The report: 2024: The Embedded Lending Outlook

Source: Visa

Why we picked the report: Demand for embedded lending payments is spiking – a trend often perceived as a threat by banking executives. But in an increasingly crowded and competitive consumer lending market, embedded finance offers banks and credit unions a powerful tool for differentiation and growth — if they act quickly to meet consumers’ rising expectations for speed, flexibility, and convenience, according to a new report from Visa.

Executive Summary

Consumers are clamoring for more convenient and accessible borrowing options, but most providers come up short of consumer expectations. As many people grow frustrated with their access to credit, the demand for embedded lending solutions, in particular, is surging across global markets.

A recent report commissioned by Visa surveyed over 8,000 consumers across six major economies. It found that only half are highly satisfied with their current borrowing options, and 43% express strong interest in embedded lending solutions that would allow them to easily access credit at the point of purchase, whether shopping online or in-store.

“Consumers are open to sharing their data for quick embedded lending access, especially from trusted institutions,” the report notes. With the right solutions in place, “embedded lending can deliver value to consumers and fill gaps in the current market.”

Key Takeaways:

- Only half of consumers across the U.S., UK, Australia, India, Germany, and Japan are highly satisfied with their current access to credit.

- 43% are very or extremely likely to switch to a provider that offers embedded lending options, but only 15% have used embedded lending in the last 90 days.

- Consumers who use credit strategically for budgeting or rewards are equally likely to tap embedded lending for essentials and discretionary purchases.

- 37% of embedded lending users cite low credit limits as a key pain point.

What we liked about the report: It’s important for banks and credit unions, in a time when data has never been more freely shared and available, to be looking at reports from reliable resources, like Visa, that also look at large sample pools. This report surveyed over 8,000 consumers globally, providing an international perspective and does a strong job providing the key opportunity zones that financial institutions can pursue for embedded lending solutions.

What we didn’t: Even for the experts in the industry, it’s not always easy to understand the lingo and terms floating around banking. This report assumed that anyone reading the report was keenly tuned into each of the terms — such as “embedded lending” and “POS financing” — it referenced. However, clearer upfront definitions could improve accessibility for a broader audience. Additionally, case studies providing competitive analysis and insight would benefit the whitepaper.

Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Uncover the techniques behind this bank's impressive ROI boost through data-driven marketing.

Read More about Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

The Digital Solution for Prepaid, Incentive and Reward Cards

Join experts from CPI for an informative webinar to learn where digital cards are today and what they will look like in the future.

Read More about The Digital Solution for Prepaid, Incentive and Reward Cards

Significant Gaps Between Embedded Lending Supply and Demand

The study reveals a major mismatch between consumers’ interest in embedded lending and their actual usage of these solutions. While 43% of respondents indicated they are “very or extremely likely” to choose a merchant or provider that offers embedded lending options, only 15% had utilized embedded lending solutions in the last 90 days.

This gap signals a major untapped opportunity for lenders and merchants. Consumers across age groups and income levels expressed interest in point-of-sale financing options, with particularly high demand among younger generations. 56% of Gen Z consumers and 55% of Millennials said they would switch to providers that offer embedded lending.

So, what’s driving the surge in consumer interest in embedded lending solutions? Two key themes emerged from the study: flexibility and accessibility.

For many consumers, embedded lending offers a much-needed lifeline in the face of short-term cash shortages or unexpected expenses: 29% of respondents said they would prefer embedded lending options over other financing solutions for emergency or unplanned costs.

This was especially true among the 25% of consumers who regularly experience unstable cash flow.

“Consumers tend to see embedded lending as a good fit for financing in certain situations, particularly unplanned expenses and short-term financial pressure,” the report notes. “Unplanned expenses rank as the use case in which consumers would be most likely to choose embedded lending over other forms of payment.”

But embedded lending isn’t only for emergencies — strategic credit users are also drawn to the convenience and flexibility of these solutions: 21% of respondents who use credit proactively for budgeting or rewards (rather than out of necessity) have used embedded lending in the last three months. This segment is equally likely to finance discretionary purchases like travel and luxury goods as they are to pay for essentials.

Overcoming Barriers to Adoption

To realize the full potential of embedded lending, providers will need to overcome some key challenges and points of friction. Chief among them are credit limit restrictions, with 37% of current embedded lending users saying their credit line was insufficient for their borrowing needs.

Cost is also a key consideration. The report found that 59% of respondents would not use financing options that charge additional fees or interest, underscoring the need for transparent and competitive pricing.

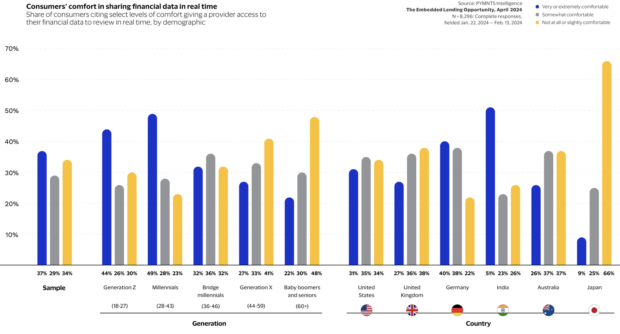

Finally, brands and lenders will need to build trust with consumers, who expressed varying degrees of comfort with sharing financial data for real-time underwriting. While younger consumers are more open to sharing this data for a seamless borrowing experience, only 31% of U.S. consumers said they would be “very” or “extremely” comfortable doing so. In comparison, a little over a third (34%) say they would not feel at all safe sharing that type of data.

[CHART FROM PG. 33]

Unlocking the Embedded Lending Opportunity

As consumer interest in embedded lending accelerates, lenders and merchants alike have a prime opportunity to deepen customer relationships and drive growth by integrating point-of-sale financing into the shopping experience. Additionally, if banks and credit unions are looking to break into the market, they’ll need to consider doing the following:

- Offer higher credit limits that accommodate both planned and unexpected borrowing needs.

- Provide clear terms and competitive rates to build trust and drive repeat usage.

- Streamline application processes and harness data to provide a seamless customer experience.

With the right approach, embedded lending can be a powerful tool for banks and credit unions to boost sales, build loyal, long-term relationships with customers and members and expand consumers’ purchasing power in an increasingly digital and fast-paced commercial landscape.

Editor’s note: This article was prepared with AI language software and edited for clarity and accuracy by The Financial Brand editorial team.