Building a strong omnichannel experience is an ever-changing challenge for any company, but one with unique and often perplexing issues for the financial services industry, particularly when it comes to social media. That’s because not only are financial institutions looking to drive growth, they also have to balance those goals with strict regulations when it comes to customer communications.

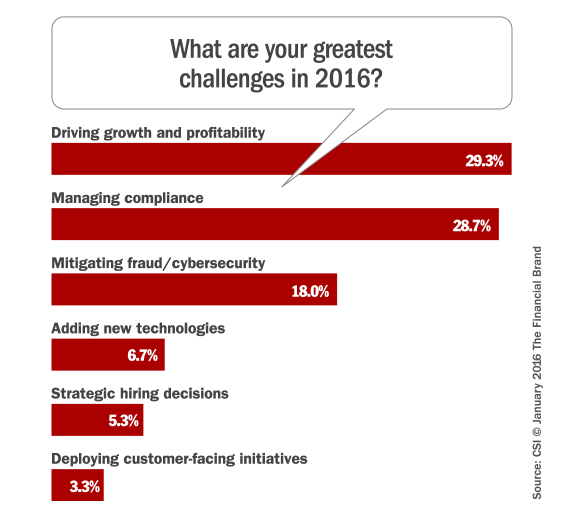

According to a study from Computer Services Inc., driving growth and managing compliance are the top two concerns financial institutions are facing. So it’s no wonder that when it comes to a very open, authentic and often unpredictable venue like social media, crafting a social media strategy in the financial services sector presents some delicate food for thought.

Today’s Social Consumer

The financial consumer has evolved to an audience that expects rapid response times, and they also want a cohesive omnichannel experience while being able to pick their preferred communication channel with the company. They may take to social media for one of two reasons: either they are simply using their preferred communication channel, or they are frustrated by a lack of response on another channel and expect that social channels will give them the immediate response they are seeking, or a combination of both reasons.

If a consumer walks into a branch and physically plants themselves in front of a branch employee, they are hard to ignore. But they may also have to wait in line first. Jumping online to a social media site such as Facebook or Twitter often equates in the customer’s mind as a means to get in front of the company quickly, no lines and not to be ignored.

Research shows that 74% of customers believe that if they criticize a brand on social media, they’ll get better customer service. Often better service means a fast or immediate response. A study by Lithium Technologies found that 53% of customers who ask a brand a question on Twitter expect a response within 1 hour regardless of when they tweeted, with that percentage rising to 72% if it’s a complaint.

This is particularly true of the younger audience that banks and financial service companies are trying to reach. This increasingly social audience, especially Gen Y customers, want to use social to communicate with financial institutions, but they are often frustrated by limited capabilities on those channels for addressing their needs.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Balancing Social Channels with Financial Regulations

What we find when we look at the bank or financial service company’s point of view, however, is that responding to tweets or social posts is not in fact so straight forward. That’s because they often have regulations and compliance considerations before responding. When it comes to security and privacy, they have to be particularly thoughtful in their response and handling of social media communications.

Some brokers may be required to file any form of written communication with a customer, which would include Facebook and Twitter posts as they are in written form. This is made trickier, however, when a user’s customer status is not always readily apparent on social media.

Financial service organizations must review what obligations they have to consider before mapping out their social strategy. A recent ebook by Smarsh outlines some of the considerations; including FINRA Regulatory Notice 10-06 (Jan. 2010) which explores how social media communication affects recordkeeping, suitability and supervision requirements, and provides definition for aspects unique to the channel.

While customers may see social media as a quicker way to get help, some have pointed out that this new approach to customer service does not save time because, due to the confidential nature of most financial issues, the issue is ultimately redirected to a traditional form of customer service, such as a call center or the customer’s local branch.

While this may be the case for some financial firms, others are adopting innovative customer engagement solutions to bridge the gap and deliver a unified omni-channel experience. For example, advances in technology have enabled TouchCommerce to launch a social customer engagement solution that allows customers to seamlessly click on a link in a Facebook or Twitter (or other social network) post that immediately switches the conversation to a live online chat with a customer service agent handling the customer’s concerns privately.

Some popular commercial banking institutions have even adopted multiple social media profiles on platforms such as Twitter to further segment conversations by customer need. For example, a few offer a help or support profile that actively responds to and routes customer concerns. Not all banks have this strategy.

This speaks to the importance of looking at your internal resources to maintain such an approach and to align your efforts with internal and external requirements. In other words, what works for one may not work for all, but companies shouldn’t ignore what’s happening. Companies can choose to sit on the sidelines and not participate in the conversation, but your customers may be having it with or without you.

The lesson: be prepared and know how you are going to handle issues as they arise.

To Post or Not to Post?

As for those that may worry that customers’ complaints and questions are aired publicly for the world to see, this actually may be a good thing. Especially since the nature of social media as an authentic and honest communal conversation allows others who have the same question to see the response and take solace in knowing that the institution values customer concerns and responds quickly.

It may even serve as a venue to turn a positive into a negative in those instances where a financial firm responds in a timely and accurate manner. Other users with a similar problem may even take it upon themselves to respond to the issue, if they know the answer, creating more of an open forum and possibly reducing the work load for internal staff. In some instances the issue may apply universally (e.g., the website is down), which may serve as a means of broadcasting important information and reducing strain on other channels such as a call center.

So what can companies do to better brave this new social world? Here are just a few areas financial service companies should make sure they address in planning their social customer service strategy.

Confidentiality – Know how you will collect, protect, and archive confidential user information while staying compliant. Ask your technology partner if they have systems in place to help you achieve that goal. Surprisingly, consumers will often disclose personal information in social posts, such as PINs, so agents will need to manage those breaches appropriately by coaching the customer to take down the post and/or moving the conversation to an appropriate location such as a private live chat or phone call.

Response times – Consumers are turning to social media for a quick response to their question or concern, and brands must address how they will staff for this channel to provide 24 hour monitoring and support, with response times that are within minutes, not hours.

Social media management – Firms must decide how they are going to address social media by outlining specific guidelines for the medium, and not relying on other polices to include them. They must also clearly define who internally will have ownership of the communication and how it will be managed.

Agent and CSR training – Representatives need to be properly trained on appropriate cross-sell opportunities and to accurately address customer issues, especially since not all information is appropriate for every consumer. They will want to plan the content of their posts accordingly. They also need to be mindful to monitor public conversations and leverage the attention to improve their image through positive feedback, prompt responses, and the discernment to know when to move the conversation into a more private setting, such as a live online chat session.

Internal integration – Does the customer service rep handling social media have access to the same customer information that a rep would have on a phone call or in a bank branch? The answer should be yes, or they should at least have the ability to get the answers quickly, otherwise you sacrifice the opportunity to offer a unified omnichannel experience with the consumer. This again is another area where technology can help to unify your staff and allow them to all access the same customer profiles, instead of having silos within the organization.

Data and system integrity – Ensure that the message that was intended for public display in a social post is indeed what was published. Banks and their IT vendors may also need to protect the system against accidental or malicious misuse by internal and external parties.

Record-keeping responsibilities – Firms may be required to retain records of social media communications as required by Rules 17a-3 and 17a-4 under the Securities Exchange Act of 1934 and FINRA Rule 3110. The content of the communication is determinative as to whether the communication is a business record, and thus whether firms must retain those records. This again may be an area where technology can help ease this strain.

Availability and uptime of technology – Ensure that any technology you are leveraging to manage social media offers SLAs, defines uptime, and describes contingency planning for disasters and high-volume scenarios.

Delivering a Positive Experience

Offering social customer service provides another important “touch point” between the firm and its customers, and, according to a financial industry insider, “customer satisfaction is almost directly correlated with the number of touch points.” Social media can be a convenient way for consumers to reach out to their bank or insurance company, however, because of personal information that should not be shared on a public forum; these businesses can offer to bring social media conversations into a more private environment.

Adopting new consumer engagement technologies and systems can be essential for customer satisfaction, especially for bridging public social media posts into more private or personalized settings such as chat or SMS.

Financial service companies must ensure they are offering what consumers expect in order to foster an effective and successful relationship, while also keeping up with changing social preferences and technologies. When consumers can’t use the channel they prefer for a transaction, they are less satisfied with their experience than customers who used their favored channel to meet their needs.

The gap that exists between consumers and financial organizations can translate to dissatisfaction, and less engagement overall ultimately affects the bottom line through lost transactions or closed accounts. If organizations can master this communication challenge, though, the opportunity to personalize and humanize the experience with consumers can be incredibly rewarding.