In a comprehensive research report, Raddon Financial Group explores the attitudes and behaviors of younger consumers with respect to financial services to help determine how banks and credit unions can best meet the evolving needs of this critical segment. The study compares Millennials’ behavior and attitudes against those of Gen X and Baby Boomers, with a heavy emphasis on lending.

The Pain, Impact and Cost of Student Loans Is Real

Today, the amount of student-loan indebtedness carried by US consumers is simply staggering. Raddon says the volume of student loans has skyrocketed since 2004, and is now second only to total home mortgage loan indebtedness.

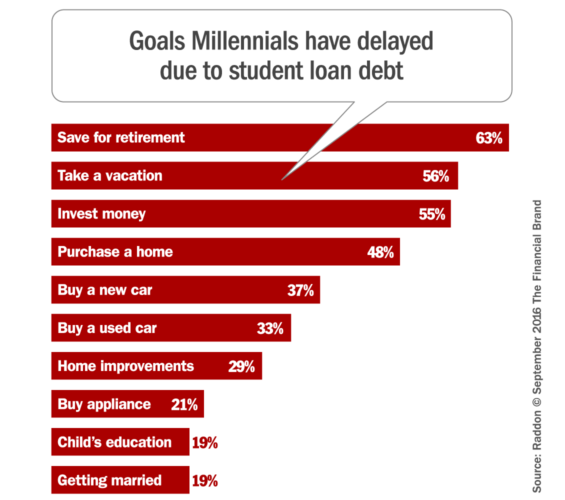

While 15% of all consumers have a student loan, six out of ten of those (57%) are Millennials. In Raddon’s study, 36% of Millennials said they currently carry student loan debts, creating a tremendous financial burden for them. One-half (52%) feel their student loan debt has prevented- or will prevent them from fulfilling their personal and financial goals — e.g., saving for retirement, taking a vacation, investing funds to build personal wealth, purchasing a home, or buying a car. Millennials with student loans are also much less likely to form their own households.

Student loan debt is having a huge impact on the borrowing habits of Millennials. Indeed, Raddon’s research reveals that 15% of those with student loans have already been turned down for another loan because of their student loan or because their monthly student loan payments were too high. Another 27% of all student loan borrowers have further avoided or delayed applying for a loan because of their student loans/payments.

Reality Check: Student loans are crushing Millennials’ financial souls.

This is a huge problem, because Millennials make up the future of the lending market. They are the ones that need credit cards, auto loans, mortgages — not Gen X or Boomers, who are more focused on either accumulating or protecting their wealth.

Raddon’s research shows anticipated loan demand among US consumers has dropped sharply. Only 18% of all consumers anticipate applying for any type of loan in the next 12 months. Compare that to just five years ago, where 35% of all consumers were in the market for some type of loan.

Even among those who are willing to get a loan, the situation is tenuous. One-quarter (28%) of all consumers who are in the market for a loan would delay their plans to apply for the loan if interest rates were to go up by just 1 percent, and this attitude is significantly more pronounced among potential Millennial borrowers.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Is The American Dream Slipping Away?

One component that has consistently been part of the American Dream is the ability to own a home. But current market data suggests this may no longer to be the case. The US Census Bureau’s most recent report shows the home ownership rate in the first quarter of this year fell to 63.7%, the lowest since the 1990s.

Raddon’s own research on home ownership shows that today, fewer Millennial consumers own a home, and are instead opting to rent or live with their parents. Today, four out of every ten Millennials (41%) rent, while one in ten (10%) live at home with their parents.

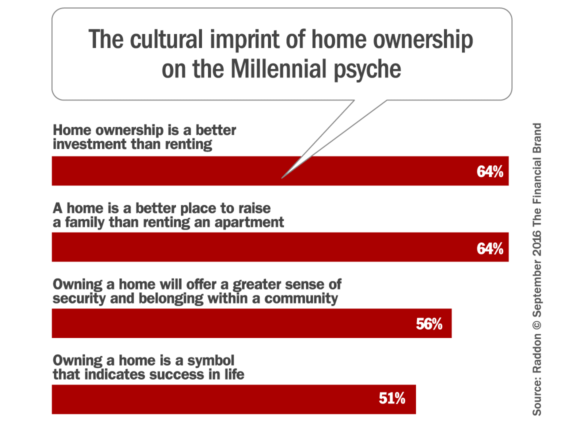

Most would like to own a home, but they just aren’t sure how they can make it happen. In Raddon’s study, almost two-thirds (64%) of all Millennials said home ownership is a better financial investment than renting. An equal number (64%) agree that a home provides a better place to raise children than living in an apartment. 56% feel that owning a home will offer them a greater sense of security and belonging within the community, while half (51%) say that owning a home is or will be a symbol that their lives are successful.

Two-thirds (68%) of all Millennial renters have aspirations to own a home some day, so why do so many rent? According to Raddon, it’s due to either personal lifestyle choices, or they are financially constrained… or both. Four out of 10 of say they rent because it provides them more flexibility in their lifestyle. Over one-half of all Millennial renters agree that renting is less stressful than owning a home because they do not have to worry about the home’s upkeep. One half of all Millennial renters say they rent because they cannot save enough to make a down payment on a home.

Reality Check: 84% of would-be first-time Millennial homebuyers say they aren’t able to make a purchase because can’t make a down payment.

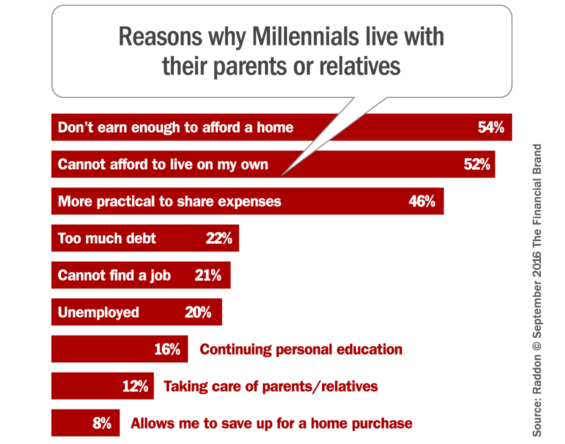

While it may be tempting to dismiss Millennials who live at home with their parents, banks and credit unions should remember this segment makes up 10% of the market. Granted, only half of this group has aspirations to own their own home, and 62% believe they will continue living with their parents for the foreseeable future. But there is still lending potential here that should not be ignored.

Over half of those living at home or with relatives indicate they currently don’t earn enough to afford owning a home, and almost as many feel it is financially more practical to share living expenses. One out of every five Millennials living at home do so because they either have too much debt to repay, they can’t find a job, or they are unemployed.

Becoming a Financial Friend and Ally

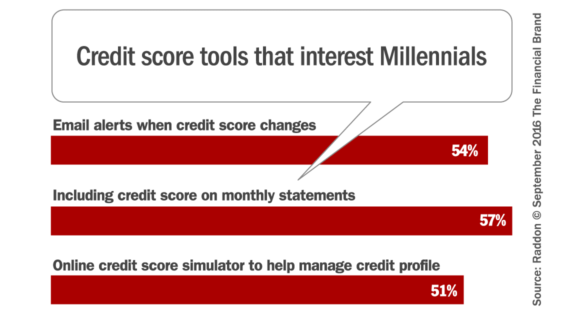

Lending opportunities will be harder to come by in the future. Consequently, in order to secure the lending opportunities that do arise, Raddon recommends banks and credit unions consider various outreach interventions, such as providing credit counseling services to help Millennials manage their debt, and providing tools to keep customers informed about their credit histories. In their research, 37% of Millennials said they were either “very” or “extremely” receptive to one-on-one credit counseling, and would find similar services focused on financial education valuable.

Younger consumers see the value in having access to their credit score information. Raddon sees an opportunity for retail financial institutions here as well. Not only is credit score monitoring a service Millennials want, financial institutions may avoid potential underwriting hiccups down the road by helping younger borrowers manage their credit scores, complemented and supported by additional educational tools.

Such a program could be extended to specifically cover mortgages, including an online interactive course for home buyers that provides a basic understanding about home loans, how their application is evaluated, how much they will be able to borrow, and generally what they expect during the home buying/borrowing process.

Raddon says financial institutions must also consider refitting their mortgage lending programs and services to cater to first-time buyers–younger consumers–in order to orient them about the home purchasing and mortgage lending processes.

Concurrently, financial institutions must acknowledge the role real estate brokers plays not only in the home purchase process, but also as a major influence in the first-time buyer’s choice of mortgage lender. As a result, banks and credit unions should cultivate or continue to cultivate their contacts within the realtor community to leverage this mortgage loan sourcing channel.