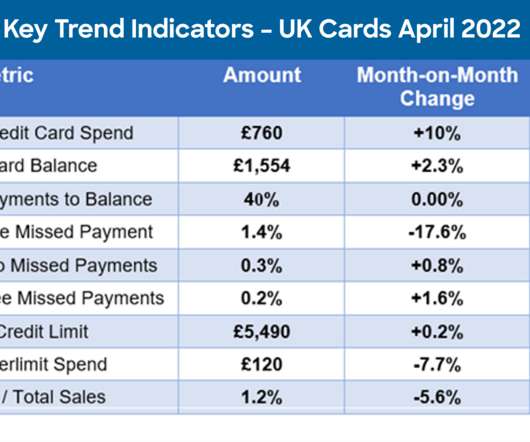

But this year’s rise seems to also have been driven by inflation, pushing the amount of average credit card spend in the UK to the highest level since our UK Risk Benchmarking records began in 2006. This rise occurred in a month when UK retail sales volumes were widely reported as being down relative to past years.

Let's personalize your content